Receipt Maker Fake is a tool that allows you to generate fake receipts. This can be useful for a variety of purposes, such as:

- Providing proof of purchase for warranty claims

- Creating receipts for tax purposes

- Generating fake receipts for use in movies or TV shows

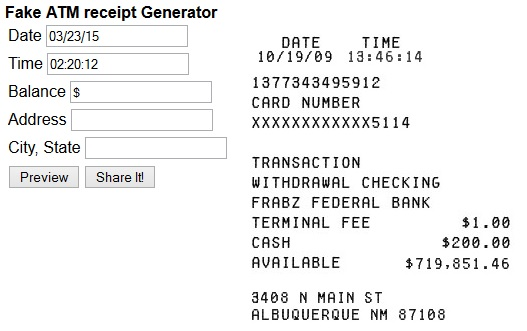

To use Receipt Maker Fake, simply follow these steps:

- Enter the business name, address, and phone number.

- Enter the date of the purchase.

- Enter the items purchased, along with their prices.

- Enter the total amount of the purchase.

- Click the “Generate Receipt” button.

Receipt Maker Fake will then generate a fake receipt that you can print or save to your computer.

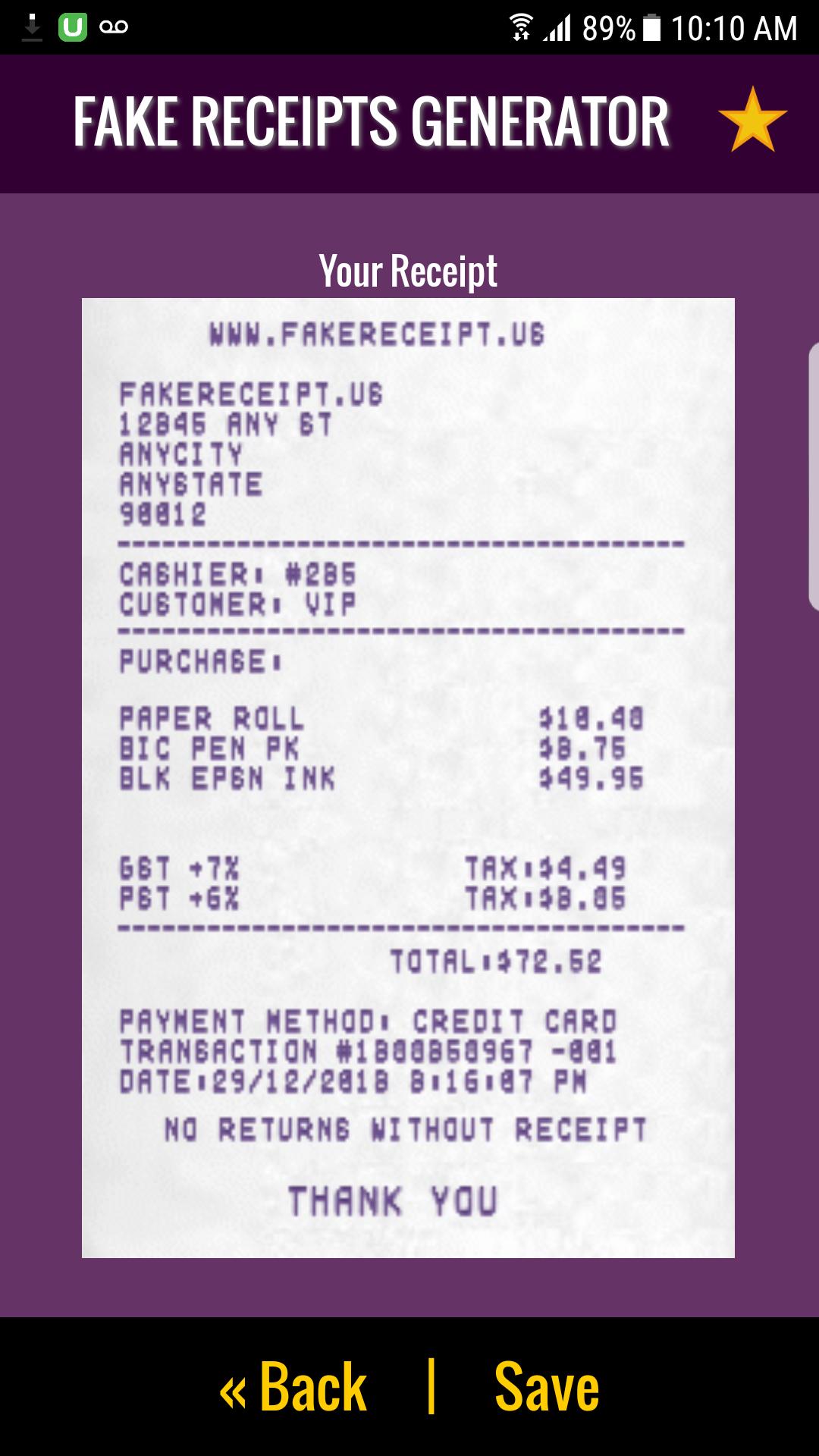

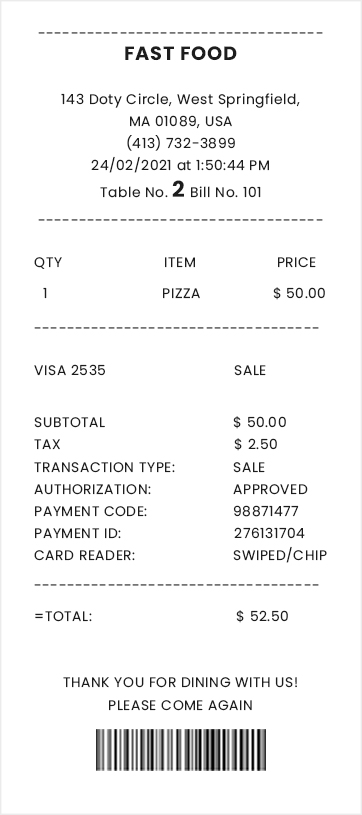

Here is an example of a fake receipt that was generated by Receipt Maker Fake:

Business Name: ABC Store

Address: 123 Main Street, Anytown, CA 12345

Phone Number: (123) 456-7890

Date: 2024-03-08

Items Purchased:

- Item 1: $10.00

- Item 2: $20.00

- Item 3: $30.00

Total: $60.00

Please note that Receipt Maker Fake is not intended to be used for fraudulent purposes. Using this tool to generate fake receipts for illegal purposes could result in serious consequences.## [Receipt Maker Fake]

Executive Summary

Fake receipt makers offer a convenient way to generate realistic-looking receipts for various purposes, including personal expense tracking, business reimbursements, and customer records. However, it is crucial to use these tools with caution and only for legitimate reasons, as creating false receipts can have legal consequences.

Introduction

Receipt makers have become increasingly popular in the digital age, providing an easy way to document expenses, track purchases, and manage finances. However, some individuals have exploited these tools to create fake receipts for fraudulent purposes. This article explores the potential risks and benefits of using fake receipt makers and provides guidance on ethical and legal considerations.

FAQs

1. What is a fake receipt maker?

A fake receipt maker is a tool or software that allows users to create receipts that resemble authentic documents issued by businesses or individuals.

2. What are the legitimate uses of fake receipt makers?

Fake receipt makers can be used for legitimate purposes, such as:

- Personal expense tracking

- Business reimbursement claims

- Customer record-keeping

3. What are the risks of using fake receipt makers?

