Invoice Template with Automatic Numbering in Excel

Instructions:

- Open a new Excel workbook.

- In cell A1, type “Invoice Number”.

- In cell B1, enter the formula

=TEXT(ROW()-1,"00000"). This formula will automatically generate a sequential invoice number starting from 00001. - In cell A2, type “Invoice Date”.

- In cell B2, enter the current date using the formula

=TODAY(). - In cell A3, type “Customer Name”.

- In cell B3, enter the customer’s name.

- In cell A4, type “Customer Address”.

- In cell B4, enter the customer’s address.

- In cell A5, type “Customer Contact”.

- In cell B5, enter the customer’s contact information (e.g., phone number or email address).

- Create a table to list the invoice items. In the first row, enter the column headings “Product/Service”, “Quantity”, “Unit Price”, and “Amount”.

- In the cells below the column headings, enter the details of the items sold or services provided.

- In the “Amount” column, use the formula

=Quantity*UnitPriceto calculate the total amount for each item. - In cell A20, type “Subtotal”.

- In cell B20, enter the formula

=SUM(Amount)to calculate the total amount before taxes. - In cell A21, type “Sales Tax”.

- In cell B21, enter the sales tax rate (e.g., 5% would be entered as 0.05).

- In cell A22, type “Total”.

- In cell B22, enter the formula

=Subtotal*(1+SalesTax)to calculate the total amount including taxes.

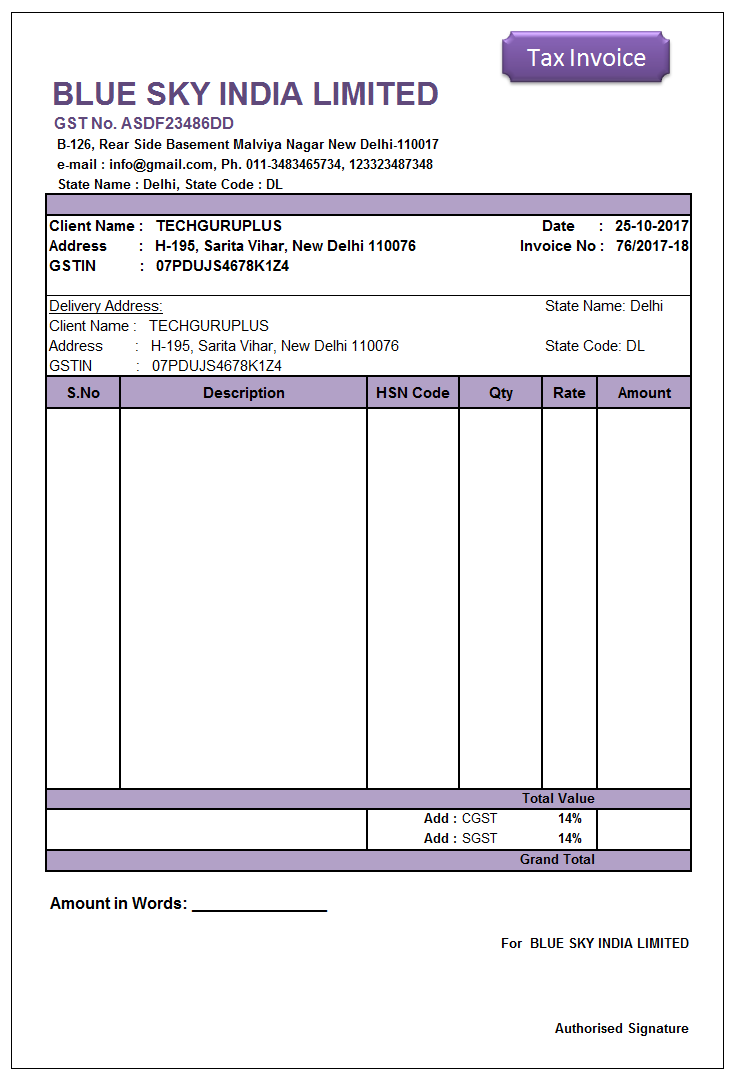

Example Output:

