VAT Receipt Generator

Business Information

- Business Name:

- Address:

- Tax ID Number:

Customer Information

- Customer Name:

- Address:

- Contact Number:

Invoice Details

- Invoice Number:

- Invoice Date:

- Due Date:

- Payment Terms:

Itemized List of Goods or Services

- Item Description:

- Quantity:

- Unit Price (Excluding VAT):

- Total Price (Excluding VAT):

- VAT Rate:

- VAT Amount:

Invoice Summary

- Subtotal (Excluding VAT):

- Total VAT:

- Grand Total (Including VAT):

Payment Details

- Payment Method:

- Amount Paid:

- Balance Due:

Additional Notes

- (Any additional information related to the invoice, such as delivery terms, warranty details, etc.)

Terms and Conditions

- (Include any relevant terms and conditions applicable to the invoice.)

Contact Information

- For any inquiries or support, please contact:

- Email:

- Phone Number:## [Vat Receipt Generator]

Executive Summary

Value-added tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production and distribution. VAT receipts are essential documents that provide evidence of VAT transactions and ensure compliance with tax regulations. In this article, we will discuss the importance of VAT receipts, key features, and how to generate them using an online VAT receipt generator.

Introduction

VAT is a critical tax that businesses must understand to ensure accurate reporting and avoid penalties. Proper issuance of VAT receipts is vital for businesses to maintain accurate records, facilitate customer reimbursement claims, and prevent disputes with tax authorities. This article explores the significance of VAT receipts, providing valuable insights for businesses to effectively manage their VAT obligations.

FAQs

1. What is a VAT receipt?

A VAT receipt is a legal document that records a transaction involving the sale of goods or services subject to VAT. It provides details of the transaction, including the amount charged, VAT rate, VAT amount, and other relevant information.

2. Why is it important to issue VAT receipts?

Issuing VAT receipts is crucial for both businesses and customers. For businesses, it helps maintain accurate records, supports customer refund claims, and ensures compliance with tax regulations. For customers, it serves as proof of purchase and allows them to reclaim VAT if they are eligible.

