Online VAT Invoice Generator

Generate Professional VAT Invoices Easily

Our online VAT invoice generator helps you create compliant VAT invoices quickly and accurately. Simply enter your details and choose from pre-populated fields to generate a professional invoice in seconds.

Features:

- VAT Compliant: Meets all VAT regulations, including those for domestic and international transactions.

- Customizable: Add your company logo, brand colors, and payment details.

- Easy to Use: Intuitive interface makes invoice creation a breeze.

- Time-Saving: Generate VAT invoices instantly without the hassle of manual calculations.

- Automatic Numbering: Invoices are automatically numbered for easy tracking and compliance.

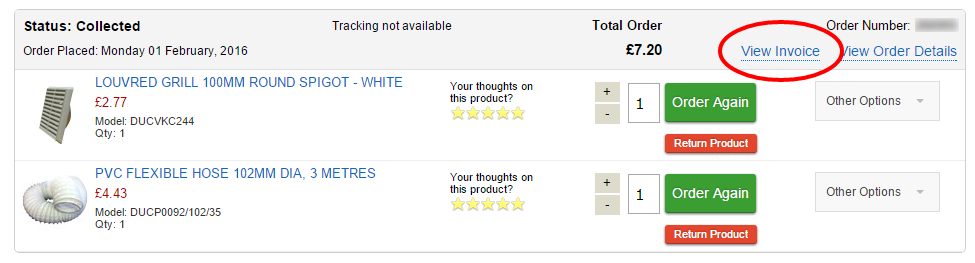

How to Use:

- Enter Your Details: Fill in the required fields, including your company information, customer details, and VAT registration number.

- Choose Item Details: Select items from the pre-populated list or add custom items, including quantity, unit price, and VAT rate.

- Customize Invoice: Add your logo, adjust the font and colors, and include any additional notes.

- Generate Invoice: Click “Generate Invoice” to create a professional VAT invoice instantly.

Benefits:

- Save Time and Effort: Automate the invoice creation process, saving you valuable time.

- Ensure Compliance: Create invoices that meet all VAT requirements, avoiding penalties.

- Boost Professionalism: Present your business in a professional manner with well-formatted invoices.

- Improve Efficiency: Streamline your invoicing process and enhance efficiency.

- Reduce Errors: Eliminate manual errors by using automated calculations and pre-populated fields.

Try it Now:

Visit our website to start generating VAT invoices seamlessly. No software installation or subscription required. Create professional invoices in minutes and simplify your business operations.## Online Vat Invoice Generator

Executive Summary

An online VAT invoice generator is a valuable tool for businesses required to issue invoices that comply with VAT regulations. It automates the process of calculating and including VAT in invoices, ensuring accuracy and efficiency. This article provides a comprehensive guide to online VAT invoice generators, covering features, benefits, and best practices for their use.

Introduction

Value Added Tax (VAT) is a consumption tax levied on goods and services in many countries around the world. Businesses that are VAT-registered are required to include VAT in their invoices. Manually calculating and including VAT can be time-consuming and error-prone. Online VAT invoice generators simplify this process by automating these calculations.

FAQs

1. What is an online VAT invoice generator?

An online VAT invoice generator is a web-based or software-based tool that allows businesses to create VAT-compliant invoices quickly and easily. It automates the calculation of VAT and includes it in invoices, ensuring compliance with VAT regulations.

2. Who can benefit from using an online VAT invoice generator?

Any business that is required to issue VAT-compliant invoices can benefit from using an online VAT invoice generator. This includes small businesses, freelancers, and large enterprises.

3. Is it safe to use an online VAT invoice generator?

Yes, it is safe to use an online VAT invoice generator provided that you choose a reputable and secure provider. reputable providers use encryption and other security measures to protect your data.

Key Features and Benefits

1. VAT Calculation

- Automates VAT calculations based on the VAT rate and the amount of the invoice.

- Supports multiple VAT rates for different products or services.

- Handles calculations for both standard and reduced VAT rates.