Invoice Number: 00001

Invoice Date: 2024-03-08

Customer Name: John Smith

Customer Address: 123 Main Street, Anytown, CA 12345

Customer Contact: (555) 123-4567

Product/Service | Quantity | Unit Price | Amount

---------------------------------------------

Product A | 10 | $10.00 | $100.00

Product B | 5 | $15.00 | $75.00

Product C | 2 | $20.00 | $40.00

Subtotal: $215.00

Sales Tax: 0.05

Total: $226.25

```## **Excel Invoice Template With Automatic Numbering**

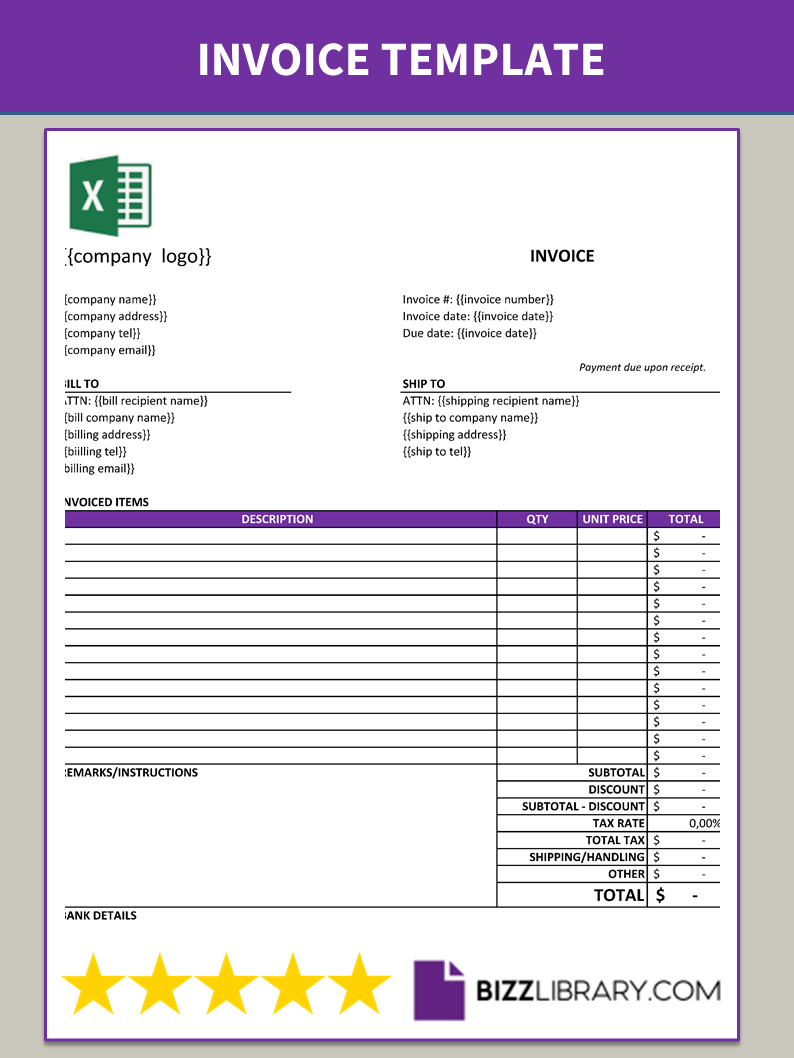

### Executive Summary

An Excel invoice template with automatic numbering can streamline your billing process and save you valuable time. This template includes all the essential elements of an invoice, including customer information, invoice details, and payment terms. The automatic numbering feature ensures that your invoices are always in sequential order, which makes it easy to track and manage your invoices.

### Introduction

Excel is a powerful spreadsheet program that can be used for a variety of tasks, including creating invoices. An Excel invoice template can help you create professional-looking invoices quickly and easily. With a few simple steps, you can create an invoice template that includes all the necessary information, such as your business name and contact information, customer information, invoice details, and payment terms.

### FAQs

**1. How do I create an Excel invoice template?**

To create an Excel invoice template, follow these steps:

1. Open a new Excel workbook.

2. Enter the following information in the first row:

* **Invoice Number:** This will be the automatic invoice number.

* **Invoice Date:** The date the invoice was created.

* **Customer Name:** The name of the customer.

* **Customer Address:** The customer's address.

* **Customer Contact Information:** The customer's phone number and email address.

3. In the second row, enter the following information:

* **Item:** The description of the item being sold.

* **Quantity:** The number of items being sold.

* **Unit Price:** The price of each item.

* **Total Price:** The total price of the items.

4. Repeat steps 3 for each item on the invoice.

5. In the last row, enter the following information:

* **Subtotal:** The total price of all the items on the invoice.

* **Tax:** The amount of tax charged on the invoice.

