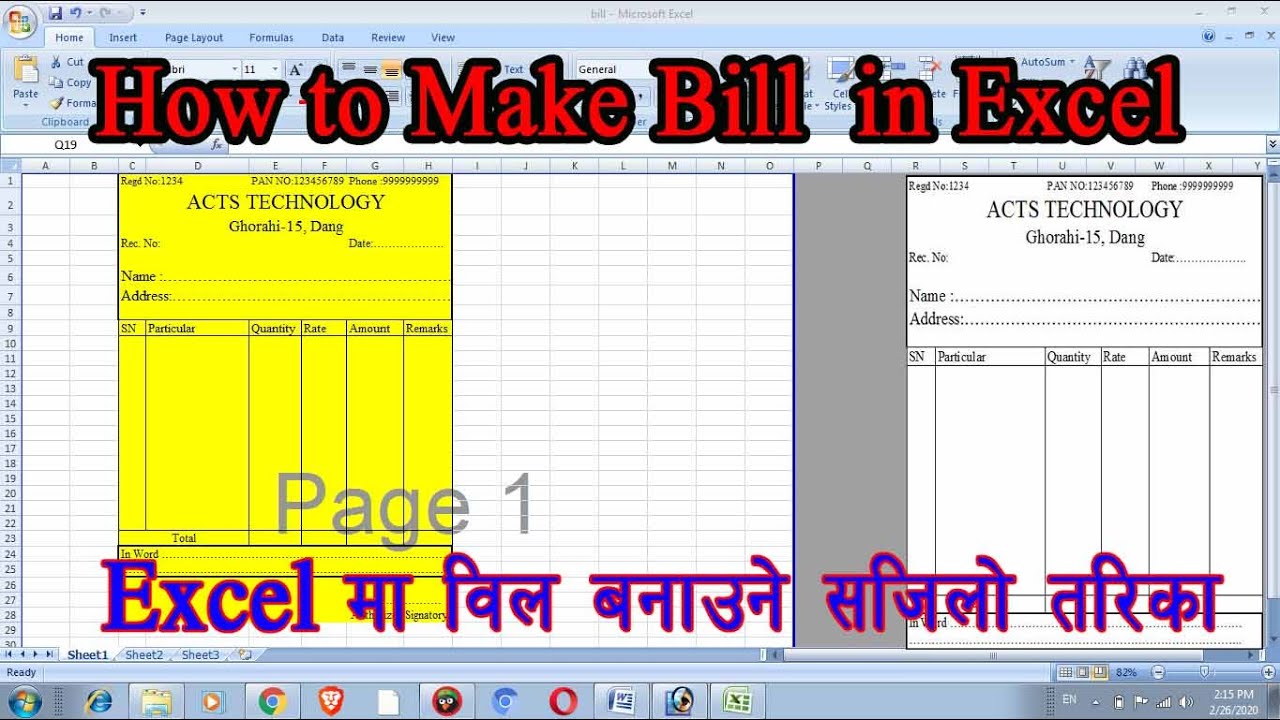

Bill Format Maker

Step 1: Header

- Business Name: Enter the name of your business.

- Logo: Upload your business logo (optional).

- Contact Information: Provide your business address, phone number, and email address.

