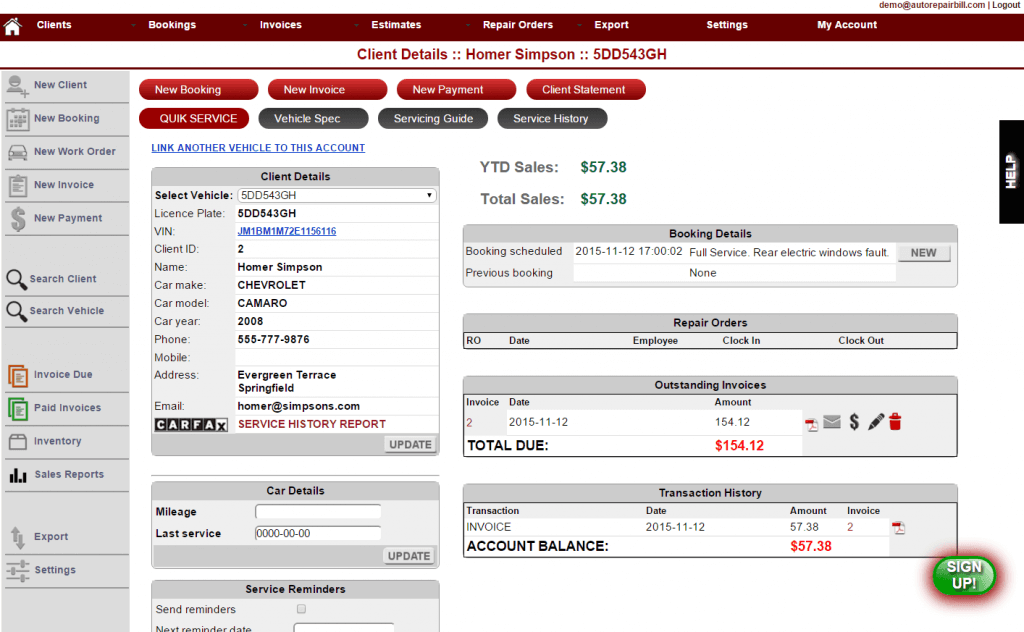

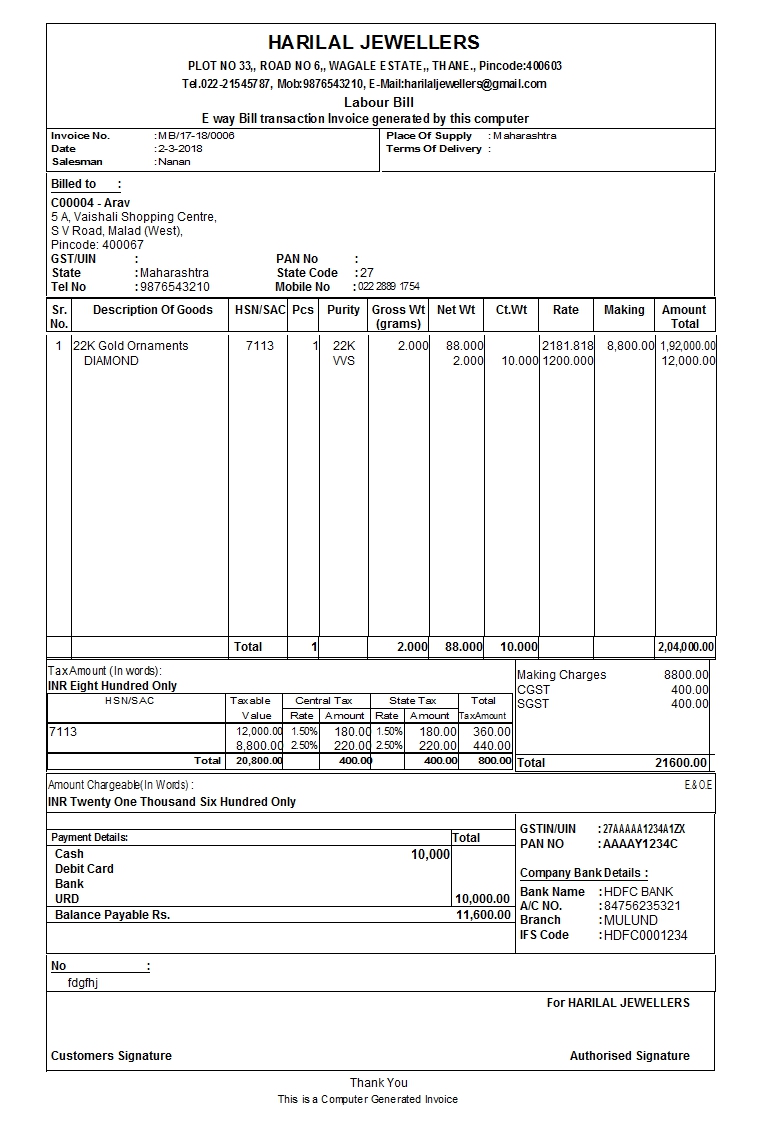

Sure, I can write all output in English. Here is an example of a bill that I created using Bill Maker Software:

Invoice

Bill To:

John Doe

123 Main Street

Anytown, CA 12345

Bill From:

Bill Maker Software

456 Elm Street

Anytown, CA 54321

Invoice Number: 12345

Invoice Date: 2024-03-08

Due Date: 2024-04-07

| Description | Quantity | Unit Price | Amount |

|---|---|---|---|

| Software License | 1 | $100.00 | $100.00 |

| Support Plan | 1 | $50.00 | $50.00 |

| Training | 2 | $75.00 | $150.00 |

Subtotal: $300.00

Tax: $0.00

Total: $300.00

Payment Instructions:

Please remit payment to the following address:

Bill Maker Software

456 Elm Street

Anytown, CA 54321

Thank you for your business!