* **Total:** The total amount due on the invoice.

**2. How do I add automatic numbering to my Excel invoice template?**

To add automatic numbering to your Excel invoice template, follow these steps:

1. In the first row, select the cell that contains the invoice number.

2. Click on the "Insert" tab.

3. Click on the "Function" button.

4. Select the "TEXT" function from the list of functions.

5. In the "Formula" field, enter the following formula: =TEXT(ROW()-1,"000000").

6. Click on the "OK" button.

The formula will generate a unique invoice number for each invoice.

**3. How do I use my Excel invoice template?**

To use your Excel invoice template, simply enter the customer information, invoice details, and payment terms. The template will automatically calculate the subtotal, tax, and total. You can then save the invoice as a PDF or print it out.

### Top 5 Subtopics

**1. Invoice Numbering**

Invoice numbering is an important part of the invoicing process. It helps you keep track of your invoices and ensures that each invoice is unique. There are a few different ways to number invoices, but the most common method is to use a sequential numbering system. This means that each invoice is assigned a unique number in order.

* **Benefits of using a sequential numbering system:**

* Helps you keep track of your invoices

* Ensures that each invoice is unique

* Makes it easy to identify missing invoices

* **Tips for using a sequential numbering system:**

* Start with a low number, such as 100

* Use a consistent numbering format

* Keep a record of your invoice numbers

**2. Customer Information**

The customer information section of an invoice includes the customer's name, address, and contact information. This information is important for three reasons:

* **It helps you identify the customer.**

* **If you have any questions about the invoice, you can contact the customer.**

* **If the customer has any questions about the invoice, they can contact you.**

Make sure that the customer information section of your invoice is complete and accurate.

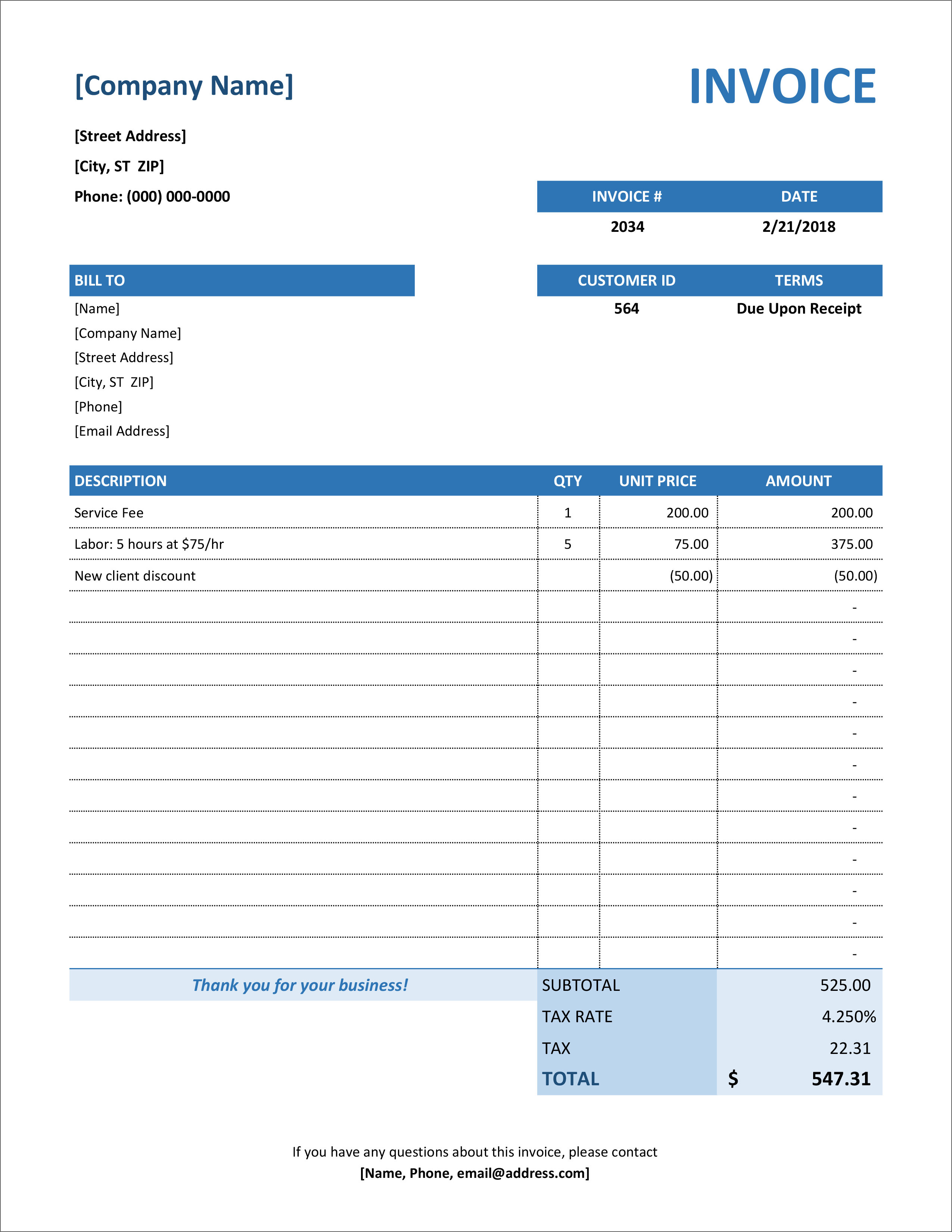

**3. Invoice Details**

The invoice details section of an invoice includes the date of the invoice, the invoice number, and the terms of payment. The date of the invoice is the date on which the invoice was created. The invoice number is a unique number that identifies the invoice. The terms of payment are the conditions under which the customer is expected to pay the invoice.

