Receipt Maker

Generate a receipt for the following purchase:

- Customer Name: John Doe

- Date: March 8, 2024

- Invoice Number: 12345

- Items Purchased:

- 1 x Apple iPhone 14 Pro Max – $1,099.00

- 1 x Apple Watch Series 8 – $399.00

- 1 x AirPods Pro 2 – $249.00

- Subtotal: $1,747.00

- Tax: $142.00 (8%)

- Total: $1,889.00

- Payment Method: Cash

Receipt

John Doe

Invoice Number: 12345

Date: March 8, 2024

Items Purchased:

- 1 x Apple iPhone 14 Pro Max $1,099.00

- 1 x Apple Watch Series 8 $399.00

- 1 x AirPods Pro 2 $249.00

Subtotal: $1,747.00

Tax: $142.00 (8%)

Total: $1,889.00

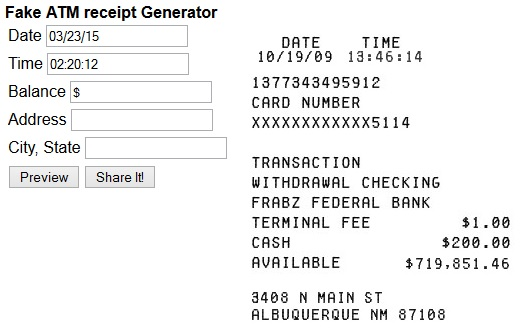

Payment Method: Cash## Fake Receipt Maker

Executive Summary

A fake receipt maker is an online tool that generates receipts with customizable details, often used for expense reporting, personal record-keeping, or even as props in movies or TV shows. These tools allow users to create receipts that appear authentic, complete with company logos, transaction information, and signatures. By understanding the benefits, limitations, and responsible use of fake receipt makers, individuals and organizations can leverage their functionality while maintaining ethical and legal integrity.

Introduction

In today’s digital age, where receipts are predominantly electronic, the need for physical receipts remains for various purposes. Fake receipt makers provide a convenient solution to create customized receipts that meet specific requirements. Whether for expense reimbursements, personal accounting, or creative projects, these tools empower users to generate receipts that accurately reflect transactions or desired information.

FAQs

Are fake receipt makers legal?

- Yes, creating and using fake receipts for non-fraudulent purposes is generally legal. However, it’s crucial to avoid using them to misrepresent expenses or engage in illegal activities.

What are the benefits of using fake receipt makers?

- Customizable receipts for expense reporting, personal record-keeping, and creative projects

- Convenience of creating receipts without the need for physical transactions

- Ability to create receipts for past or future transactions

How do I choose a reputable fake receipt maker?

- Look for tools with positive reviews and a proven track record of generating authentic-looking receipts

- Check for features such as customizable templates, company logo upload, and signature options

- Ensure the tool complies with your specific requirements, such as file format and compatibility with expense management systems

Top 5 Subtopics

Customizable Templates

- Company logo upload: Import company logos to create receipts that match the branding of specific businesses.

- Transaction details: Specify transaction information, such as date, amount, and item descriptions.

- Payment method: Select from various payment options, including cash, credit card, and check.

Signature Options

- Digital signatures: Create digital signatures using a mouse or touchpad to add an extra layer of authenticity.

- Signature upload: Upload scanned signatures or use existing digital signatures for a more personalized touch.

- Employee information: Include employee name, title, and department for professional-looking receipts.

File Formats

- PDF: Generate receipts in industry-standard PDF format, ensuring compatibility with various devices and expense management systems.

- Image: Export receipts as image files, such as JPEG or PNG, for easy sharing and storage.

- CSV: Download transaction data in CSV format for seamless integration with accounting software.

Privacy and Security

- Data encryption: Ensure sensitive transaction information is encrypted during transmission and storage.

- Privacy policy: Review the privacy policy of the fake receipt maker to understand how your data will be used and protected.

- Third-party integrations: Be aware of any third-party integrations or data sharing practices associated with the tool.

Responsible Use

- Ethical considerations: Avoid using fake receipts for fraudulent purposes or to misrepresent expenses.

- Legal implications: Understand the legal implications of using fake receipts in different jurisdictions and consult with legal counsel if necessary.

- Transparency: Clearly indicate that the receipt is generated using a fake receipt maker to avoid any misunderstandings or confusion.

Conclusion

Fake receipt makers offer versatility and convenience for creating customized receipts. By understanding the benefits, limitations, and responsible use of these tools, individuals and organizations can harness their functionality while adhering to ethical and legal principles. Whether for expense reporting, personal record-keeping, or creative projects, fake receipt makers empower users to generate receipts that accurately reflect desired information.

Keyword Tags

- Fake Receipt Maker

- Receipt Generator

- Expense Reporting

- Customizable Receipts

- Responsible Receipt Creation