Invoice

Invoice No: INV-001

Date: 01-01-2024

Customer Name: John Doe

Customer Address: 123, Main Street, Anytown

Bill to Address: (If different from Customer Address)

GSTIN: 0123456789

Terms of Payment: Net 30 days

| **Description | Quantity | Unit Price (INR) | Amount (INR)** |

|---|---|---|---|

| Product A | 10 | 100 | 1,000 |

| Product B | 5 | 200 | 1,000 |

| Product C | 1 | 500 | 500 |

Subtotal: 2,500

GST (18%): 450

Total Amount Payable (INR): 2,950

Notes:

- Please make the payment within 30 days of the invoice date.

- Late payments may be subject to a late payment fee.

- All prices are exclusive of GST.

- Thank you for your business!

Bank Details:

Account Name: Anytown Enterprises

Account Number: 1234567890

Bank: ABC Bank

IFSC Code: ABC0123456[Invoice Generator In Rupees]

Executive Summary

An invoice generator in rupees is a crucial tool for businesses in India to create professional and legally compliant invoices in the local currency. This article provides a comprehensive guide to using an invoice generator in rupees, covering its features, benefits, and top subtopics.

Introduction

Invoices are essential documents in any business transaction. They serve as records of sale, providing details about the goods or services provided, their quantities, rates, and the total amount payable. For businesses operating in India, it’s crucial to know how to use an invoice generator in rupees to ensure accuracy and compliance with local regulations.

FAQs

What is an invoice generator?

An invoice generator is a software tool that allows businesses to create invoices quickly and easily. It automates the process of calculating totals, generating invoice numbers, and adding business and customer information.Why should I use an invoice generator in rupees?

Using an invoice generator in rupees simplifies the invoice creation process, streamlines billing, and helps ensure that invoices are in accordance with Indian GST regulations.What are the benefits of using an invoice generator in rupees?

