Money Transfer Receipt Generator

Sender Information:

- Name: [Sender’s Name]

- Address: [Sender’s Address]

- Phone Number: [Sender’s Phone Number]

- Email: [Sender’s Email]

Recipient Information:

- Name: [Recipient’s Name]

- Address: [Recipient’s Address]

- Phone Number: [Recipient’s Phone Number]

- Email: [Recipient’s Email]

Transaction Details:

- Transaction Date: [Date]

- Amount Sent: [Amount]

- Transfer Type: [Transfer Method]

- Reference Number: [Reference Number]

Payment Instructions:

- The sender has authorized the transfer of the above amount to the recipient.

- The funds will be credited to the recipient’s account according to the transfer method selected.

Additional Notes:

- [Any additional notes or instructions]

Disclaimer:

- This receipt is for informational purposes only and does not constitute legal or binding proof of payment.

- The recipient should verify the accuracy of the information provided before completing the transaction.

- Any disputes or discrepancies should be directed to the payment provider.

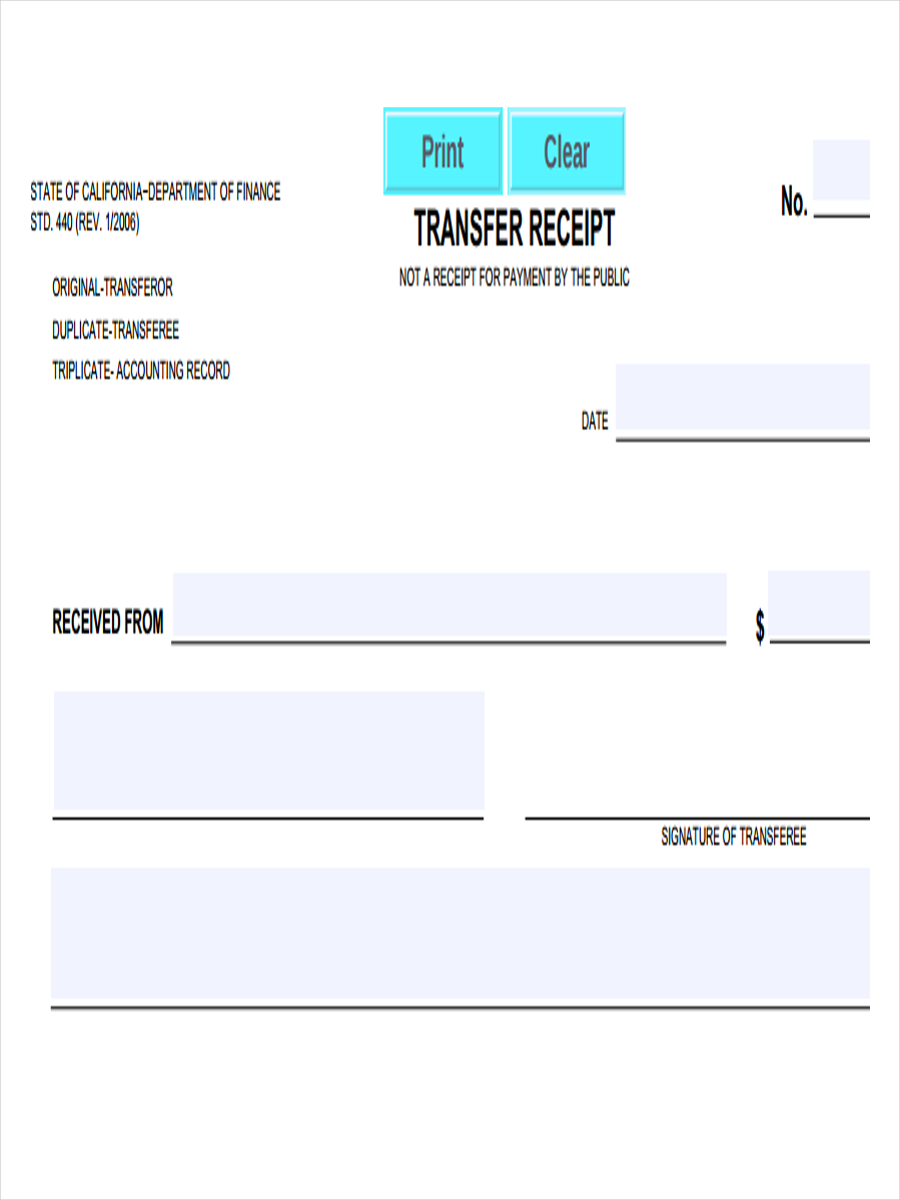

Signature:

- Signature of Sender: [Sender’s Signature]

- Signature of Recipient: [Recipient’s Signature]## Money Transfer Receipt Generator

Executive Summary

Conducting financial transactions online is becoming increasingly prevalent, and transferring funds between individuals and businesses is no exception. To ensure the legitimacy and accountability of these transactions, a money transfer receipt generator is an invaluable tool. This comprehensive guide delves into the essential components of a money transfer receipt, explores key subtopics related to money transfers, and provides insightful FAQs to empower readers with the knowledge they need to generate professional and compliant receipts.

