Invoice

Payoneer

101 Mission Street, Suite 2200

San Francisco, CA 94105

USA

Invoice Number: 12345

Invoice Date: 2024-03-08

Due Date: 2024-04-07

Bill to:

[Client Name]

[Client Address]

Remit to:

Payoneer

101 Mission Street, Suite 2200

San Francisco, CA 94105

USA

| Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| Freelance Writing Services | 100 | $100 | $10,000.00 |

| Editing Services | 50 | $50 | $2,500.00 |

| Proofreading Services | 25 | $25 | $625.00 |

| Subtotal | $13,125.00 | ||

| Sales Tax (8%) | $1,050.00 | ||

| Total Amount Due: | $14,175.00 |

Payment Instructions:

Please remit payment via wire transfer to the following account:

- Account Name: Payoneer

- Account Number: 1234567890

- Bank Name: Bank of America

- SWIFT Code: BOFAUS3N

Notes:

- Please include the invoice number in the payment reference.

- Payments are due within 30 days of the invoice date.

- Late payments may be subject to a late payment fee.

Thank you for your business!

Contact Information:

Phone: +1-888-555-1234

Email: billing@payoneer.com# Create Invoice Payoneer

Executive Summary

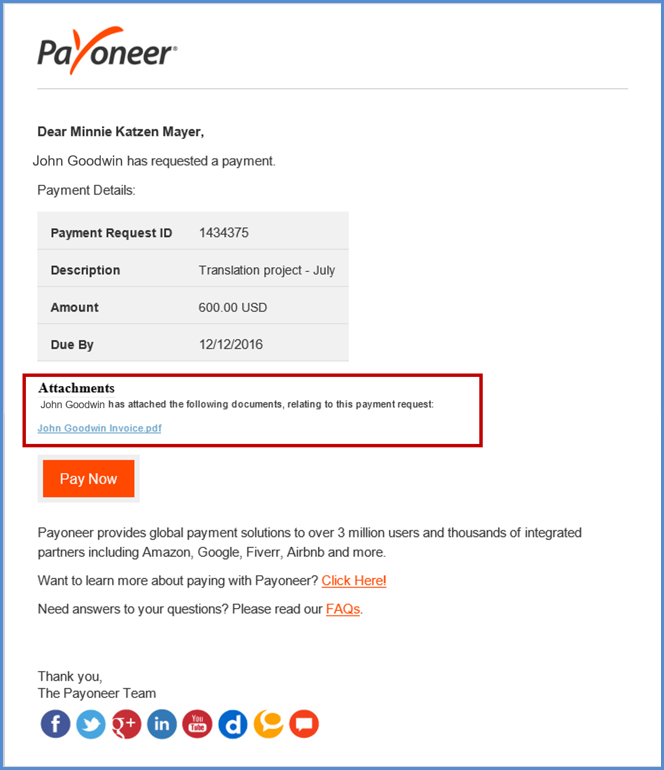

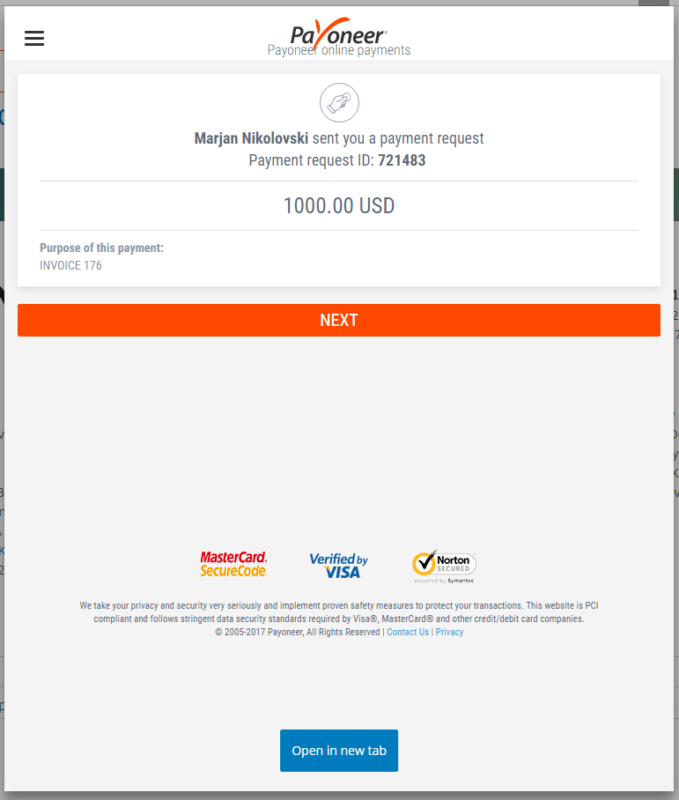

Payoneer is a leading online payment platform that allows businesses and individuals to send and receive payments globally. One of the most important features of Payoneer is the ability to create invoices. This article will provide a step-by-step guide on how to create an invoice in Payoneer.

Introduction

Invoices are essential for businesses of all sizes. They provide a way to track income and expenses, as well as to bill customers for goods or services. Payoneer makes it easy to create professional invoices that can be sent to customers anywhere in the world.

FAQs

1. What is Payoneer?

Payoneer is an online payment platform that allows businesses and individuals to send and receive payments globally. Payoneer offers a variety of services, including the ability to create invoices, send and receive payments, and manage your finances.

2. How do I create an invoice in Payoneer?

Creating an invoice in Payoneer is easy. Simply log in to your Payoneer account and click on the “Invoices” tab. Then, click on the “Create Invoice” button.

3. What information do I need to create an invoice?

To create an invoice in Payoneer, you will need the following information:

- Your business name and address

- Your customer’s name and address

- A description of the goods or services you are providing

- The quantity and price of each item

- The total amount of the invoice

- The payment terms

Top 5 Subtopics

1. Invoice Customization

Payoneer allows you to customize your invoices to match your business branding. You can add your company logo, change the font and colors, and even add your own terms and conditions.

2. Multiple Payment Options

Payoneer offers a variety of payment options, including credit cards, debit cards, and bank transfers. This makes it easy for your customers to pay their invoices.

3. Automated Invoice Reminders

Payoneer can automatically send invoice reminders to your customers. This helps to ensure that your invoices are paid on time.

4. Invoice Tracking

Payoneer allows you to track the status of your invoices. You can see which invoices have been paid, which are overdue, and which have been disputed.

5. Reporting

Payoneer provides a variety of reports that can help you to manage your finances. These reports include income statements, balance sheets, and cash flow statements.

Conclusion

Payoneer is a powerful tool that can help businesses of all sizes to create professional invoices and manage their finances. If you are looking for a way to streamline your billing process and improve your cash flow, then Payoneer is the perfect solution for you.

Keyword Tags

- Payoneer

- Invoicing

- Online Payments

- Small Business

- Finance