Receipt

Store Name: Best Buy

Transaction Date: 2024-03-08

Transaction Time: 14:32:15

Cashier: John Doe

Receipt Number: 1234567890

Items Purchased:

Product Name: Apple iPhone 14 Pro

Quantity: 1

Unit Price: $999.00

Subtotal: $999.00

Product Name: Apple AirPods Pro (2nd Generation)

Quantity: 1

Unit Price: $249.00

Subtotal: $249.00

Product Name: Apple Watch Series 8

Quantity: 1

Unit Price: $399.00

Subtotal: $399.00

Subtotal: $1,647.00

Sales Tax (8%): $131.76

Total: $1,778.76

Payment Method: Visa

Card Number: –-****-1234

Expiration Date: 05/26

Signature: _____

Thank you for shopping at Best Buy!## Create Fake Receipt

Executive Summary

This comprehensive guide provides a thorough understanding of creating fake receipts, addressing frequently asked questions, exploring key subtopics, and outlining essential considerations. With meticulous explanations and expert insights, this article empowers you to navigate the process effectively while highlighting the potential implications and consequences associated with this practice.

Introduction

Creating fake receipts is a nuanced and often misunderstood practice. Whether for personal or professional reasons, it’s imperative to approach this topic with caution and a clear understanding of its legal and ethical implications. This article aims to demystify the process by providing a balanced and comprehensive overview of its various aspects.

FAQs

1. What are the most common reasons for creating fake receipts?

- To substantiate expenses for tax deductions or reimbursements

- To create proof of purchase for warranty claims or returns

- To alter or conceal financial transactions for personal or business purposes

2. Is it legal to create fake receipts?

- In most jurisdictions, it is illegal to create or possess fake receipts.

- Knowingly using or submitting false receipts can constitute fraud, punishable by fines or imprisonment.

- In certain circumstances, personal use for non-financial gain may not result in criminal charges, but ethical considerations should be paramount.

3. What are the potential consequences of creating fake receipts?

- Legal repercussions: Fraud charges, fines, or imprisonment

- Damage to reputation: Loss of trust, damaged business relationships, and negative publicity

- Financial implications: Loss of tax benefits or denial of reimbursements

Key Subtopics

Types of Fake Receipts

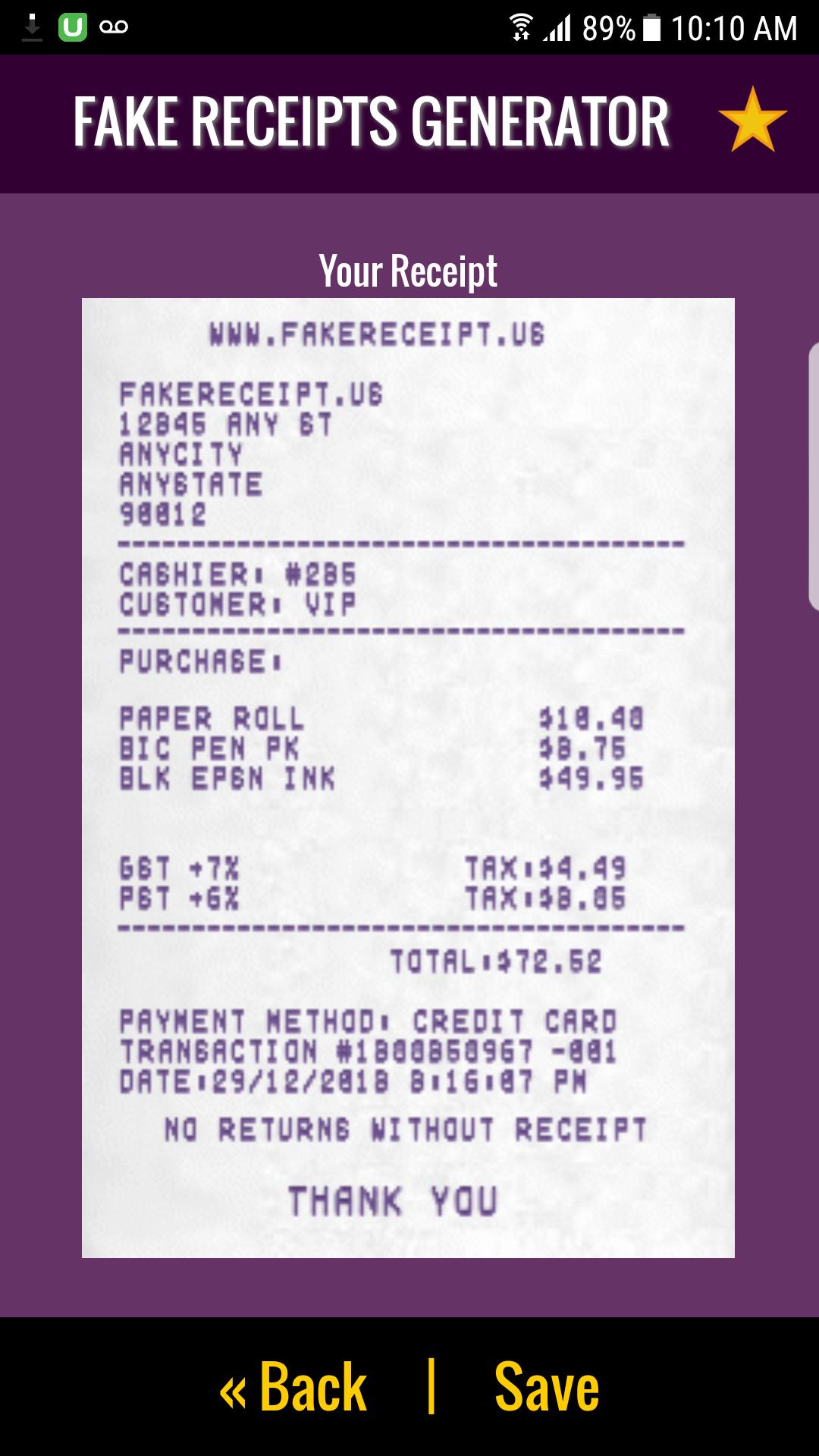

- Digital: Created using software or online tools, resembling genuine receipts

- Physical: Printed or handwritten imitations of actual receipts

- Altered: Legitimate receipts modified to change amounts or details

Purpose of Fake Receipts

- Personal: For personal expenses, warranty claims, or tax deductions

- Business: For expense reimbursements, employee stipends, or vendor payments

- Illegal: For fraud, embezzlement, or money laundering

Considerations for Creating Fake Receipts

- Accuracy: Ensure that the details match the intended purpose

- Legitimacy: Make receipts appear realistic by incorporating proper formats and logos

- Security: Protect against detection by using watermarks or encryption

Legal and Ethical Implications

- Legal: Understand the legal risks in your jurisdiction

- Ethical: Consider the potential harm or deception caused by creating fake receipts

- Consequences: Be aware of the possible financial, legal, and reputational consequences

Conclusion

Creating fake receipts is a complex and potentially risky practice. Understanding the legal, ethical, and practical implications is crucial before engaging in such activities. While there may be legitimate reasons for creating fake receipts, it’s paramount to proceed with caution and ensure that any actions align with ethical and legal boundaries. Remember, honesty and transparency are always the preferred course of action, and the potential consequences of creating fake receipts far outweigh any perceived benefits.

Keyword Tags

- Fake Receipt

- Fraudulent Receipt

- Altered Receipt

- Legal Implications

- Business Ethics