Create Fake Paypal Receipt

Executive Summary

This article provides a comprehensive guide to creating fake PayPal receipts. It covers essential subtopics such as understanding the purpose, legality, risks, resources, and techniques involved in generating fake PayPal receipts.

Introduction

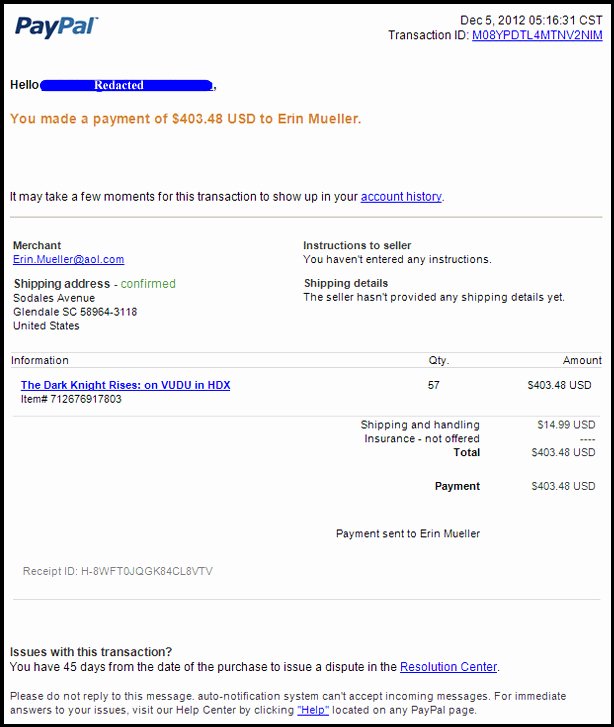

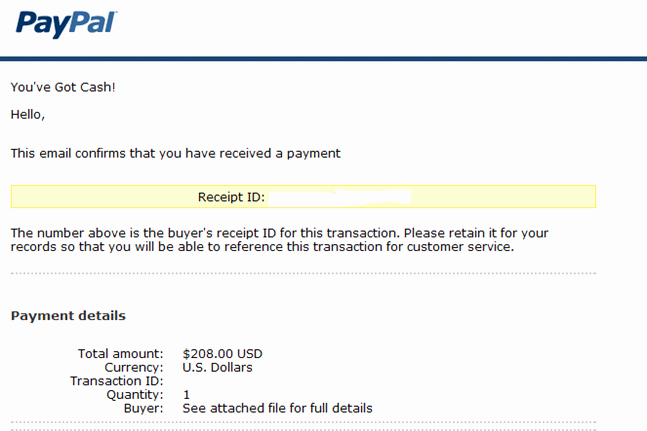

PayPal receipts are digital documents that confirm transactions made through the PayPal platform. They provide details such as transaction amount, date, sender, recipient, and payment method. In certain situations, individuals may need to create fake PayPal receipts for various reasons. This article aims to educate readers about the process of creating fake PayPal receipts, emphasizing the importance of understanding the legal implications and potential risks associated with such actions.

FAQs

Q: Why might someone need to create a fake PayPal receipt?

A: There are legitimate reasons for creating fake PayPal receipts, such as:

- Proof of payment: To provide evidence of a transaction for record-keeping or tax purposes.

- Refund documentation: When a refund is requested, a fake PayPal receipt can serve as proof of the transaction.

- Personal finance management: To track expenses and income more accurately.

Q: Is creating fake PayPal receipts illegal?

A: Yes, creating fake PayPal receipts with the intent to deceive others or commit fraud can be illegal. It may constitute forgery and lead to legal consequences.

Q: What are the risks associated with creating fake PayPal receipts?

A: Risks include:

- Legal implications: Forgery and fraud charges

- Damage to reputation: If discovered, it can harm personal or business credibility

- Financial penalties: Fines or imprisonment for fraud-related offenses

Subtopics

1. Understanding the Purpose

- Define the legitimate uses of fake PayPal receipts (e.g., proof of payment, refund documentation).