Introduction

In today’s digital era, the ability to seamlessly transfer funds online has revolutionized financial transactions. However, ensuring the accuracy, transparency, and traceability of these transfers is crucial for both parties involved. A money transfer receipt generator plays a pivotal role in fulfilling this need by providing a standardized and verifiable record of the transaction.

FAQs

1. What is a money transfer receipt?

A money transfer receipt is a legal document that serves as proof of a financial transaction between two parties. It typically includes essential information such as the transaction date, amount transferred, sender and recipient details, and transaction reference number.

2. Why is it important to have a money transfer receipt?

Money transfer receipts are vital for various reasons:

- Proof of transaction: They provide irrefutable evidence of the funds transfer, protecting both parties in case of disputes or queries.

- Tax purposes: Receipts can serve as documentation for tax purposes, especially for business transactions or self-employment income.

- Record-keeping: They provide a systematic record of financial transactions, facilitating easy tracking and management of funds.

3. How do I generate a money transfer receipt?

Using a money transfer receipt generator simplifies the process. Simply input the required information, such as transaction details, sender and recipient details, and the generator will create a professional and compliant receipt in seconds.

Subtopics

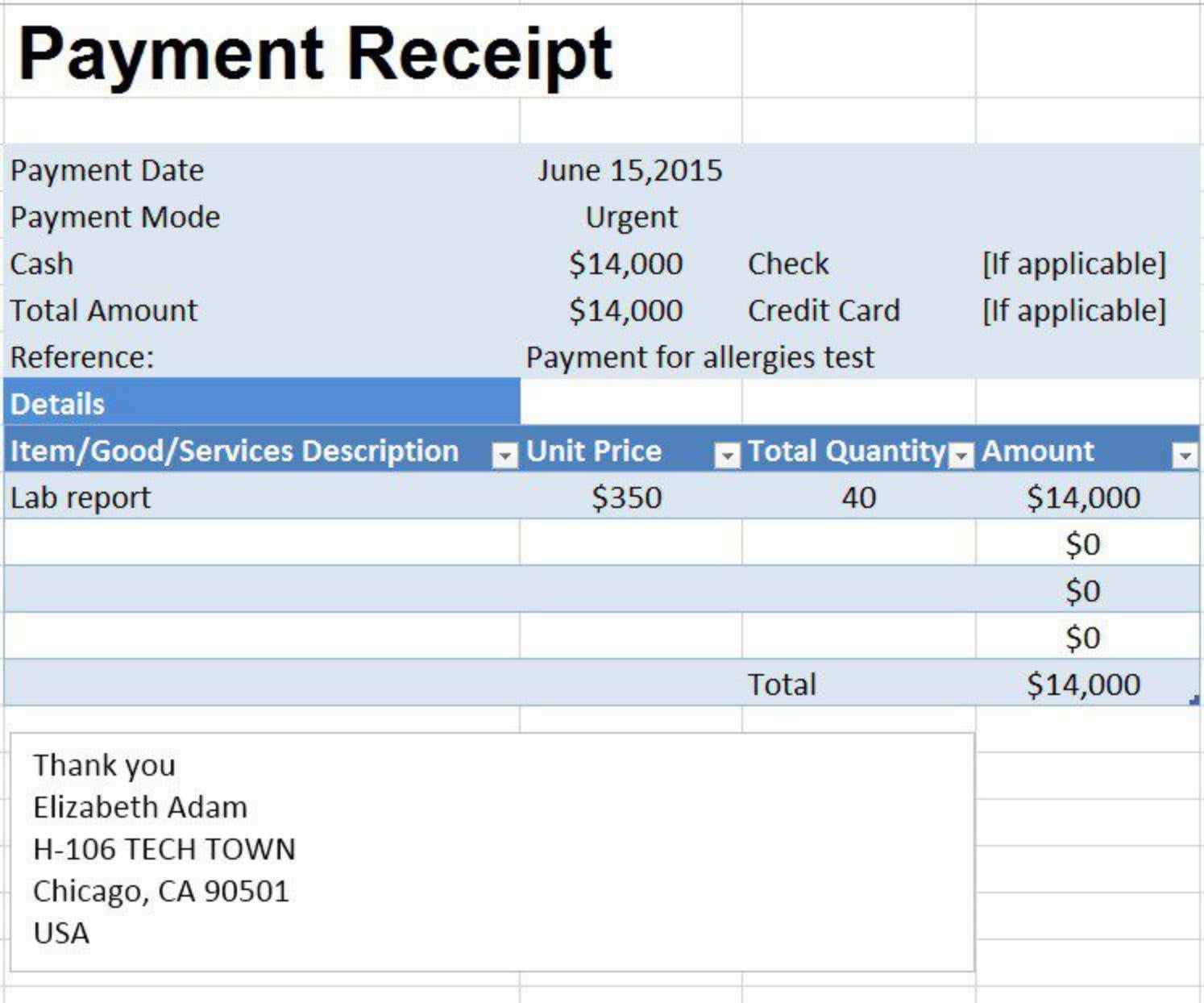

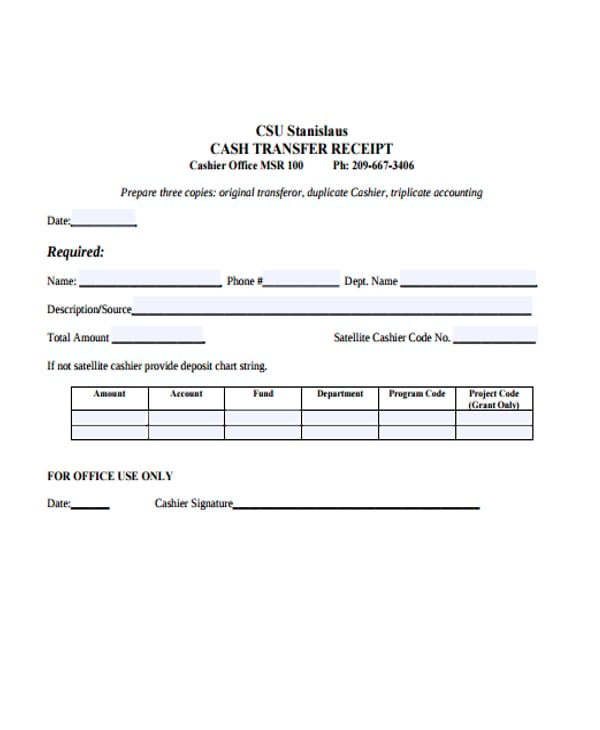

1. Essential Components of a Money Transfer Receipt

- Transaction date: The date on which the money was transferred.

- Amount transferred: The exact amount of money that was transferred.

- Sender details: The name, address, and contact information of the person sending the money.

- Recipient details: The name, address, and contact information of the person receiving the money.

- Transaction reference number: A unique identifier for the transaction.

- Signature: A digital or physical signature from the sender to validate the authenticity of the receipt.

2. Types of Money Transfers

- Domestic money transfers: Transfers within the same country.

- International money transfers: Transfers between different countries.

- Bank-to-bank transfers: Transfers between two bank accounts.

- Mobile money transfers: Transfers using mobile devices and platforms.

- Cryptocurrency transfers: Transfers using decentralized digital currencies.

3. Money Transfer Fees and Charges

