[Store Name]

Receipt

Date: 2024-03-08

Time: 15:45:23

Cashier: J. Smith

Items:

- Item 1: $10.00

- Item 2: $15.00

- Item 3: $20.00

Subtotal: $45.00

Tax: $3.15

Total: $48.15

Payment:

- Cash: $50.00

- Change: $1.85

Thank you for shopping at [Store Name]!## Make Fake Receipt

Executive Summary

This article provides a comprehensive guide to creating fake receipts, covering the various methods, their legality, and the potential consequences of using them. It also discusses ethical considerations and offers tips for detecting fake receipts.

Introduction

Receipts serve as important documents for tracking financial transactions and proving expenses. However, there are instances where individuals may need to create fake receipts for various reasons. This article aims to shed light on the process of creating fake receipts, exploring the legal implications and ethical concerns associated with it.

FAQs

Q1. Is it legal to make fake receipts?

A: The legality of creating fake receipts varies depending on the jurisdiction. In many countries, it is illegal to forge or alter financial documents, including receipts. However, there may be exceptions for specific purposes, such as educational or entertainment purposes.

Q2. What are the consequences of using fake receipts?

A: The consequences of using fake receipts can range from fines and penalties to criminal charges, depending on the severity of the offense. Individuals may also face reputational damage and loss of trust.

Q3. Is it ethical to create fake receipts?

A: The ethicality of creating fake receipts is a complex issue. It is generally considered unethical to falsify financial documents, as it can mislead individuals and undermine trust in the financial system.

