Fake Invoice Receipt

Executive Summary

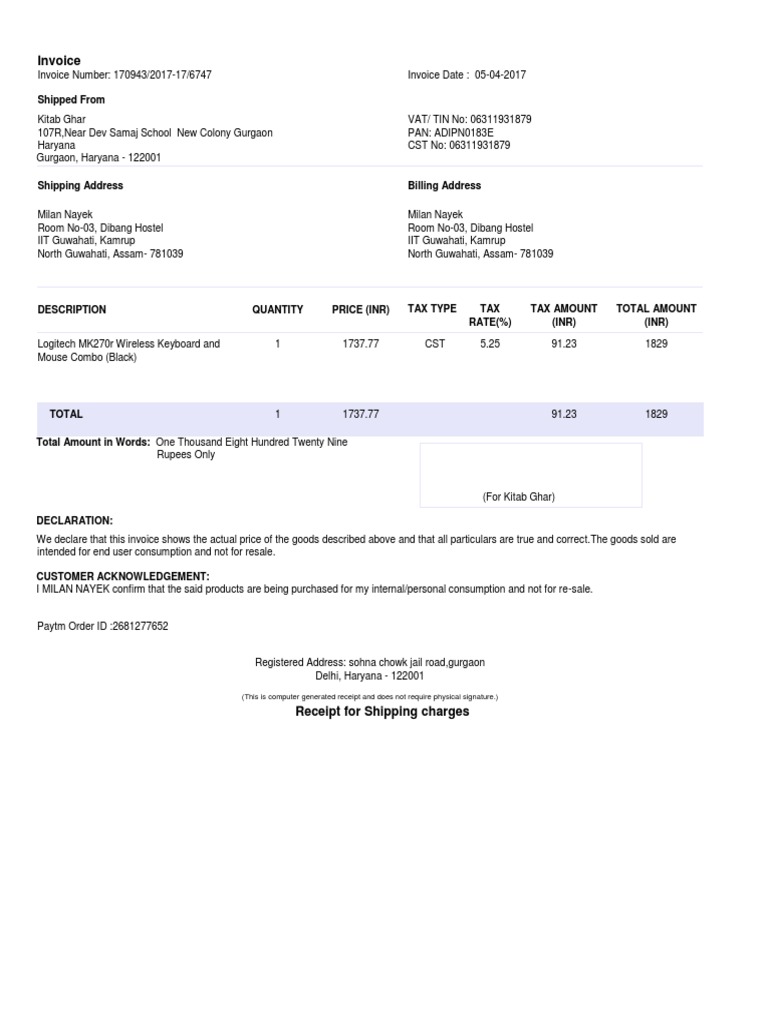

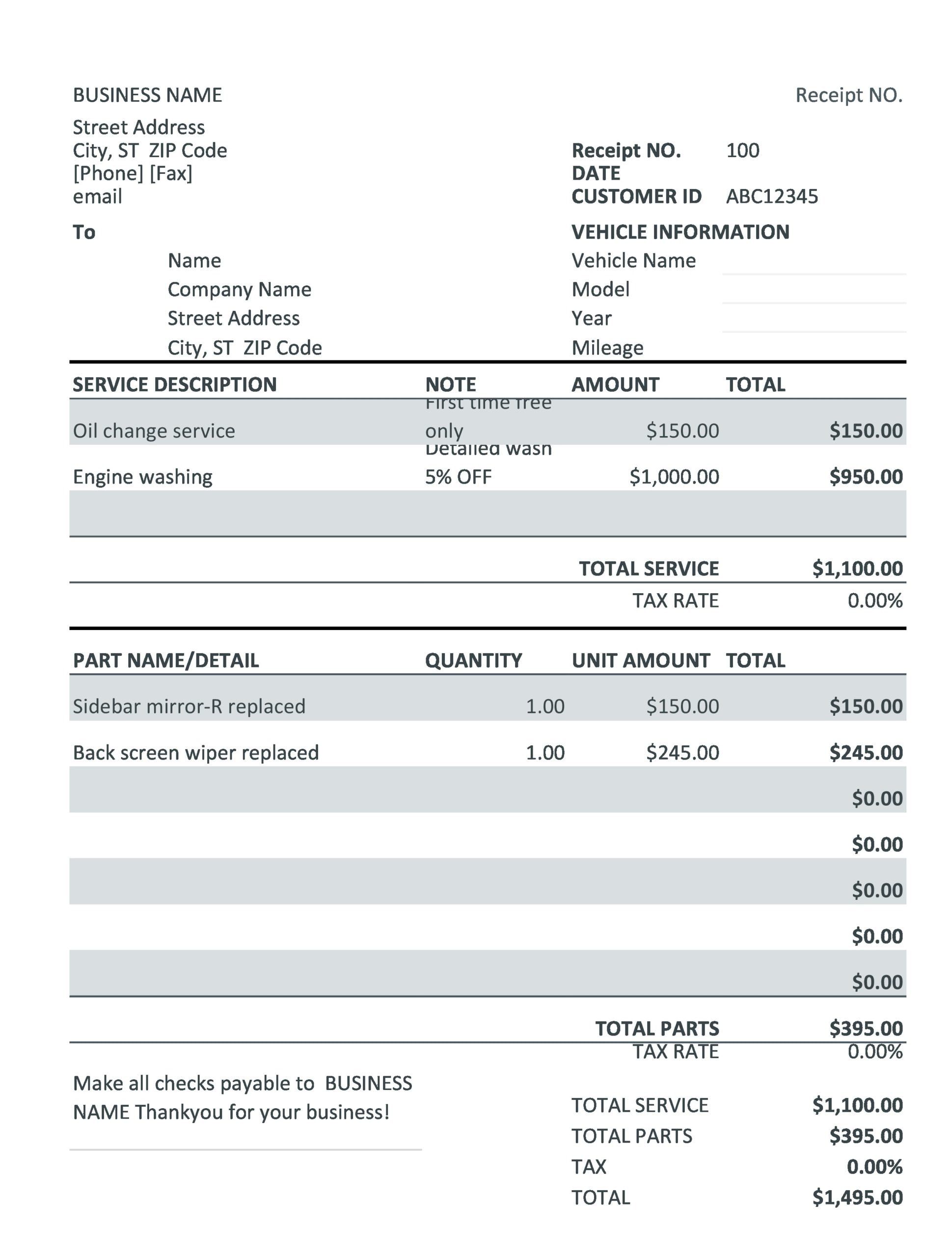

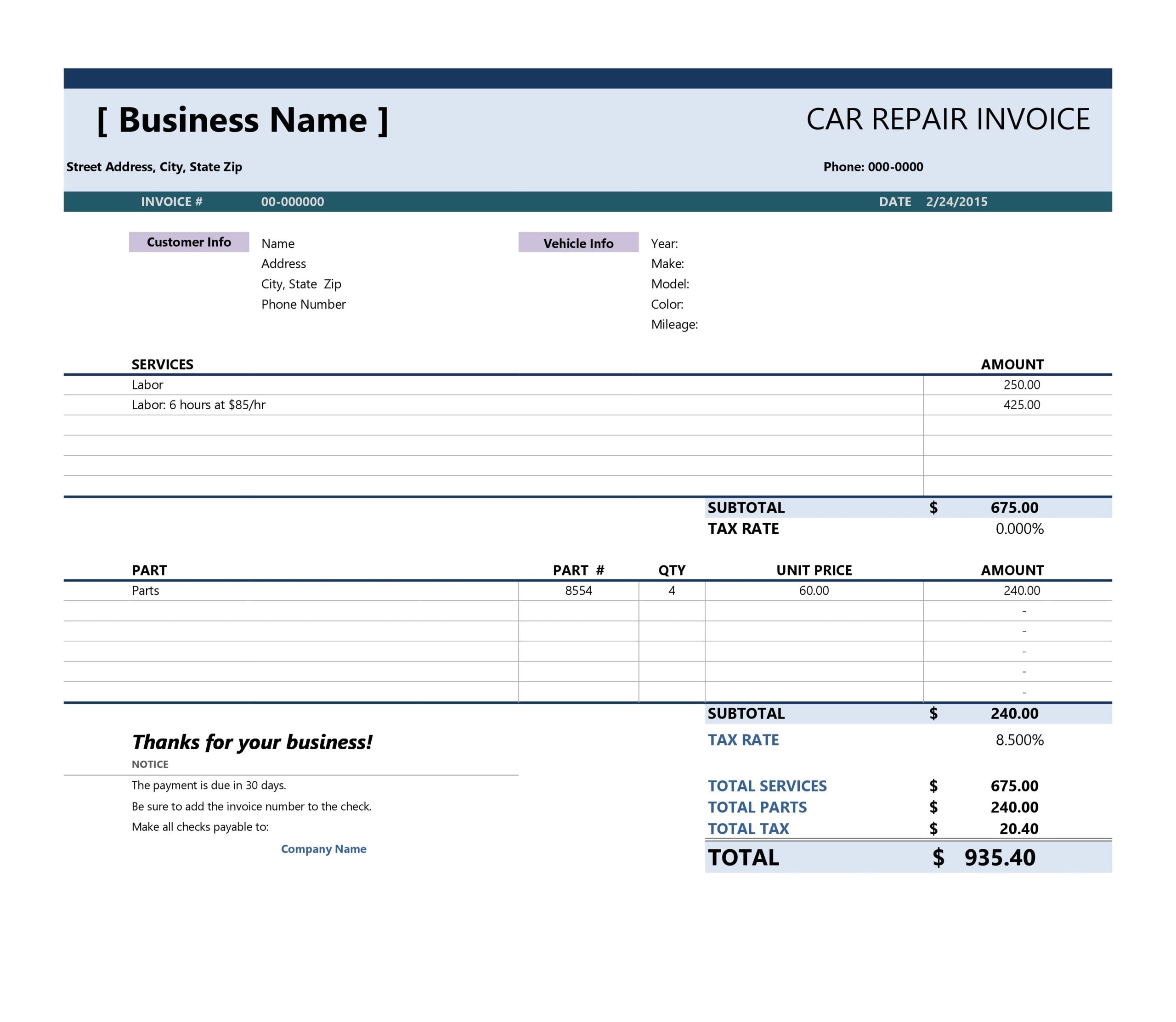

A fake invoice receipt is a deceptive document that fraudulently resembles a genuine invoice issued by a legitimate business. It is created with the intent to deceive or mislead the recipient, often for fraudulent purposes such as tax evasion, money laundering, or receiving of goods without payment. To protect against the use of fake invoice receipts, businesses and individuals should conduct due diligence by verifying the authenticity of invoices received and reporting suspicious activity to appropriate authorities.

Introduction

In today’s digital age, where business transactions are increasingly conducted electronically, the risk of fraudulent activities such as the use of fake invoice receipts has risen significantly. These fraudulent documents pose a threat to businesses and individuals alike, potentially leading to financial losses, legal complications, and reputational damage. Understanding the modus operandi of fake invoice receipts and implementing effective measures to prevent and detect them is crucial for businesses and individuals to safeguard their financial and legal interests.

FAQs

What are the typical indicators of a fake invoice receipt?

- Missing business contact information (address, phone number, email)

- Inconsistent or incorrect branding (logos, fonts, colors)

- Suspicious or unfamiliar payment details (untraceable bank accounts)