- Transaction fees: Fees charged by the service provider for processing the transfer.

- Currency conversion fees: Fees charged when converting the funds from one currency to another.

- Intermediary bank fees: Fees charged by banks involved in the transfer if it passes through multiple financial institutions.

- Regulatory fees: Fees imposed by government or financial regulators.

- Recipient fees: Fees charged to the recipient for receiving the funds.

4. Security and Fraud Prevention

- Encryption: Encrypting transaction data to protect it from unauthorized access.

- Two-factor authentication: Requiring additional verification steps to prevent unauthorized access to accounts.

- Fraud monitoring: Monitoring transactions for suspicious activity and blocking fraudulent attempts.

- Compliance with regulations: Adhering to industry standards and regulations to ensure transparency and prevent money laundering.

- Consumer protection laws: Providing legal safeguards and remedies for consumers in case of fraud or unauthorized transactions.

5. Best Practices for Generating Money Transfer Receipts

- Use a reputable money transfer receipt generator: Choose a generator that is reliable, secure, and compliant with industry standards.

- Provide accurate and complete information: Ensure that all the required information is accurately entered to create a valid receipt.

- Retain receipts for record-keeping: Store receipts safely for future reference and documentation purposes.

- Consider using electronic receipts: Opt for electronic receipts to save paper and facilitate easy access and sharing.

- Verify receipts before sending them: Carefully review the receipt to ensure its accuracy and completeness before sending it to the recipient.

Conclusion

A money transfer receipt generator is an indispensable tool for individuals and businesses that conduct online financial transactions. By providing a standardized and verifiable record of the transaction, it enhances transparency, accountability, and legal protection. Understanding the essential components, types, and security considerations of money transfers empowers users to generate professional and compliant receipts that meet their specific needs. By embracing best practices and staying informed, individuals and organizations can ensure the integrity and reliability of their financial transactions in the digital age.

Keyword Tags

- Money Transfer Receipt Generator

- Money Transfer Receipt

- Online Money Transfers

- Essential Components of Money Transfer Receipts

- Secure Money Transfer Receipts