[Fake Bank Transfer Receipt Maker]

Executive Summary

The advent of digital banking has brought convenience and efficiency, but it has also opened doors to fraudulent activities. One such fraudulent practice is the creation of fake bank transfer receipts to deceive individuals or businesses. This article delves into the world of fake bank transfer receipt makers, examining their tactics, identifying red flags, and providing comprehensive guidance on protecting yourself from falling prey to such scams.

Introduction

Bank transfer receipts serve as proof of financial transactions, providing assurance and peace of mind in an increasingly digital world. However, unscrupulous individuals have exploited the ease of creating digital documents to forge bank transfer receipts, leading to substantial financial losses for unsuspecting victims.

FAQ

1. What is a fake bank transfer receipt?

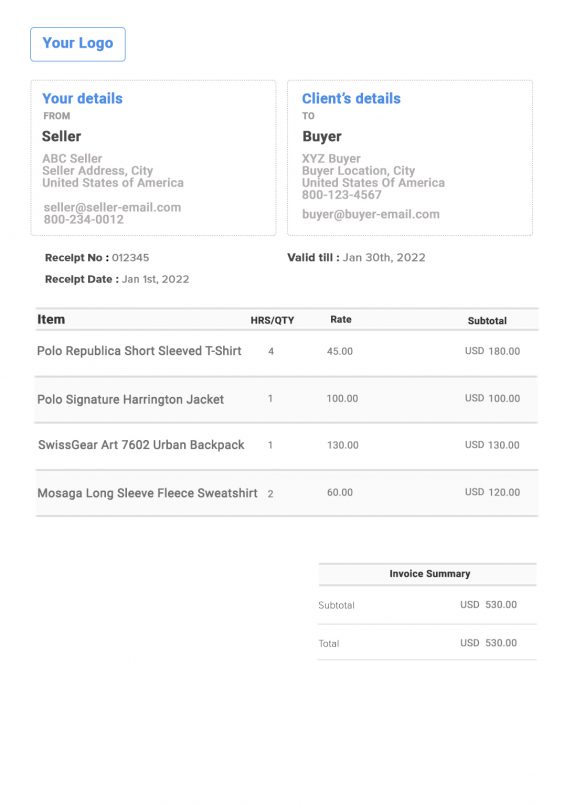

A fake bank transfer receipt is a document that fraudulently represents a genuine transfer of funds from one account to another. It is designed to deceive the recipient into believing that a payment has been made, often for a product or service rendered.

2. How are fake bank transfer receipts created?

Cybercriminals use sophisticated software and techniques to generate fake receipts that mimic the appearance and format of authentic bank receipts. They may also use stolen or forged bank account information to create the illusion of a legitimate transaction.

3. What are the consequences of receiving a fake bank transfer receipt?

Falling victim to a fake bank transfer receipt can result in significant financial losses. The recipient may send goods or services without ever receiving payment, or they may inadvertently release sensitive financial information to fraudsters.

Subtopics

1. Identifying Red Flags

- Unfamiliar email addresses or sender names: Fraudulent receipts often come from unfamiliar or suspicious email addresses that do not match the official domain of the bank.

- Inconsistencies in bank account numbers: Check the bank account number on the receipt against the one you have on file. Any discrepancies could indicate a fraudulent attempt.

- Misspellings or grammatical errors: Professional banks typically produce error-free receipts. Grammatical errors or misspellings in the receipt can be a red flag.

- Unusual timing or amounts: Be wary of receipts that arrive outside of business hours or for amounts that do not match the agreed-upon transaction.

- Unknown or unfamiliar business names: If the receipt is for a payment from an unknown or unfamiliar business, it is important to confirm the legitimacy of the transaction.

2. Prevention and Protection

- Verify with the bank: Always contact your bank to confirm the authenticity of any suspicious receipts before releasing goods or services.

- Use secure payment methods: Opt for secure payment methods such as PayPal or Stripe that provide buyer protection.

- Be cautious of unexpected payments: Treat unsolicited payment receipts with caution and verify them thoroughly before taking any action.

- Educate employees: Train employees who handle financial transactions to recognize the signs of fake bank transfer receipts and to follow proper verification procedures.

- Consider receipt verification services: Utilize third-party services that can verify the authenticity of bank transfer receipts, adding an extra layer of protection.

3. Reporting Fraud

- Contact your bank immediately: Report any suspected fake bank transfer receipt to your bank as soon as possible. Provide detailed information about the receipt and the circumstances surrounding it.

- File a police report: In cases of substantial fraud, consider filing a police report to initiate an official investigation.

- Alert the sender: If possible, notify the sender of the fake receipt to inform them of the fraudulent activity and to prevent them from falling victim to similar scams.

- Share information with relevant agencies: Report fake bank transfer receipts to organizations such as the Internet Crime Complaint Center (IC3) or the Federal Trade Commission (FTC) to help combat fraud.

4. Recovery and Remediation

- Secure your accounts: Freeze your bank accounts and credit cards to prevent further fraudulent activity.

- Monitor your credit reports: Regularly check your credit reports for unauthorized activity or new accounts opened in your name.

- Dispute fraudulent charges: Contact your bank and credit card companies to dispute any fraudulent charges.

- Seek legal advice: Consider seeking legal assistance if you have suffered significant financial losses due to fake bank transfer receipts.

5. Conclusion

Fake bank transfer receipt makers pose a serious threat to individuals and businesses alike. By understanding the tactics of cybercriminals, identifying red flags, and implementing preventive measures, you can safeguard yourself from falling prey to such fraudulent schemes. Remember, vigilance and due diligence are crucial to protecting your financial well-being in the digital age.

Keyword Tags

- Fake Bank Transfer Receipts

- Fraudulent Bank Receipts

- Bank Transfer Receipt Verification

- Prevention of Fake Bank Transfer Receipts

- Recovery from Fake Bank Transfer Fraud