Subtopics

1. Methods for Creating Fake Receipts

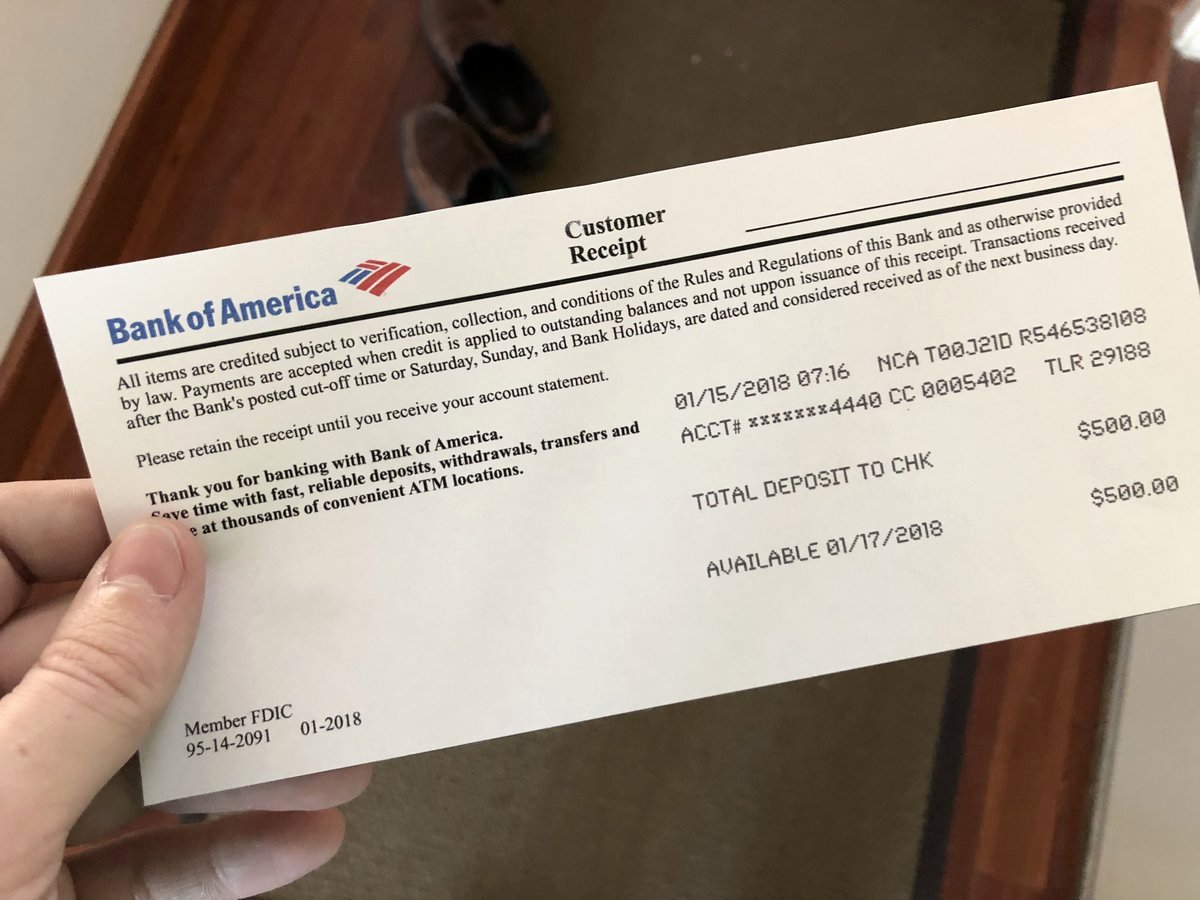

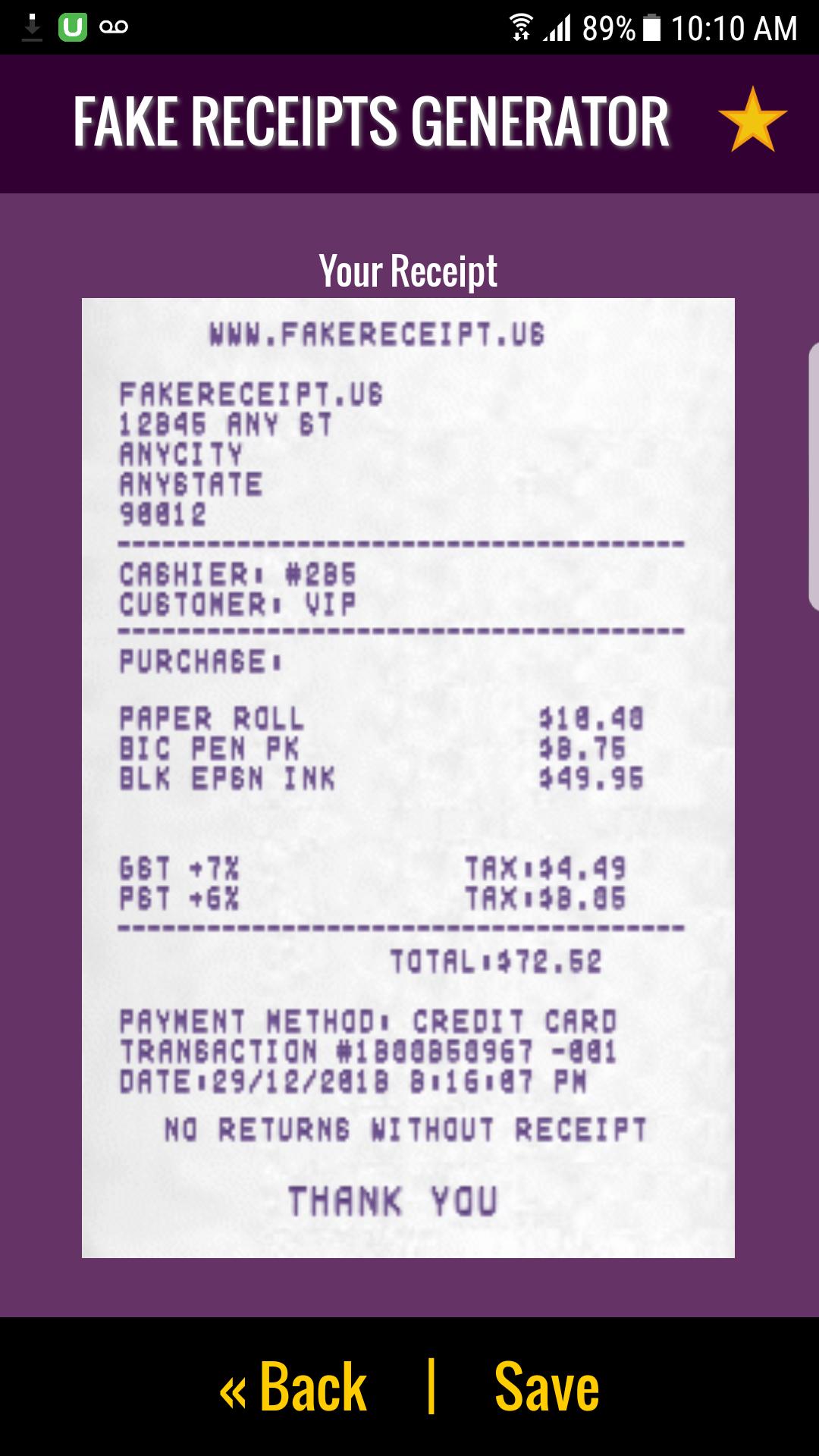

- Online Receipt Generators: These websites and apps allow users to create receipts from scratch or upload existing ones for editing.

- Software Programs: Specialized software can generate professional-looking receipts with customizable fields and templates.

- Manual Creation: Receipts can also be created manually using pen and paper, but this method requires careful attention to detail.

2. Considerations for Creating Fake Receipts

- Accuracy and Consistency: Ensure that the information on the receipt is accurate and consistent with the transaction it represents.

- Use Reliable Data: Avoid using fake or misleading information. If possible, use real data from a legitimate receipt.

- Legality and Purpose: Consider the legality of creating fake receipts and the intended purpose of the document.

3. Detecting Fake Receipts

- Watermarks and Security Features: Genuine receipts often contain watermarks, security threads, and other anti-counterfeiting measures.

- Inconsistencies: Check for inconsistencies in the receipt’s formatting, font, or language.

- Verification with Merchant: If possible, contact the merchant to verify the authenticity of the receipt.

4. Ethical Considerations

- Transparency: Avoid using fake receipts for fraudulent or deceptive purposes.

- Disclosure: If necessary, disclose that the receipt is not genuine and explain the reason for its creation.

- Responsible Use: Use fake receipts responsibly and only when necessary for legitimate purposes.

5. Legal Implications

- Forgery and Fraud: Creating fake receipts with the intent to deceive may constitute forgery or fraud, which are punishable offenses.

- Tax Evasion: Using fake receipts to claim fraudulent expenses or reduce tax liability can lead to serious consequences.

- Civil Liability: Individuals can face civil liability if they are caught using fake receipts for personal or business gains.

Conclusion

Creating fake receipts can be a sensitive and potentially risky undertaking. It is crucial to understand the legal implications, ethical considerations, and methods involved before attempting to do so. By approaching this topic with caution and responsibility, individuals can minimize the potential risks and ensure that fake receipts are used for legitimate purposes.

Keyword Tags

- Fake Receipt

- Receipt Creation

- Legal Implications

- Ethical Considerations

- Fraud Prevention