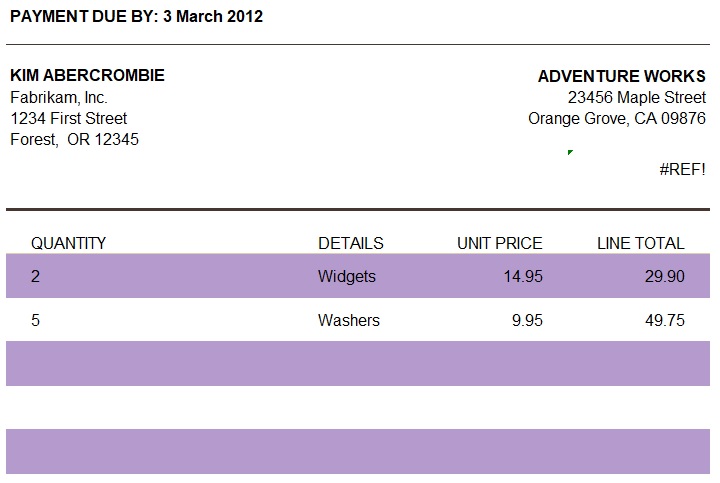

Step 2: Bill Details

- Invoice Number: Generate a unique invoice number for each bill.

- Invoice Date: Specify the date the invoice was created.

- Due Date: Indicate the date by which payment is expected.

- Bill To: Enter the customer’s name and address.

- Ship To: If different from the bill-to address, enter the shipping address.

- Terms of Payment: State the accepted payment methods and any payment deadlines.

Step 3: Itemized List

- Item Description: Detail the products or services provided.

- Quantity: Specify the number of units for each item.

- Unit Price: Indicate the price per unit.

- Amount: Calculate the total cost for each item.

Step 4: Subtotal and Taxes

- Subtotal: Calculate the total cost of all items before applying taxes.

- Taxes: Specify any applicable taxes, such as sales tax or GST.

- Tax Amount: Calculate the total tax amount.

Step 5: Total Due

- Total Amount Due: Calculate the final amount due, including taxes.

Step 6: Payment Information

- Payment Instructions: Provide instructions on how the customer can make payment.

- Payment Options: List the available payment methods, such as credit card, bank transfer, or cash.

Additional Features

- Notes Section: Add any additional notes or instructions for the customer.

- Custom Fields: Create custom fields to capture specific information, such as a purchase order number or project ID.

- Logo: Upload a watermark logo to prevent unauthorized use of the invoice template.

- Barcode: Generate a barcode for easy scanning and payment processing.

- Proof of Delivery: Include a section for the customer to sign off on the delivery of goods or services.## Bill Format Maker

Executive Summary

A bill format maker is a valuable tool for businesses to streamline and professionalize their billing processes. It allows users to create invoices and other billing documents quickly and easily, ensuring accuracy and consistency while saving time and effort.

Introduction

In today’s fast-paced business environment, efficient and accurate billing is crucial for maintaining customer satisfaction and business growth. A well-designed bill format maker empowers businesses to create professional-looking invoices that clearly communicate payment details and other essential information.

FAQs

1. What are the benefits of using a bill format maker?

- Saves time and effort: Automates the billing process, freeing up staff for more strategic tasks.

- Ensures accuracy: Pre-defined templates eliminate errors and inconsistencies.

- Improves customer experience: Provides clear and easy-to-understand invoices.

2. What types of businesses can benefit from a bill format maker?

- Freelancers and small businesses: Simplifies billing and reduces administrative tasks.

- Large enterprises: Streamlines billing processes and maintains consistency across departments.

- Service-based businesses: Facilitates invoicing for services provided.

3. What features should I look for in a bill format maker?

- Customization: Ability to personalize invoices with company branding and logo.

- Flexibility: Supports different invoice formats and payment methods.

- Integration: Seamless integration with accounting software and payment gateways.