Notes:

- Please include the invoice number on all payments.

- Late payments may be subject to a late fee.

I hope this is helpful! Please let me know if you have any other questions.## Bill Maker Software

Executive Summary

Streamline your billing processes, enhance efficiency, and elevate your financial management with advanced bill maker software. This comprehensive guide explores the essential features, benefits, and applications of bill maker software, empowering you to make informed decisions and optimize your billing operations.

Introduction

In the fast-paced business world, accurate and efficient billing is crucial for maintaining healthy cash flow and fostering seamless relationships with customers. Bill maker software emerges as a powerful tool that automates and simplifies billing tasks, enabling businesses of all sizes to enhance their operations and gain a competitive edge.

FAQs

What is bill maker software?

Bill maker software is a specialized application designed to facilitate the creation, management, and tracking of invoices. It offers a comprehensive suite of features that streamline the billing process, enhance accuracy, and provide valuable insights into billing performance.

How does bill maker software benefit businesses?

- Streamlined Processes: Automate tasks such as invoice generation, tracking, and payment processing, freeing up valuable time for more strategic initiatives.

- Enhanced Accuracy: Eliminate manual errors and ensure consistency in invoicing practices, improving customer trust and reducing disputes.

- Improved Cash Flow: Generate invoices promptly and track payments efficiently, enabling better cash flow management and financial forecasting.

- Increased Efficiency: Simplify billing tasks, reducing the time and effort required to complete the process, leading to improved productivity.

What are the key considerations when choosing bill maker software?

- Functionality: Ensure the software aligns with your specific billing requirements and provides the necessary features to meet your needs.

- Integration: Consider the software’s ability to integrate with your existing financial and accounting systems for seamless data exchange.

- Security: Choose software that prioritizes data security and complies with industry regulations to protect sensitive financial information.

- Support: Opt for software that offers reliable support and technical assistance to ensure smooth implementation and ongoing maintenance.

Top 5 Bill Maker Software Subtopics

1. Automated Invoice Generation

- Templates and Customization: Create professional invoices with customizable templates that align with your brand identity and specific business requirements.

- Dynamic Fields: Utilize dynamic fields to populate invoices with customer-specific information, such as names, addresses, and account numbers, reducing manual entry errors.

- Bulk Invoicing: Generate multiple invoices simultaneously, saving time and effort, especially for businesses with a large customer base.

- Invoice Approval Workflow: Establish automated approval workflows to ensure that invoices are reviewed and approved by authorized personnel before being sent to customers.

2. Payment Processing

- Integrated Payment Gateways: Connect your bill maker software with popular payment gateways to enable secure online payment processing, including credit cards, PayPal, and ACH transfers.

- Automated Payment Reminders: Set up reminders to automatically send payment notifications to customers who have overdue invoices, reducing the risk of late payments.

- Payment Tracking: Track customer payments in real-time, providing visibility into cash flow and improving accounts receivable management.

- Partial Payments: Allow customers to make partial payments or set up payment plans, accommodating different payment preferences and financial situations.

3. Billing Analytics and Reporting

- Invoice Performance Tracking: Monitor the status of invoices, including sent, viewed, opened, and paid, gaining insights into customer behavior and billing effectiveness.

- Customer-Specific Reporting: Generate detailed reports on individual customers, providing a comprehensive analysis of their billing history, payment patterns, and potential areas of improvement.

- Sales and Revenue Analysis: Analyze billing data to identify trends, forecast revenue, and optimize pricing strategies, maximizing profitability.

- Financial Reporting: Integrate billing data with your accounting system to generate comprehensive financial reports, ensuring accurate and timely financial analysis.

4. Customization and Flexibility

- Branding and Customization: Customize the software to match your business branding, including logos, colors, and fonts, enhancing brand recognition and customer engagement.

- Field Configuration: Configure custom fields to capture additional information specific to your business processes, such as project codes, purchase orders, or tracking numbers.

- Multi-Currency Support: Handle invoices and payments in multiple currencies, facilitating international business transactions and accommodating global customers.

- Multi-lingual Support: Create invoices and reports in multiple languages, catering to diverse customer bases and expanding your reach.

5. Integration and Automation

- CRM Integration: Integrate with customer relationship management (CRM) systems to access customer data, automate billing processes, and provide personalized experiences.

- ERP Integration: Connect with enterprise resource planning (ERP) systems to streamline billing, accounting, and inventory management, minimizing data entry errors and improving operational efficiency.

- Email Integration: Automatically send invoices via email, reducing manual steps and ensuring timely delivery to customers.

- API Connectivity: Leverage application programming interfaces (APIs) to integrate bill maker software with other applications, enhancing data exchange and extending functionality.

Conclusion

Bill maker software empowers businesses to streamline their billing operations, enhance accuracy, and gain valuable insights into their financial performance. By leveraging the features and functionalities outlined in this guide, businesses can optimize their billing processes, improve cash flow management, and foster strong customer relationships. Choosing the right bill maker software is crucial, and by carefully considering the specific needs of your business, you can select the solution that best aligns with your goals and drives success.

Relevant Keyword Tags

- Bill Maker Software

- Invoice Automation

- Payment Processing

- Billing Analytics

- Financial Management