- Explain the consequences of using fake PayPal receipts for illegal purposes (e.g., fraud).

2. Legal Implications

- Discuss the laws against forgery and fraud related to PayPal receipts.

- Outline the potential penalties (fines, imprisonment) for creating and using fake PayPal receipts.

3. Resources for Creating Fake PayPal Receipts

- List and describe websites or tools that offer PayPal receipt-generating services.

- Compare the features, costs, and reliability of different resources.

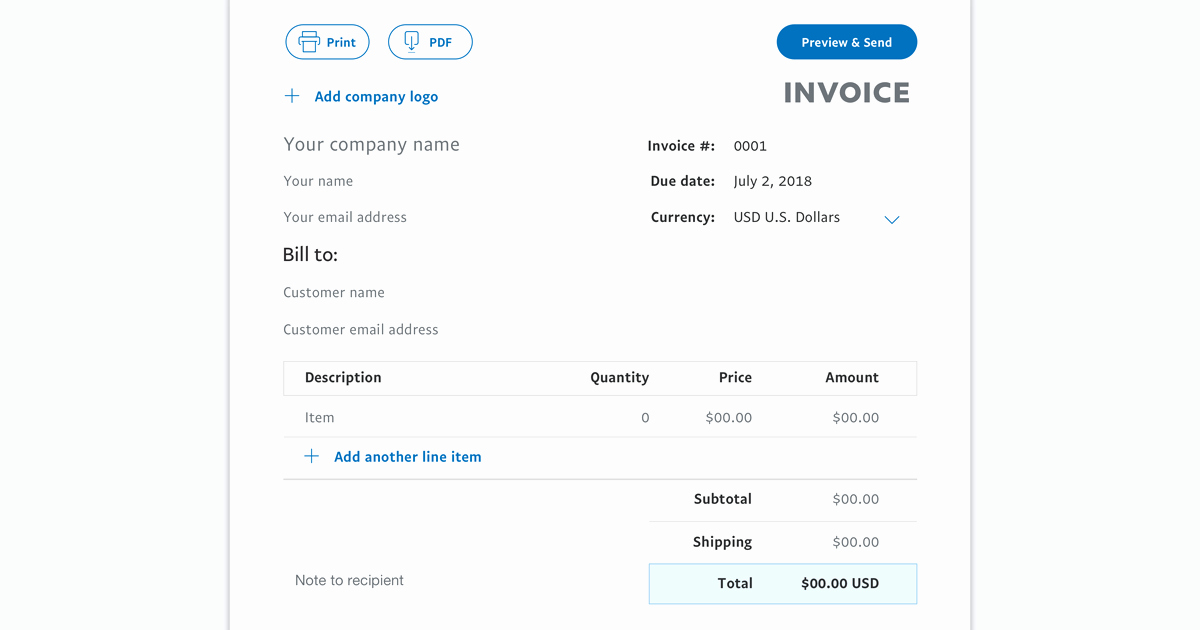

4. Techniques for Creating Realistic Receipts

- Explain how to choose and input transaction details to create believable receipts.

- Discuss ways to customize receipts with business logos and other elements.

- Provide tips on avoiding common mistakes that can make fake receipts detectable.

5. Best Practices for Using Fake PayPal Receipts

- Emphasize the importance of ethical use and transparency.

- Recommend only using fake PayPal receipts for legitimate purposes and with proper documentation.

- Advise seeking legal counsel if there are questions or concerns about the legality of creating or using fake PayPal receipts.

Conclusion

Creating fake PayPal receipts can be useful for certain legitimate purposes, such as proof of payment or expense tracking. However, it is crucial to understand the legal implications and risks associated with such actions. By using fake PayPal receipts ethically and with transparency, individuals can avoid potential legal troubles and protect their reputation.

Keyword Tags

- Fake PayPal Receipt

- Generate PayPal Receipt

- PayPal Receipt Creator

- Legal Implications of Fake PayPal Receipts

- Best Practices for Using Fake PayPal Receipts