Subtopics

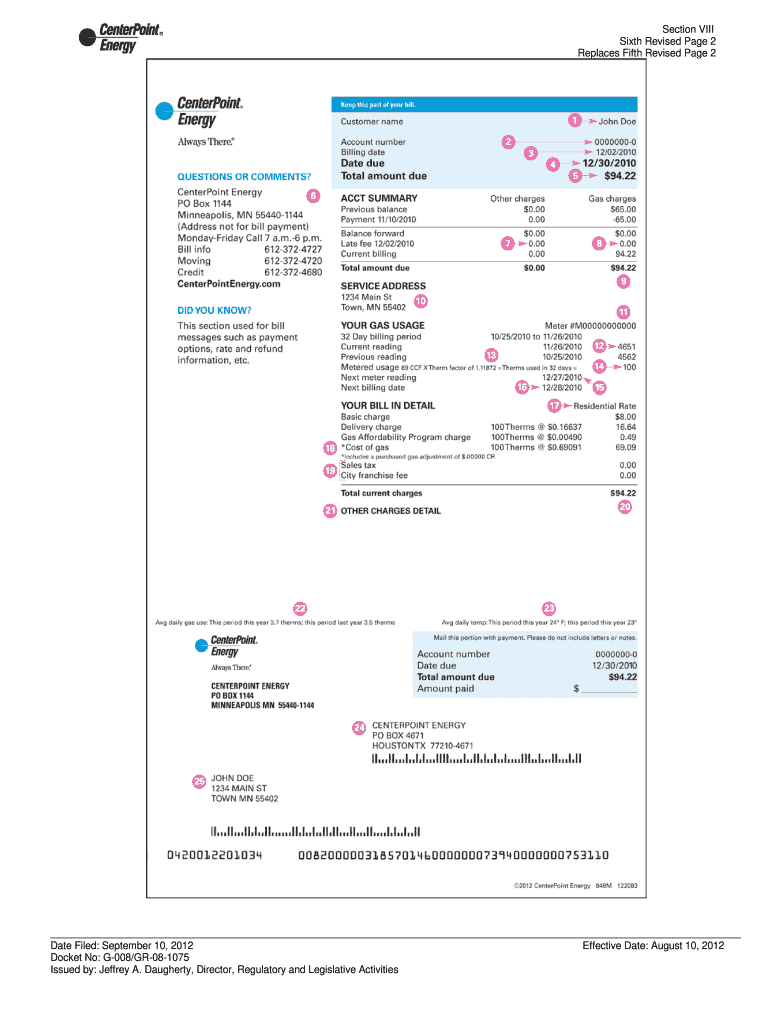

Invoice Creation

Invoices are the primary documents used to bill customers for products or services. Key features include:

- Itemized line items: Accurately describes the goods or services provided.

- Payment terms: Clearly states the payment due date, penalties, and discounts.

- Company contact information: Facilitates communication and inquiry resolution.

Quote/Estimate Management

Quotes provide customers with an estimate of potential costs before committing to a purchase. Important aspects:

- Detailed breakdown of services: Outlines the scope of work and associated costs.

- Validity period: Specifies the duration for which the quote remains valid.

- Acceptance and approval workflow: Streamlines the process of reviewing and approving quotes.

Purchase Order Management

Purchase orders are used to request goods or services from suppliers. Key elements include:

- Vendor information: Clearly identifies the supplier to whom the order is issued.

- Itemized product/service details: Describes the quantities, prices, and delivery instructions.

- Payment terms: Specifies the method and timeframe for payment.

Credit Memo and Refund Management

Credit memos are issued to adjust invoices when a customer returns products or receives a discount. Important features:

- Reason for adjustment: Clearly states the reason for the credit being issued.

- Original invoice reference: Links the credit memo to the original invoice.

- Impact on payment: Indicates the adjustment to the total payment amount.

Report Generation

Bill format makers often provide reporting capabilities to analyze billing performance and trends. Key reports:

- Sales and revenue reports: Summarizes invoice data for analysis and forecasting.

- Customer payment history: Tracks customer payment patterns and identifies potential issues.

- Bill aging reports: Identifies overdue invoices and facilitates collection efforts.

Conclusion

Utilizing a bill format maker is a strategic decision that can significantly improve a business’s billing and payment processes. By streamlining invoice creation, providing customizable templates, and enabling advanced functionality, bill format makers empower businesses to enhance customer experience, increase efficiency, and gain valuable insights into their financial performance.

Keyword Tags

- Bill Format Maker

- Invoice Template

- Quote Management

- Purchase Order

- Financial Reporting