- Saves time and effort

- Ensures accuracy and consistency

- Improves invoice presentation and credibility

- Facilitates GST calculations and compliance

- Allows for easy customization and branding

Top 5 Subtopics

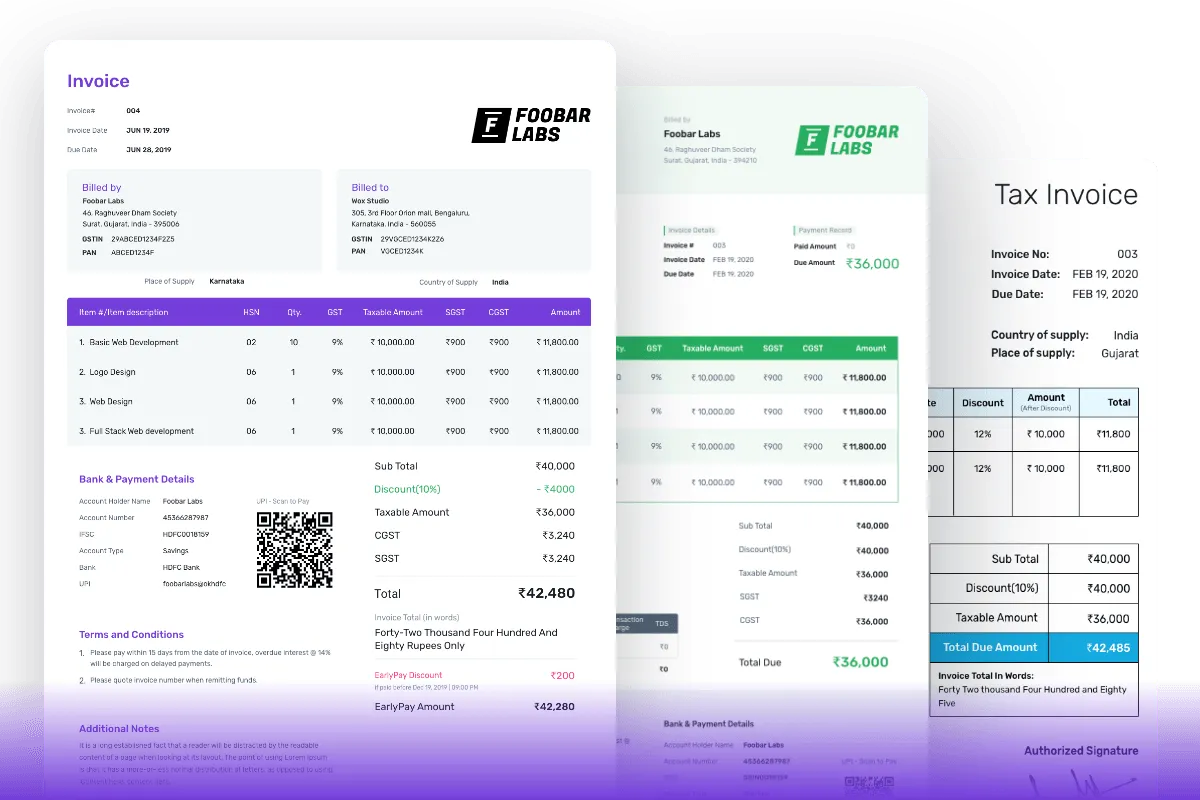

1. Key Features of an Invoice Generator in Rupees

- Template Customization: Allows businesses to create customized invoice templates with their logos, contact details, and branding.

- GST Calculation and Inclusion: Automatically calculates and includes GST amounts in invoices based on the applicable tax rates.

- Multiple Currency Support: Enables businesses to generate invoices in multiple currencies, including rupees.

- Payment Tracking: Allows businesses to track invoice payments and send reminders to customers.

- Reporting and Analytics: Provides insights into invoice performance, customer payment patterns, and other relevant data.

2. Benefits of Using an Invoice Generator in Rupees

- Compliance with GST Regulations: Ensures that invoices meet the requirements of the Indian GST Act, reducing the risk of penalties.

- Improved Billing Efficiency: Streamlines the invoice creation process, freeing up time for other important tasks.

- Enhanced Invoice Accuracy: Minimizes errors in invoice calculations and data entry.

