Receipt Generator Fake

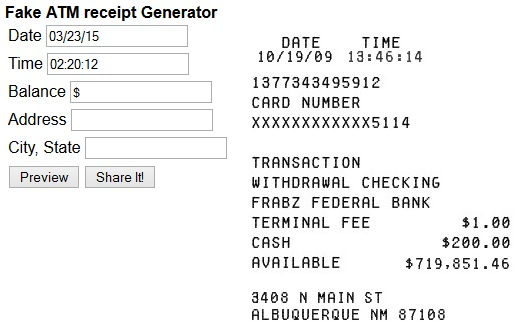

Generate a fake receipt for any purchase you want.

Instructions:

- Enter the store name.

- Enter the date of purchase.

- Enter the items you purchased.

- Enter the quantity of each item.

- Enter the price of each item.

- Enter the total amount of the purchase.

- Click the “Generate Receipt” button.

Example Receipt:

Store Name: Walmart

Date of Purchase: 2024-03-08

Items Purchased:

- Milk – 1 gallon – $3.99

- Eggs – 1 dozen – $2.99

- Bread – 1 loaf – $2.49

- Cheese – 1 block – $4.99

- Bacon – 1 pound – $6.99

Total Amount: $21.45

Thank you for shopping at Walmart!# Receipt Generator Fake

Executive Summary

In the contemporary business landscape, organizations are increasingly turning to technology to enhance efficiency and streamline operations. Receipt generators have emerged as a powerful tool for businesses seeking to automate their receipting processes and provide customers with convenient and accurate documentation. However, the proliferation of sophisticated counterfeiting techniques has led to the emergence of fake receipt generators, which pose significant risks to both businesses and consumers. This comprehensive article delves into the realm of fake receipt generators, exposing their deceptive nature, highlighting the legal implications, and providing practical guidance for businesses and consumers to combat this pervasive issue.

Introduction

Receipts serve as essential records of financial transactions, providing proof of purchase, tax deductions, and warranty claims. However, the advent of sophisticated digital technologies has facilitated the creation of fake receipt generators, which can produce fraudulent receipts that mimic genuine documents. These fake receipts are often used for illicit purposes, such as tax evasion, money laundering, and insurance fraud.

FAQs

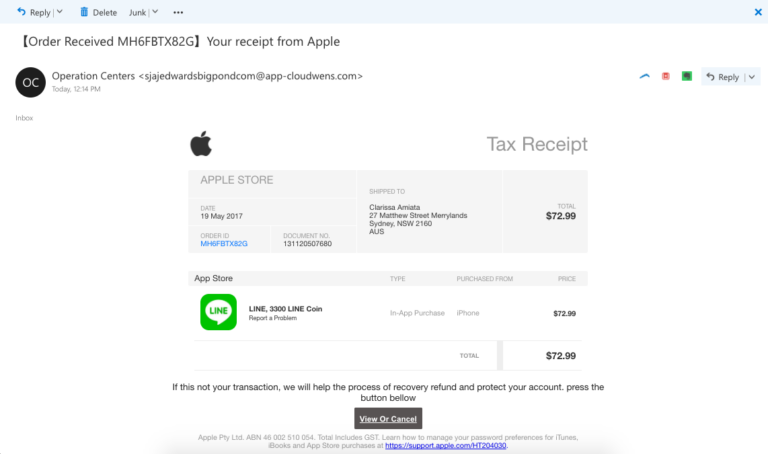

What are the signs of a fake receipt generator?

- Inconsistent or missing business information: Fake receipt generators may use fictitious business names, addresses, or phone numbers.

- Blurry or pixelated logos: Legitimate businesses typically use high-quality logos on their receipts.

- Unrealistic prices or discounts: Fake receipts may offer excessively low prices or discounts to attract customers.

- Absence of a company website or social media presence: Legitimate businesses usually have an online presence.

- Generic or boilerplate text: Fake receipts often use generic or boilerplate text that lacks specific details about the transaction.

What are the legal implications of using fake receipt generators?

- Tax evasion: Using fake receipts to claim fraudulent tax deductions can lead to severe legal consequences, including fines and imprisonment.

- Money laundering: Fake receipts can be used to disguise the origins of illicit funds, which is a serious criminal offense.