- Lack of proper invoice numbering or sequencing

- Unusual or inflated prices/quantities

What are the consequences of accepting a fake invoice receipt?

- Potential financial losses due to payment for non-delivered goods/services

- Tax liabilities if fraudulent invoices are used to claim false expenses

- Legal action if involved in fraudulent schemes or money laundering

- Damage to reputation and trust with legitimate suppliers

How can businesses protect themselves from fake invoice receipts?

- Establish clear invoice verification procedures

- Verify business details and contact information

- Use anti-fraud software and tools

- Monitor payments closely for suspicious activity

- Train employees on fraud detection and reporting

Top 5 Subtopics

1. Modus Operandi of Fake Invoice Receipt Scams

- Fraudulents create fake invoices resembling those from legitimate businesses.

- They target individuals or businesses with weak invoice verification processes.

- Fake invoices are often sent via email or posted to unsuspecting recipients.

- The recipient is tricked into paying for goods/services not received.

2. Red Flags to Detect Fake Invoice Receipts

- Inconsistent or missing business information

- Mismatched contact details or website URLs

- Suspicious payment instructions (e.g., wire transfers to offshore accounts)

- Unexplained or excessive charges/quantities

- Poorly written or unprofessional presentation

3. Prevention Measures for Businesses

- Implement rigorous invoice verification procedures

- Train employees on fraud detection and reporting

- Establish clear payment authorization processes

- Use anti-fraud software and tools

- Report suspicious invoices to relevant authorities

4. Detection and Reporting

- Monitor payments for discrepancies or suspicious activity

- Verify invoices against purchase orders and receipts

- Contact the issuing business to confirm legitimacy

- Report fake invoices to the business, authorities (e.g., FTC, FBI), and creditors

5. Legal Implications and Consequences

- Accepting fake invoices can lead to legal liabilities for businesses and individuals.

- Fraudulent invoices may be used for tax evasion, money laundering, or other illegal activities.

- Businesses may face legal action for accepting fraudulent invoices or failing to prevent their use.

Conclusion

Fake invoice receipts pose a significant threat to businesses and individuals, potentially leading to financial losses, legal complications, and reputational damage. By understanding the modus operandi of fake invoice scams, implementing effective prevention measures, and promptly detecting and reporting suspicious invoices, businesses and individuals can protect themselves from these fraudulent activities. Collaboration with authorities, creditors, and industry experts is essential to combat fake invoice receipts and safeguard the integrity of business transactions.

Keyword Tags

- Fake Invoice Receipt

- Fraudulent Invoices

- Invoice Verification

- Fraud Detection

- Financial Protection