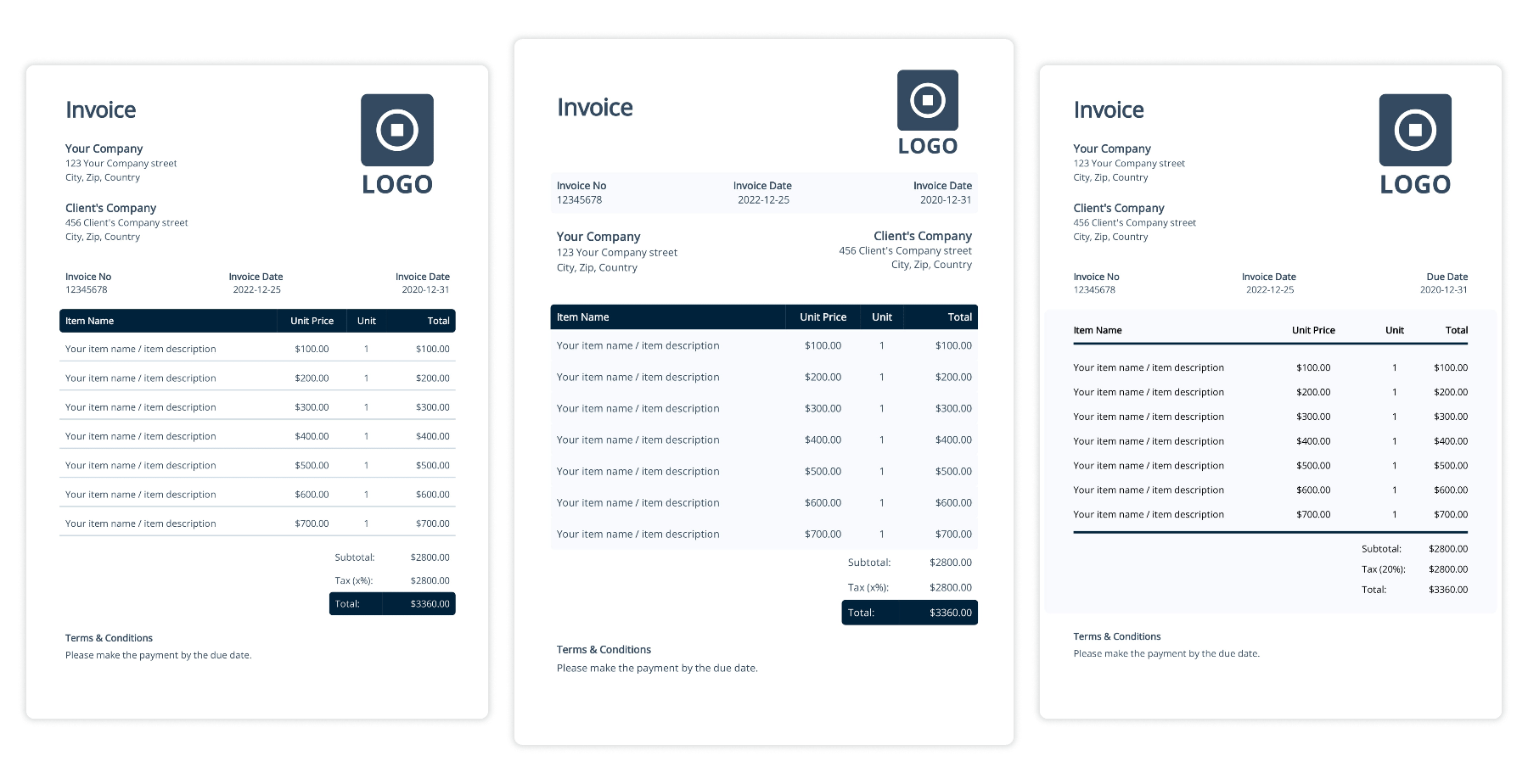

- Professional Invoice Presentation: Offers professional-looking invoices that enhance your business image.

- Increased Customer Satisfaction: Provides customers with clear and accurate invoices, improving their satisfaction.

3. Choosing the Right Invoice Generator in Rupees

- Consider Your Business Needs: Identify the specific features and functionality that your business requires.

- Check GST Compliance: Ensure that the invoice generator complies with the latest GST regulations.

- Evaluate User-Friendliness: Choose an invoice generator that is easy to use and navigate.

- Consider Integrations: Select an invoice generator that integrates with your accounting software and payment gateways.

- Check Customer Support: Opt for an invoice generator that provides reliable customer support.

4. How to Use an Invoice Generator in Rupees

- Register and Set Up: Create an account on the invoice generator platform and set up your business details.

- Create an Invoice: Fill in the required information, such as invoice number, customer details, items/services provided, and payment terms.

- Calculate GST: The invoice generator will automatically calculate the GST amount based on the tax rates specified.

- Finalize and Send: Review the invoice, make any necessary changes, and send it to your customer.

- Track and Manage: Keep track of invoice payments and follow up with customers as needed.

5. Tips for Effective Invoice Creation

- Use Clear and Concise Language: Ensure that your invoices are easy to understand and contain all necessary information.

- Include Relevant Details: Provide detailed descriptions of the goods or services provided, quantities, rates, and payment terms.

- Set Clear Payment Terms: Specify the due date, payment options, and any late payment fees.

- Proofread Carefully: Review your invoices thoroughly before sending them to customers to avoid errors.

- Send Invoices Promptly: Issue invoices as soon as possible after completing the transaction.

Conclusion

An invoice generator in rupees is an indispensable tool for businesses operating in India. By understanding its features, benefits, and key subtopics, you can select the right invoice generator and effectively create professional and compliant invoices. This not only streamlines billing processes but also ensures accuracy, enhances invoice presentation, and ultimately improves customer satisfaction.

Keyword Tags

- Invoice generator in rupees

- GST invoice

- Invoice creation

- Billing software

- Business tools