- Insurance fraud: Submitting fake receipts to insurance companies to obtain fraudulent claims can result in criminal charges.

- Breach of contract: Using fake receipts to fulfill contractual obligations can lead to legal disputes and financial losses.

How can businesses and consumers protect themselves from fake receipt generators?

- Verify business information: Always verify the business name, address, and contact information before accepting a receipt.

- Inspect the receipt carefully: Look for signs of tampering, such as blurry logos or generic text.

- Be wary of unrealistic prices or discounts: If a receipt offers excessively low prices or discounts, it may be a red flag.

- Check for an online presence: Legitimate businesses typically have a website or social media presence.

- Report suspicious receipts: If you suspect a receipt is fake, report it to the business or relevant authorities.

Subtopics

Misuse of Fake Receipt Generators

Fake receipt generators are frequently exploited for nefarious purposes, such as:

- Tax evasion: Creating fake receipts to claim fraudulent tax deductions.

- Money laundering: Concealing the origins of illicit funds through fake receipts.

- Insurance fraud: Submitting fake receipts to insurance companies to obtain fraudulent claims.

- False accounting: Manipulating financial records by using fake receipts to inflate expenses or reduce income.

- Embezzlement: Stealing funds from businesses by creating fake receipts to justify unauthorized expenses.

Impact on Businesses

Fake receipt generators pose significant risks to businesses, including:

- Financial losses: Businesses may incur financial losses due to fraudulent tax deductions, insurance claims, or embezzlement schemes.

- Reputational damage: Fake receipts can damage a business’s reputation and erode customer trust.

- Legal liability: Businesses may face legal liability for any fraudulent activities related to fake receipts.

- Increased expenses: Businesses may have to invest in additional security measures to prevent the misuse of fake receipt generators.

- Employee theft: Fake receipt generators can facilitate employee theft by providing a means to create fake expenses.

Countermeasures for Businesses

Businesses can implement various countermeasures to combat fake receipt generators:

- Implement strong internal controls: Establish clear policies and procedures for receipt handling and accounting practices.

- Use secure receipt generation software: Invest in receipt generation software that incorporates security features to prevent counterfeiting.

- Educate employees: Train employees to recognize and report suspicious receipts.

- Conduct regular audits: Regularly audit receipts to identify any fraudulent activities.

- Partner with law enforcement: Collaborate with law enforcement agencies to investigate and prosecute individuals involved in fake receipt generator schemes.

Financial Consequences

The financial consequences of fake receipt generators can be severe for both businesses and individuals:

- Tax penalties: Individuals and businesses caught using fake receipts for tax evasion may face substantial fines and imprisonment.

- Insurance fraud: Submitting fake receipts to insurance companies can result in denied claims, increased premiums, or criminal charges.

- Business losses: Businesses that use fake receipts to manipulate financial records may face legal consequences and financial penalties.

- Seizure of assets: Law enforcement agencies may seize assets acquired through fraudulent activities involving fake receipts.

- Loss of reputation: Individuals and businesses involved in fake receipt generator schemes may suffer reputational damage and loss of trust.

Legal Implications

Using fake receipt generators carries significant legal consequences:

- Counterfeiting charges: Creating or possessing fake receipts may violate counterfeiting laws, resulting in criminal charges.

- Fraud charges: Using fake receipts to obtain goods or services fraudulently can lead to fraud charges.

- Tax evasion charges: Using fake receipts to claim fraudulent tax deductions is a serious offense that can result in criminal prosecution.

- Money laundering charges: Using fake receipts to conceal the origins of illicit funds can result in money laundering charges.

- RICO charges: In severe cases, individuals involved in organized fake receipt generator schemes may face Racketeer Influenced and Corrupt Organizations (RICO) charges.

Conclusion

Fake receipt generators pose a serious threat to businesses and consumers, facilitating fraudulent activities that undermine the integrity of financial transactions. The misuse of fake receipt generators can lead to significant financial losses, reputational damage, and legal consequences. Businesses must implement robust countermeasures to prevent and detect the use of fake receipt generators. Individuals and businesses must be vigilant in recognizing and reporting suspicious receipts to protect themselves from the adverse effects of this pervasive issue.

Keyword Tags

- Receipt Generator Fake

- Counterfeit Receipts

- Tax Evasion

- Money Laundering

- Insurance Fraud