Invoice

Invoice Number: INV-00001

Date: 2024-03-08

Customer Information

Company Name: ABC Corporation

Contact Person: John Doe

Address: 123 Main Street, Anytown, CA 12345

Email: john.doe@abc-corp.com

Phone: (555) 123-4567

Billing Information

Company Name: XYZ Inc.

Contact Person: Jane Doe

Address: 456 Elm Street, Anytown, CA 98765

Email: jane.doe@xyz-inc.com

Phone: (555) 987-6543

Service Provided

Web Design and Development

- Design and development of a new website for ABC Corporation

- Implementation of e-commerce functionality

- Integration with social media platforms

Hours Worked

100 hours

Hourly Rate

$100

Total Amount Due

$10,000

Payment Terms

Net 30 days

Additional Notes

Please remit payment to the following bank account:

Account Number: 1234567890

Bank Name: Anytown Bank

Swift Code: ANYTSWIFT

Thank you for your business!## Executive Summary

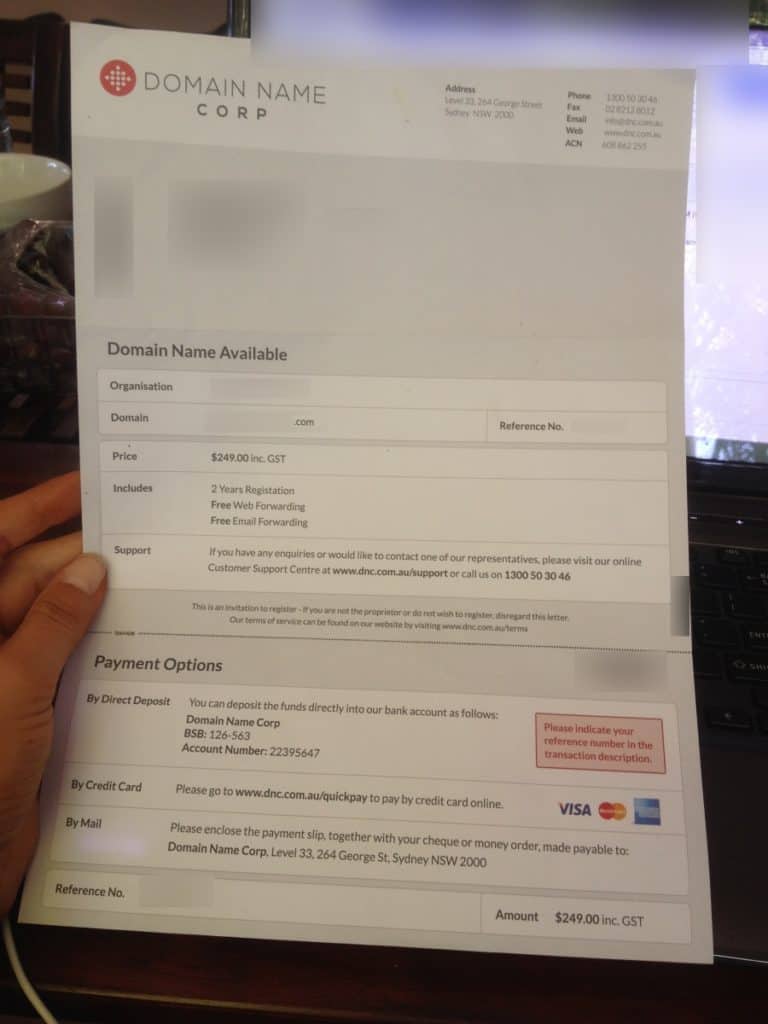

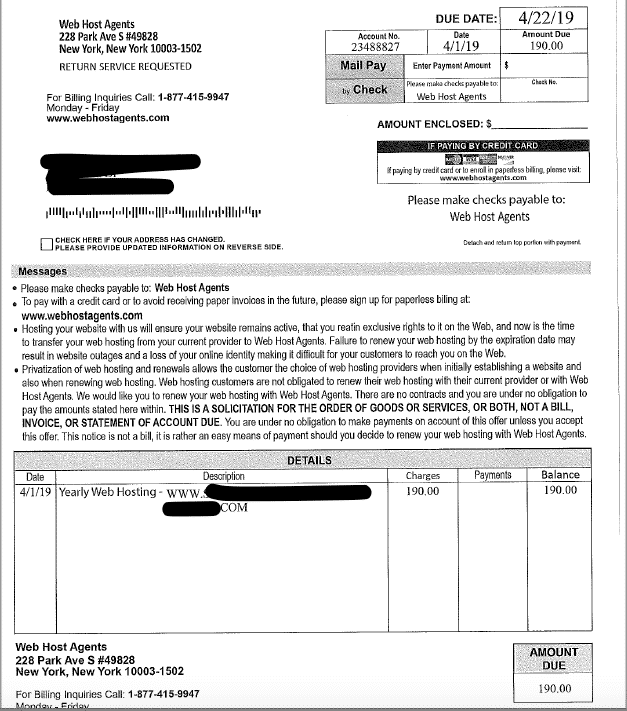

Producing invoices is a crucial aspect of business operations, and having the ability to Make Fake Invoice Online provides numerous benefits. This article will delve into the various reasons why creating fake invoices can be advantageous, explore the top subtopics related to creating fake invoices, and provide answers to frequently asked questions.

Introduction

Creating invoices is an essential task for businesses of all sizes. Invoices serve as a record of transactions, providing details about the goods or services provided, payment terms, and other relevant information. However, in certain situations, it may be necessary to Make Fake Invoice Online. This article will provide an overview of the various benefits of creating fake invoices, as well as explore some of the important considerations and best practices associated with this process.

FAQ

1. What are the benefits of making fake invoices?

- Track expenses: Fake invoices can be used to track expenses that would not otherwise be documented.

- Receive reimbursement: Fake invoices can be used to receive reimbursement for expenses that are not covered by other means.

- Provide proof of income: Fake invoices can be used to provide proof of income for various purposes, such as applying for loans or obtaining government benefits.

2. What are some of the important considerations when making fake invoices?

- Accuracy: Fake invoices should be accurate and consistent with the goods or services that were provided.

- Legality: It is important to ensure that the creation of fake invoices is legal in your jurisdiction.

- Ethics: It is important to consider the ethical implications of creating fake invoices.

3. What are some of the best practices for making fake invoices?

- Use professional software: Use professional software to create fake invoices that look realistic.

