Bill Generator

Customer Information

- Name: [Customer Name]

- Address: [Customer Address]

- Contact Number: [Customer Contact Number]

- Email: [Customer Email Address]

Invoice Number: [Invoice Number]

Invoice Date: [Invoice Date]

Due Date: [Due Date]

Service Description

- Description of service provided

- Quantity (if applicable)

- Unit Price

- Total Price

Subtotal: [Subtotal Amount]

Tax (if applicable): [Tax Amount]

Total Amount Due: [Total Amount Due]

Payment Instructions

- Payment Method: [Payment Method]

- Account Number: [Account Number]

- Routing Number: [Routing Number]

Notes:

- Please make payment by the due date to avoid any late fees.

- If you have any questions or concerns, please contact us at [Contact Number] or [Email Address].

Thank you for your business!## Bill Generator In

Executive Summary

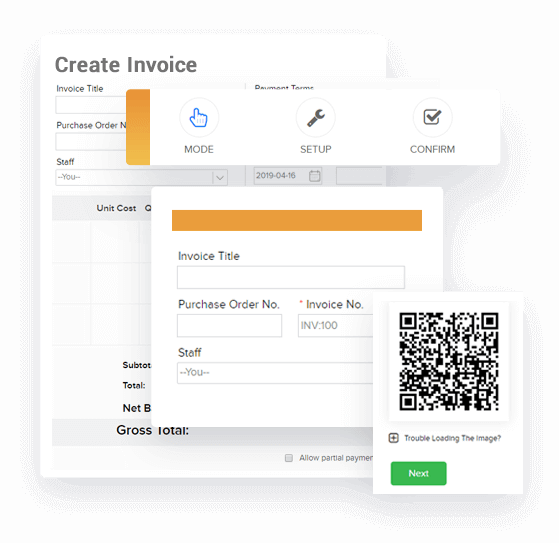

Bill generators are essential tools for businesses of all sizes, enabling them to create professional invoices and track their billing. This comprehensive guide provides an in-depth overview of bill generators, their key features, benefits, and top providers. By leveraging the insights and recommendations presented here, businesses can optimize their billing processes, enhance efficiency, and improve their cash flow.

Introduction

In today’s competitive business landscape, streamlining billing operations is crucial for success. Bill generators offer a powerful solution by automating invoice creation, streamlining payment processing, and providing valuable insights into financial performance. This detailed guide will delve into the nitty-gritty of bill generators, empowering businesses to make informed decisions and select the ideal tool for their specific needs.

FAQs

1. What is a bill generator?

A bill generator is a software tool that simplifies the process of creating and managing invoices. It enables users to create professional-looking invoices, track payments, and monitor outstanding balances.

2. What are the benefits of using a bill generator?

- Automates invoice creation: Eliminate manual data entry and reduce errors.

- Streamlines payment processing: Accept online payments and integrate with payment gateways.

- Enhances cash flow: Track outstanding invoices and send automated reminders to improve payment collection.

- Provides financial insights: Generate reports to analyze revenue, expenses, and payment trends.

3. What should I consider when selecting a bill generator?

- Features: Essential features include invoice creation, payment processing, and reporting functionality.

- Pricing: Consider the subscription model, pricing structure, and any additional fees.

- Ease of use: Choose a solution with a user-friendly interface and intuitive navigation.

- Integration: Ensure compatibility with existing accounting software and payment gateways.

Subtopics

Invoice Customization

- Configure invoice templates: Create branded invoices with custom logos, fonts, and colors.

- Add line items and descriptions: Easily enter invoice details, quantities, and unit prices.

- Apply discounts and taxes: Calculate and apply discounts, taxes, and other charges automatically.

Payment Processing

- Accept multiple payment methods: Integrate with payment gateways to enable online payments via credit cards, PayPal, and other methods.

- Send payment reminders: Automatically send payment reminders to overdue customers.

- Track payment status: Monitor the status of payments and identify outstanding invoices.

Reporting and Analytics

- Generate customized reports: Create reports to analyze sales, expenses, and other financial metrics.

- Track financial performance: Monitor key performance indicators (KPIs) such as revenue, profit margin, and cash flow.

- Identify trends and patterns: Analyze data to identify opportunities for improvement and business growth.

Collaboration and Automation

- Share invoices with clients: Easily share invoices with clients via email or other communication channels.

- Automate billing processes: Set up automated invoicing schedules, payment reminders, and follow-up emails.

- Integrate with other systems: Connect with accounting software, CRMs, and other business applications.

Security and Compliance

- Ensure data security: Choose a solution that meets industry standards for data encryption and privacy.

- Comply with regulations: Select a bill generator that complies with relevant regulations, such as PCI DSS for payment processing.

- Protect sensitive information: Safeguard customer information, financial data, and other sensitive information.

Conclusion

Bill generators are game-changers for businesses seeking to streamline their billing operations. By automating invoice creation, tracking payments, and providing valuable financial insights, these tools empower businesses to improve efficiency, enhance cash flow, and make informed decisions. Choosing the right bill generator can transform the billing process, enabling businesses to focus on growing their core operations.

Keyword Tags

- Bill generator

- Invoice creation

- Payment processing

- Financial reporting

- Business efficiency