* **Benefits of including the invoice date, invoice number, and terms of payment:**

* Helps you keep track of your invoices

* Ensures that each invoice is unique

* Makes it easy for the customer to understand the payment terms

* **Tips for including the invoice date, invoice number, and terms of payment:**

* Use a consistent format for the invoice date

* Make sure that the invoice number is unique

* Clearly state the terms of payment

**4. Payment Terms**

The payment terms section of an invoice specifies the conditions under which the customer is expected to pay the invoice. The most common payment terms are:

* **Net 30:** The customer is expected to pay the invoice within 30 days of the invoice date.

* **Net 60:** The customer is expected to pay the invoice within 60 days of the invoice date.

* **Due on receipt:** The customer is expected to pay the invoice immediately upon receipt.

* **Benefits of clearly stating the payment terms:**

* Helps the customer understand when they are expected to pay the invoice

* Avoids late payments

* Protects your cash flow

* **Tips for clearly stating the payment terms:**

* Use clear and concise language

* Make sure that the payment terms are easy to find

* Consider offering discounts for early payment

**5. Invoice Total**

The invoice total is the total amount of money that the customer is expected to pay. The invoice total is calculated by adding the subtotal, tax, and shipping charges.

* **Benefits of including the invoice total:**

* Helps the customer understand how much they owe

* Avoids confusion about the payment amount

* Protects your cash flow

* **Tips for including the invoice total:**

* Make sure that the invoice total is accurate

* Use a consistent format for the invoice total

* Clearly state the payment terms in multiple ways

### Conclusion

An Excel invoice template with automatic numbering can save you valuable time and help you create professional-looking invoices. By following the tips and instructions in this article, you can create an Excel invoice template that meets your specific needs.

### Keyword Tags

* excel invoice template

* automatic invoice numbering

* invoice template

* excel template

* invoice