- Keep records: Keep accurate records of all fake invoices that are created.

- Be cautious: Use fake invoices responsibly and only when necessary.

Top 5 Subtopics

Subtopic 1: Creating Fake Invoices for Tax Purposes

- Purpose: Creating fake invoices can be used to reduce taxable income.

- Considerations:

- Ensure that the fake invoices are accurate and consistent with the goods or services that were provided.

- Be aware of the legal implications of creating fake invoices.

- Consider the ethical implications of creating fake invoices.

Subtopic 2: Creating Fake Invoices for Expense Reimbursement

- Purpose: Creating fake invoices can be used to receive reimbursement for expenses that are not covered by other means.

- Considerations:

- Ensure that the fake invoices are accurate and consistent with the expenses that were incurred.

- Be aware of the legal implications of creating fake invoices.

- Consider the ethical implications of creating fake invoices.

Subtopic 3: Creating Fake Invoices for Proof of Income

- Purpose: Creating fake invoices can be used to provide proof of income for various purposes, such as applying for loans or obtaining government benefits.

- Considerations:

- Ensure that the fake invoices are accurate and consistent with the income that was earned.

- Be aware of the legal implications of creating fake invoices.

- Consider the ethical implications of creating fake invoices.

Subtopic 4: Creating Fake Invoices for Personal Use

- Purpose: Creating fake invoices can be used for personal use, such as tracking expenses or providing proof of income for personal reasons.

- Considerations:

- Ensure that the fake invoices are accurate and consistent with the expenses or income that was incurred.

- Be aware of the legal implications of creating fake invoices.

- Consider the ethical implications of creating fake invoices.

Subtopic 5: Creating Fake Invoices for Business Transactions

- Purpose: Creating fake invoices can be used for business transactions, such as recording sales or expenses.

- Considerations:

- Ensure that the fake invoices are accurate and consistent with the goods or services that were provided.

- Be aware of the legal implications of creating fake invoices.

- Consider the ethical implications of creating fake invoices.

Conclusion

Creating fake invoices can be a useful tool for a variety of purposes. However, it is important to consider the legal and ethical implications of doing so. By following the best practices outlined in this article, you can minimize the risks associated with creating fake invoices and ensure that they are used for legitimate purposes.

Relevant Keyword Tags

- Make Fake Invoice Online

- Create Fake Invoice

- Fake Invoice Generator

- Fake Invoice Template

- Invoice Creation