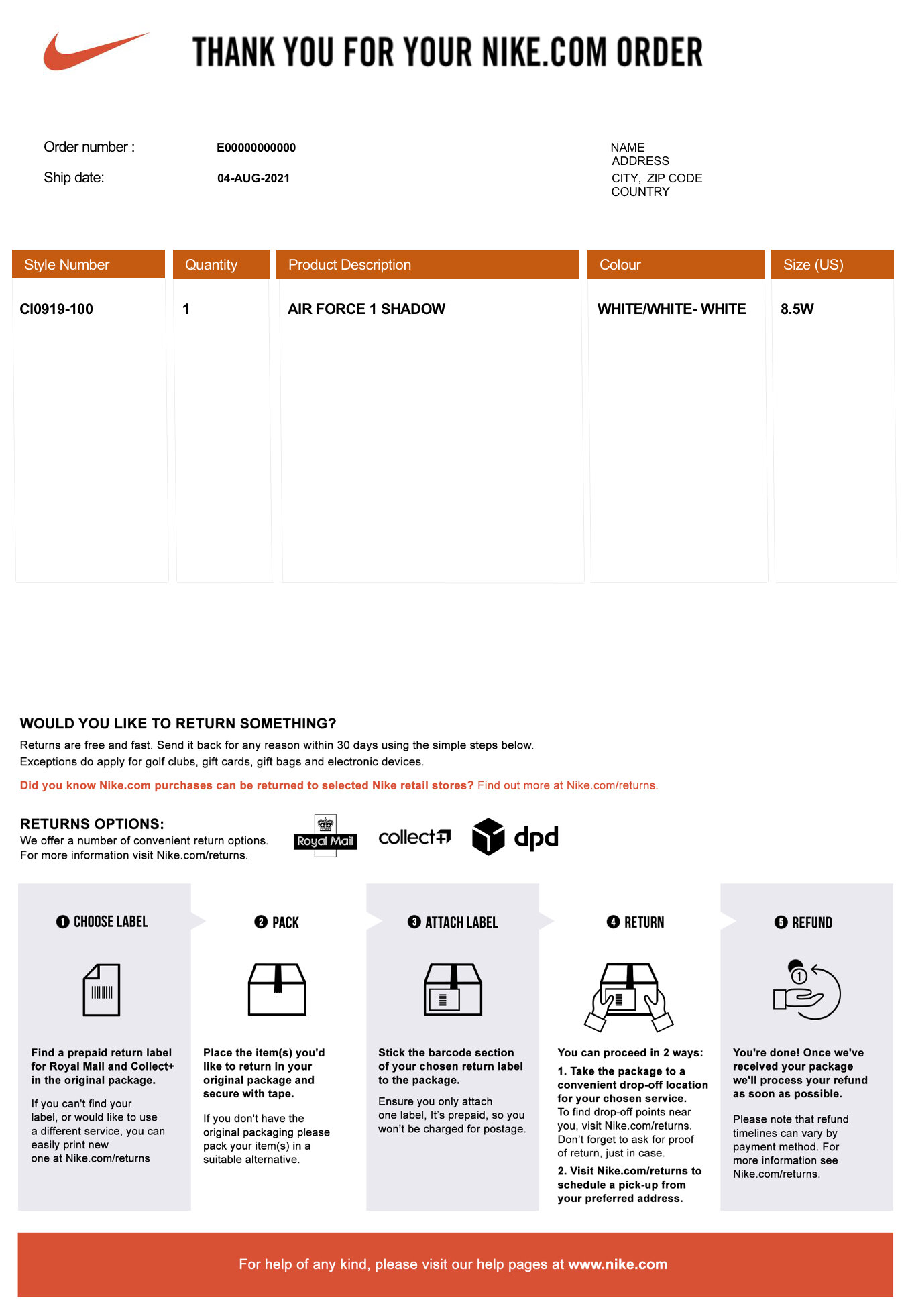

3. What information should a VAT receipt include?

A VAT receipt must include the following information:

- Supplier’s name and address

- Recipient’s name and address

- Date of transaction

- Invoice number

- Description of goods or services

- Unit price

- Quantity

- Total amount before VAT

- VAT rate

- VAT amount

- Total amount after VAT

Top 5 Subtopics

1. Benefits of Using a VAT Receipt Generator

- Accuracy: Automated calculation of VAT amounts reduces errors.

- Efficiency: Streamlines the receipt generation process, saving time.

- Customization: Allows for customization of receipts with business branding.

- Cloud Storage: Safely stores receipts online for easy access and retrieval.

- Compliance: Ensures that receipts meet all legal requirements.

2. Features of a Good VAT Receipt Generator

- Easy-to-use Interface: Intuitive design for effortless navigation.

- Multi-currency Support: Accommodates transactions in different currencies.

- Multiple VAT Rates: Handles complex VAT scenarios with varying rates.

- Customizable Templates: Provides flexibility to tailor receipts to business needs.

- Integration with Accounting Software: Seamlessly connects to accounting systems for streamlined reporting.

3. Steps to Generating a VAT Receipt

- Gather Required Information: Obtain all necessary details of the transaction.

- Choose a VAT Receipt Generator: Select a reputable platform offering reliable services.

- Enter Transaction Details: Fill in the required fields with accurate information.

- Customize Receipt: Add business logo, change font styles, and adjust margins as desired.

- Generate and Download: Review the receipt and generate a printable or digital copy.

4. Importance of VAT Receipt Archiving

- Legal Compliance: Preserves records for audit purposes and legal defense.

- Customer Service: Facilitates easy retrieval of receipts for customer inquiries.

- Financial Analysis: Provides data for analyzing sales, VAT liability, and cash flow.

- VAT Refund Claims: Supports customers in claiming VAT refunds or credits.

- Dispute Resolution: Serves as evidence in case of disputes or disagreements.

5. Best Practices for VAT Receipt Management

- Regular Issuance: Promptly issue receipts after each transaction.

- Secure Storage: Store receipts securely in both physical and digital formats.

- Periodic Reconciliation: Cross-check receipts against accounting records regularly.

- Customer Distribution: Ensure timely delivery of receipts to customers.

- Digital Archiving: Utilize cloud-based storage or software for convenient access and long-term preservation.

Conclusion

VAT receipts are essential documents for businesses to accurately record VAT transactions, maintain compliance, and support customer claims. Utilizing a reliable VAT receipt generator offers numerous benefits, including increased accuracy, efficiency, customization, and cloud storage. By understanding the importance of VAT receipts, following best practices, and adopting a robust VAT receipt management system, businesses can effectively fulfill their VAT obligations and enhance their overall financial operations.

Keyword Tags

- VAT Receipt

- VAT Receipt Generator

- Value-Added Tax

- Tax Compliance

- VAT Management