Using fake receipt makers for fraudulent purposes can have serious legal consequences, including:

- Fines

- Imprisonment

- Damage to reputation

Top 5 Subtopics

Legitimate Uses

- Expense Tracking: Fake receipts can help individuals track personal expenses, such as travel, meals, and entertainment, for budgeting or tax purposes.

- Business Reimbursements: Businesses can use fake receipts to reimburse employees for expenses incurred on company business, provided the expenses are legitimate.

- Customer Records: Businesses can generate fake receipts as proof of purchase for customers, particularly for online transactions or email orders.

Fraudulent Uses

- False Expense Claims: Fake receipts can be used to fabricate expenses that were not incurred, leading to fraudulent claims for reimbursement.

- Tax Evasion: Fake receipts can be used to reduce tax liability by inflating deductions or expenses.

- Money Laundering: Fake receipts can be used to conceal illegal activities by providing a schein of legitimacy for transactions.

Ethical Considerations

- Truthfulness: Creating fake receipts that misrepresent the truth or fabricate transactions is unethical and potentially illegal.

- Transparency: Individuals should be transparent about the use of fake receipts and ensure that they are used only for legitimate purposes.

- Accountability: Users of fake receipt makers should be held accountable for any misuse or fraudulent activity.

Legal Considerations

- Forged Documents: Creating fake receipts that resemble authentic documents can be considered forgery, which is a criminal offense.

- Fraud: Using fake receipts for fraudulent purposes, such as claiming false expenses or submitting them for tax deductions, can result in legal penalties.

- Consumer Protection Laws: Using fake receipts to deceive customers or misrepresent the terms of transactions can violate consumer protection laws.

Conclusion

Fake receipt makers can be useful tools for legitimate purposes, such as expense tracking and record-keeping. However, it is imperative to use these tools ethically and responsibly. Creating fake receipts for fraudulent purposes is illegal and can have severe consequences. Individuals should be aware of the potential risks and only use fake receipt makers for legitimate and transparent reasons.

Keyword Tags

- Fake Receipt Maker

- Receipt Generator

- Expense Tracking

- Fraudulent Receipts

- Ethics of Receipt Making