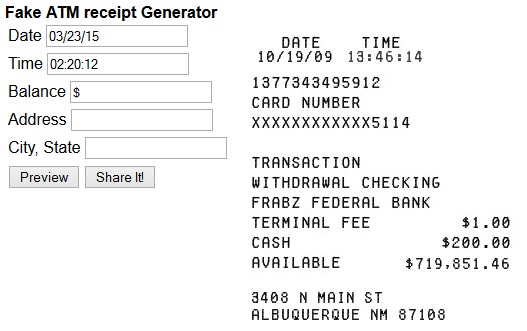

Deposit Receipt Generator

Bank Name:

Branch Name:

Account Number:

Amount Deposited:

Date:

Transaction Reference Number:

Deposited By:

Signature of Receiving Officer:

Please note that this is a fake deposit receipt and should not be used for any official purposes.## Fake Deposit Receipt Generator

Executive Summary

Fake deposit receipt generators are tools that create fraudulent documents to provide proof of payment. They can be used for a variety of purposes, such as obtaining loans, renting apartments, or committing fraud. While they may seem like a quick and easy way to obtain a desired outcome, using fake deposit receipts is illegal and can have serious consequences.

Introduction

Deposit receipts are essential documents that serve as proof of payment for various transactions. They provide a record of the amount deposited, the date of the transaction, and the recipient’s information. However, there are individuals who resort to creating fake deposit receipts for dishonest purposes. Fake deposit receipt generators facilitate this fraudulent activity by providing templates and tools to generate realistic-looking documents.

FAQs

What is a fake deposit receipt generator?

- A tool used to create fraudulent deposit receipts without making an actual deposit.

Why should I avoid using fake deposit receipts?

- It is illegal and can result in severe penalties, including fines and imprisonment.

- It can damage your creditworthiness and financial reputation.

- Using forged documents can undermine trust and lead to legal action.

Are there any legitimate alternatives to fake deposit receipts?

- Obtain a genuine deposit receipt from the intended recipient.

- Explore alternative methods of proof of payment, such as bank statements or online payment confirmations.

Top 5 Subtopics

1. Purpose of Fake Deposit Receipts

- Obtaining Loans: Fraudsters use fake deposit receipts to prove income and qualify for loans they may not otherwise be eligible for.

- Renting Apartments: Individuals may submit fake deposit receipts to secure apartments without having the funds to cover the deposit.

- Insurance Fraud: Criminals create fake deposit receipts to claim insurance benefits for fictitious losses or damages.

- Online Scams: Fake deposit receipts can be used to deceive victims into believing they have made payments for goods or services that do not exist.

- Tax Evasion: Some individuals use fake deposit receipts to fabricate deductions or expenses to reduce their tax liability.

2. Legal Consequences

- Forgery: Creating or using fake deposit receipts is a form of forgery, which is a serious crime.

- Fraud: Attempting to obtain goods, services, or benefits using fake deposit receipts constitutes fraud.

- Financial Penalties: Individuals convicted of deposit receipt forgery or fraud may face significant fines and restitution payments.

- Imprisonment: In severe cases, individuals may be sentenced to jail time for these offenses.

- Damage to Reputation: Convictions for forgery or fraud can severely damage an individual’s reputation and credibility.

3. Detection Techniques

- Verification with Banks: Banks can verify whether a deposit receipt is legitimate by checking their records for the corresponding transaction.

- Analysis of Documents: Experts can examine deposit receipts for inconsistencies, such as mismatched fonts, watermarks, or signatures.

- Investigation of Circumstances: Law enforcement officials may investigate the circumstances surrounding the creation and use of fake deposit receipts to gather evidence.

- Comparison with Genuine Receipts: Legitimate deposit receipts typically have specific security features and design elements that can be used to distinguish them from fakes.

- Reporting Suspicious Activity: Individuals should report any suspected fake deposit receipts to the appropriate authorities or financial institutions.

4. Prevention Measures

- Educate Yourself: Understand the consequences and risks associated with using fake deposit receipts.

- Verify Receipts: Always check the authenticity of deposit receipts with the intended recipient or financial institution.

- Use Trusted Sources: Obtain deposit receipts from reputable and trustworthy sources.

- Protect Your Information: Avoid sharing personal or financial information that could be used to create fake deposit receipts.

- Report Fraudulent Activity: Immediately report any suspected fake deposit receipts to the authorities or relevant parties.

5. Alternatives to Fake Deposit Receipts

- Bank Statements: Official bank statements can provide proof of deposits and transactions.

- Online Payment Confirmations: Payment platforms like PayPal or Stripe provide email confirmations and transaction histories.

- Cashier’s Checks: Cashier’s checks act as guarantees of payment and can be used as alternative proof of deposits.

- Money Orders: Money orders are purchased with cash and can be used as secure proof of payment.

- Third-Party Verification: Ask a reputable third party, such as an accountant or attorney, to verify the authenticity of deposit receipts.

Conclusion

Fake deposit receipt generators are dangerous tools that can lead to serious legal consequences. It is crucial to avoid using them and to rely on legitimate methods to provide proof of payment. Understanding the purpose, legal implications, detection techniques, and prevention measures associated with fake deposit receipts is essential for protecting oneself from financial losses, legal troubles, and reputational damage.

Keyword Tags

- Fake Deposit Receipt Generator

- Deposit Receipt Forgery

- Financial Fraud

- Proof of Payment Alternatives

- Legal Consequences of Fraud