[Your Business Name]

[Your Address]

[Your Phone Number]

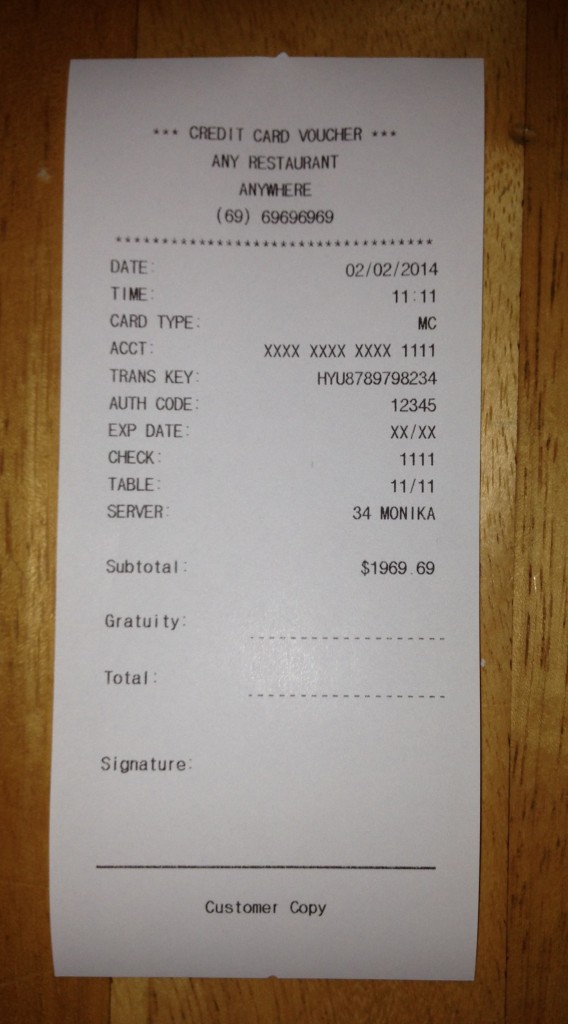

Receipt

Date: [Date]

Invoice Number: [Invoice Number]

Customer Name: [Customer Name]

Customer Address: [Customer Address]

Items Purchased:

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Product 1 | 1 | $10.00 | $10.00 |

| Product 2 | 2 | $15.00 | $30.00 |

| Product 3 | 3 | $20.00 | $60.00 |

Subtotal: $100.00

Tax (6%): $6.00

Total: $106.00

Payment Method: [Payment Method]

Notes:

- Thank you for your business!

- We appreciate your continued patronage.

- Please keep this receipt for your records.

For Support or Inquiries:

- Phone: [Support Phone Number]

- Email: [Support Email Address]

- Website: [Support Website Address]

This receipt is computer-generated and does not require a signature.## Create A Fake Receipt Online

Executive Summary

This article provides comprehensive instructions on how to create a fake receipt online. It explores the various methods available, their advantages, and potential risks. The article also addresses legal considerations and ethical implications associated with creating fake receipts.

Introduction

Fake receipts are often used for legitimate purposes, such as expense reimbursement or tax deductions. However, they can also be used for fraudulent activities. This article focuses solely on ethical and legal uses of fake receipts. Readers are strongly advised to consult with legal counsel before using fake receipts for any purpose.

FAQs

1. What is the easiest way to create a fake receipt?

There are many online tools and software that can be used to create fake receipts. Some of the most popular options include:

- Receipt Generator: This online tool allows you to generate fake receipts from scratch or upload your own template.

- Invoice Maker: This software can be used to create both invoices and receipts. It offers a wide range of templates and customization options.

- Fake Receipt Generator: This website provides a simple and straightforward way to create fake receipts.

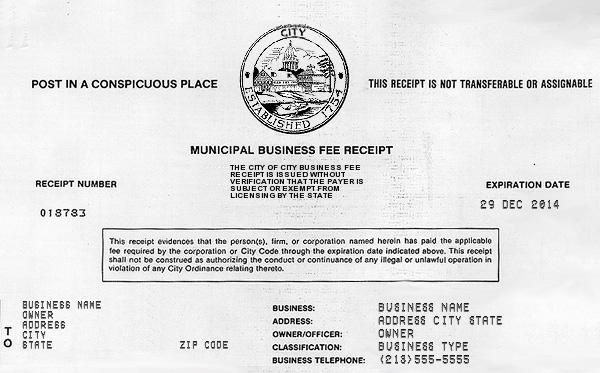

2. What information should I include on a fake receipt?

The information you include on a fake receipt will depend on its purpose. However, some common elements include:

- Company name

- Date

- Description of goods or services

- Amount

- Payment method

- Signature

3. Is it illegal to create a fake receipt?

Creating a fake receipt is not illegal in itself. However, it can be illegal to use a fake receipt for fraudulent purposes. For example, using a fake receipt to claim a tax deduction could be considered fraud.

Top 5 Subtopics

1. Choosing the Right Tool

The first step in creating a fake receipt is to choose the right tool. There are many different options available, so take some time to compare features and prices. Consider the following factors when choosing a tool:

- Ease of use: The tool should be easy to use, even for beginners.

- Templates: The tool should offer a variety of templates to choose from.

- Customization options: The tool should allow you to customize the receipt to your specific needs.

- Security: The tool should be secure and protect your personal information.

2. Creating a Fake Receipt

Once you have chosen a tool, you can begin creating your fake receipt. The process will vary depending on the tool you are using. However, most tools will follow a similar process:

- Enter the basic information: This includes the company name, date, description of goods or services, and amount.

- Customize the receipt: You can customize the receipt by adding your own logo, changing the font, or adding additional information.

- Save and download the receipt: Once you are satisfied with your receipt, save it and download it to your computer.

3. Editing a Fake Receipt

Once you have created a fake receipt, you may need to edit it at some point. This could be due to a mistake or because you need to update the information. Editing a fake receipt is usually easy to do. Most tools will allow you to make changes to the receipt and then save the new version.

4. Using a Fake Receipt

Fake receipts can be used for a variety of purposes. Some common uses include:

- Expense reimbursement: You can use a fake receipt to get reimbursed for business expenses.

- Tax deductions: You can use a fake receipt to claim tax deductions for business expenses.

- Proof of purchase: You can use a fake receipt as proof of purchase for a product or service.

5. Legal Considerations

Creating and using fake receipts can have legal implications. It is important to understand the laws in your jurisdiction before using fake receipts. In some cases, creating or using a fake receipt could be considered a crime.

Conclusion

Creating a fake receipt online can be a quick and easy way to get the documents you need. However, it is important to use fake receipts responsibly and to be aware of the legal risks involved. By following the tips in this article, you can create fake receipts that are safe and effective.

Relevant Keyword Tags

- Fake receipt

- Create fake receipt

- Receipt generator

- Invoice maker

- Expense reimbursement