VAT Invoice Maker

Invoice Number: 001

Invoice Date: 2024-03-08

Supplier Information:

Name: ABC Corp.

Address: 123 Main Street, Anytown, CA 12345

VAT Number: DE1234567890

Customer Information:

Name: XYZ Ltd.

Address: 456 Elm Street, Othertown, CA 98765

VAT Number: US1234567890

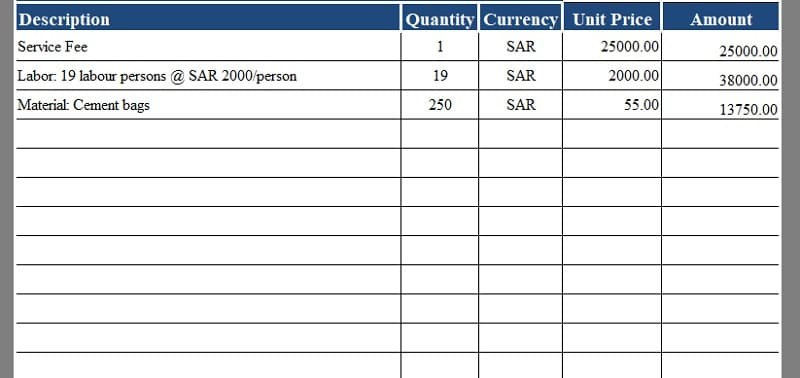

Items:

| Description | Quantity | Unit Price (excl. VAT) | VAT Rate | VAT Amount | Total (incl. VAT) |

|---|---|---|---|---|---|

| Product 1 | 10 | 10.00 | 20% | 2.00 | 12.00 |

| Product 2 | 5 | 15.00 | 10% | 0.75 | 15.75 |

| Product 3 | 2 | 20.00 | 0% | 0.00 | 20.00 |

Subtotal (excl. VAT): 55.00

VAT Amount: 2.75

Total (incl. VAT): 57.75

Payment Terms:

Due upon receipt.

Notes:

- Please note that the VAT rate is subject to change.

- The invoice number should be quoted on all correspondence.## [Vat Invoice Maker]

Executive Summary

Vat invoice maker is a software program that helps businesses create and manage Value Added Tax (VAT) invoices. It can be used by businesses of all sizes, from small businesses to large enterprises. A VAT invoice maker can help businesses save time and money by automating the invoicing process. It can also help businesses ensure that their invoices are accurate and compliant with VAT regulations.

Introduction

VAT is a type of indirect tax that is levied on the sale of goods and services. It is a consumption tax, which means that it is ultimately borne by the consumer. VAT is a complex tax, and there are many rules and regulations that businesses must follow when charging VAT.

Creating and managing VAT invoices can be a time-consuming and error-prone process. A VAT invoice maker can help businesses streamline the invoicing process and reduce the risk of errors.

FAQs

What is a VAT invoice?

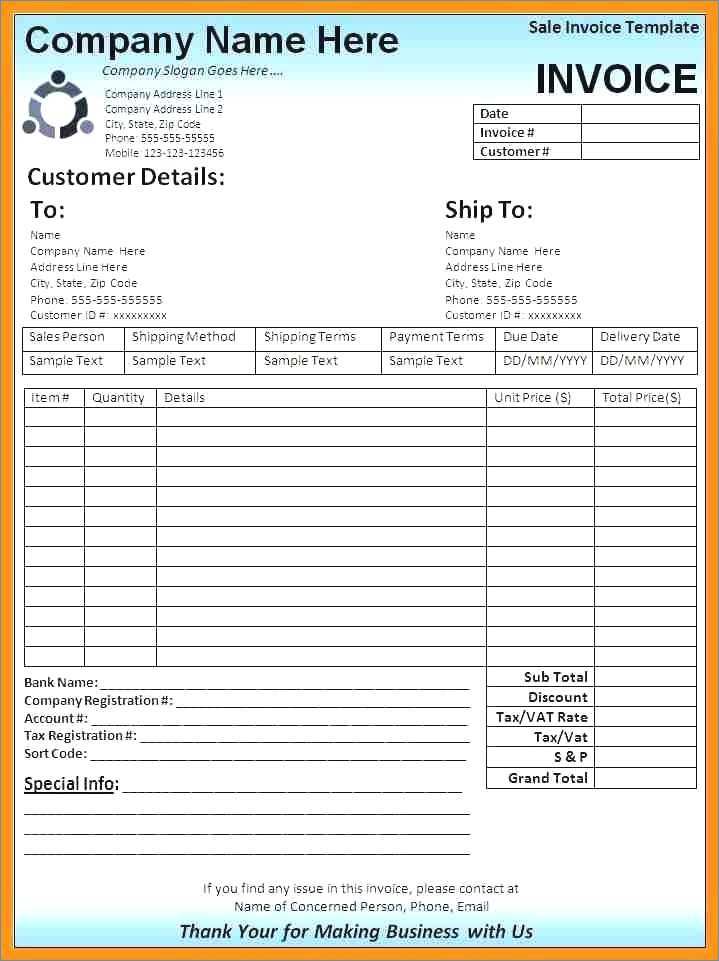

A VAT invoice is a document that is issued by a business to a customer when they sell goods or services. The invoice must include certain information, such as the date of the sale, the amount of the sale, and the amount of VAT that is due.

Who needs to use a VAT invoice maker?

Any business that charges VAT must use a VAT invoice maker. This includes businesses of all sizes, from small businesses to large enterprises.

What are the benefits of using a VAT invoice maker?

There are many benefits to using a VAT invoice maker, including:

- Saves time and money by automating the invoicing process

- Reduces the risk of errors

- Ensures that invoices are compliant with VAT regulations

- Makes it easy to track and manage invoices

Top 5 Subtopics

1. Features of a VAT Invoice Maker

A good VAT invoice maker will have a number of features, including:

- The ability to create invoices in multiple languages

- The ability to add custom fields to invoices

- The ability to generate reports on invoices

- The ability to integrate with other business software

- The ability to create invoices on the go

2. Types of VAT Invoices

There are two main types of VAT invoices:

- Standard VAT invoices: These are used for most sales of goods and services.

- Simplified VAT invoices: These are used for sales of goods and services that are below a certain threshold.

3. VAT Rates

VAT rates vary from country to country. In the European Union, the standard VAT rate is 20%, but some countries have lower rates for certain goods and services.

4. VAT Exemptions

Certain goods and services are exempt from VAT. This includes goods and services that are exported outside of the EU.

5. VAT Refunds

Businesses can claim a refund of VAT that they have paid on their purchases. This includes VAT that has been paid on goods and services that are used for business purposes.

Conclusion

A VAT invoice maker can be a valuable tool for businesses that charge VAT. It can help businesses save time and money, reduce the risk of errors, and ensure that invoices are compliant with VAT regulations.

Keyword Tags

- VAT invoice maker

- VAT invoice

- VAT rates

- VAT exemptions

- VAT refunds