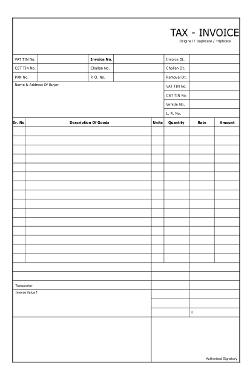

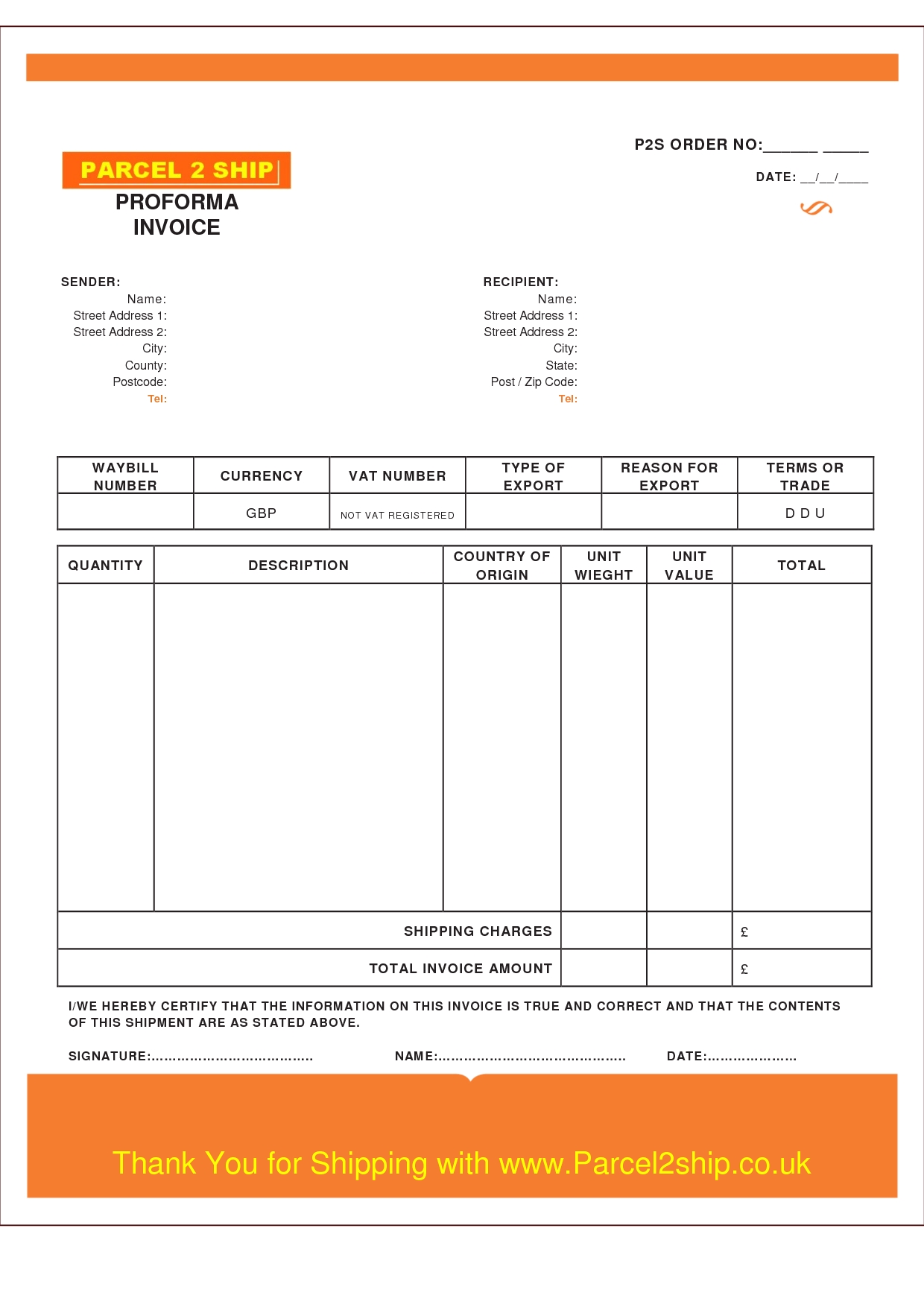

2. Invoice Creation

- Creates professional-looking invoices that comply with VAT regulations.

- Includes all necessary invoice details, such as business name, address, and contact information.

- Allows for customization of invoice templates to match your brand identity.

3. Reporting

- Generates reports that summarize VAT amounts for different periods.

- Exports reports in various formats for easy analysis and record keeping.

- Helps businesses track and manage their VAT liability.

4. Compliance

- Ensures that invoices meet the latest VAT regulations.

- Keeps businesses up-to-date with changes in VAT laws.

- Provides audit trails to demonstrate compliance.

5. Time-Saving

- Automates calculations and invoice creation, freeing up businesses to focus on other tasks.

- Reduces the risk of errors and ensures accuracy.

- Streamlines the invoicing process and saves valuable time.

Conclusion

Online VAT invoice generators are indispensable tools for businesses that need to issue VAT-compliant invoices. They automate calculations, ensure compliance, save time, and provide peace of mind. By choosing a reputable and secure provider, businesses can enjoy the benefits of these tools with confidence.

Keywords

- Online VAT invoice generator

- VAT compliance

- Invoice creation

- VAT reporting

- Time-saving