Amazon Business Invoice

Invoice Number: INV-1234567890

Invoice Date: 2024-03-08

Bill To:

Company Name: ABC Company

Street Address: 123 Main Street

City: Anytown

State: CA

Zip Code: 12345

Ship To:

Company Name: ABC Company

Street Address: 456 Elm Street

City: Anytown

State: CA

Zip Code: 12345

Items Ordered:

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| HP Envy 13 Laptop | 1 | $1,299.00 | $1,299.00 |

| Logitech MX Master 3S Mouse | 2 | $149.99 | $299.98 |

| Apple AirPods Pro (2nd Generation) | 1 | $249.00 | $249.00 |

| Microsoft Surface Pro 9 | 1 | $1,499.99 | $1,499.99 |

Subtotal: $3,347.97

Sales Tax (8%): $267.84

Total Amount Due: $3,615.81

Payment Terms:

Net 30 days

Shipping Method:

UPS Ground

Tracking Number: 1Z99999999999999999

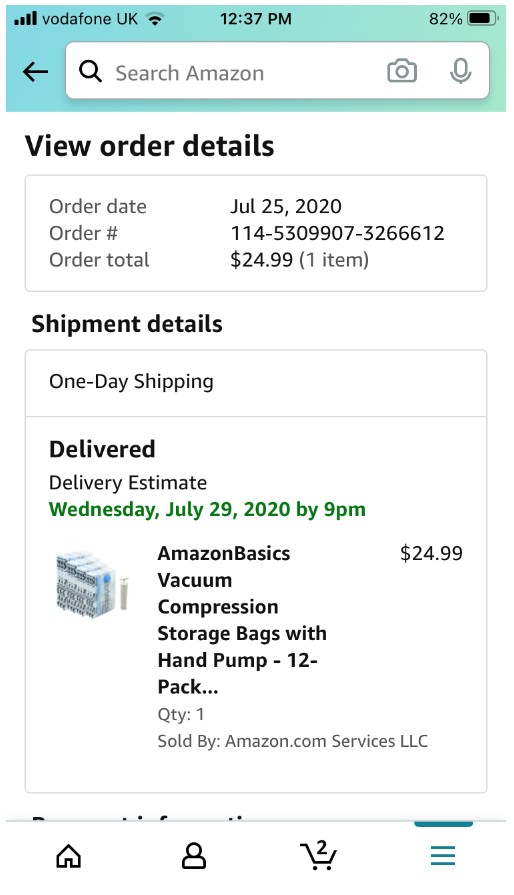

Order Date: 2024-03-01

Order Number: 9876543210

Customer Contact:

Name: John Doe

Phone: (123) 456-7890

Email: john.doe@abccompany.com

Notes:

- Please remit payment to the following address: Amazon Business Services, P.O. Box 1234, Seattle, WA 12345.

- If you have any questions, please contact Amazon Business Customer Service at (800) 123-4567.## Create Amazon Invoice

Executive Summary

Creating accurate invoices is crucial for businesses to ensure timely payments and maintain financial integrity. This extensive guide provides a comprehensive overview of how to create Amazon invoices, addressing various subtopics such as invoice format, essential elements, and common FAQs. By adhering to the guidelines outlined in this guide, businesses can streamline their invoicing process, enhance efficiency, and foster stronger relationships with their clients.

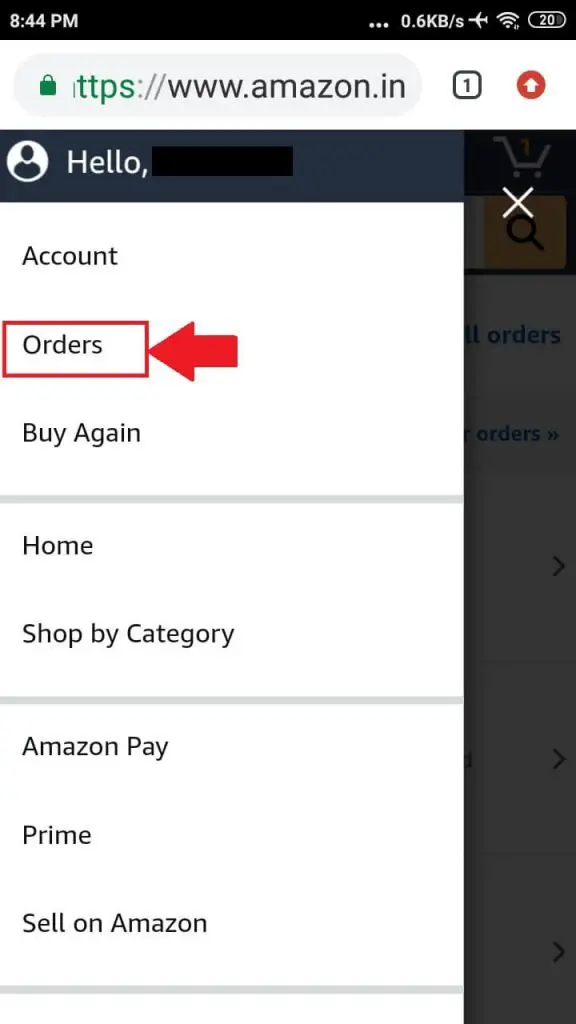

Introduction

Amazon, a global e-commerce giant, offers a robust platform for businesses to sell products and services. To facilitate efficient transactions, it is essential to generate accurate and professional invoices that meet Amazon’s requirements. This guide will delve into the intricacies of creating Amazon invoices, empowering businesses to effectively manage their finances and streamline their operations.

FAQs

- Can I create invoices for products sold on Amazon through a third-party platform?

- Yes, you can use a third-party invoicing platform to create and manage invoices for products sold on Amazon, but ensure that your invoices adhere to Amazon’s requirements.

- Is it mandatory to include my business logo on Amazon invoices?

- Including your business logo on Amazon invoices is highly recommended, as it enhances brand recognition and professionalism. However, it is not a mandatory requirement.

- What are the consequences of submitting incorrect invoices to Amazon?

- Submitting incorrect invoices can lead to payment delays, suspension of seller privileges, and damage to your reputation.

Subtopics

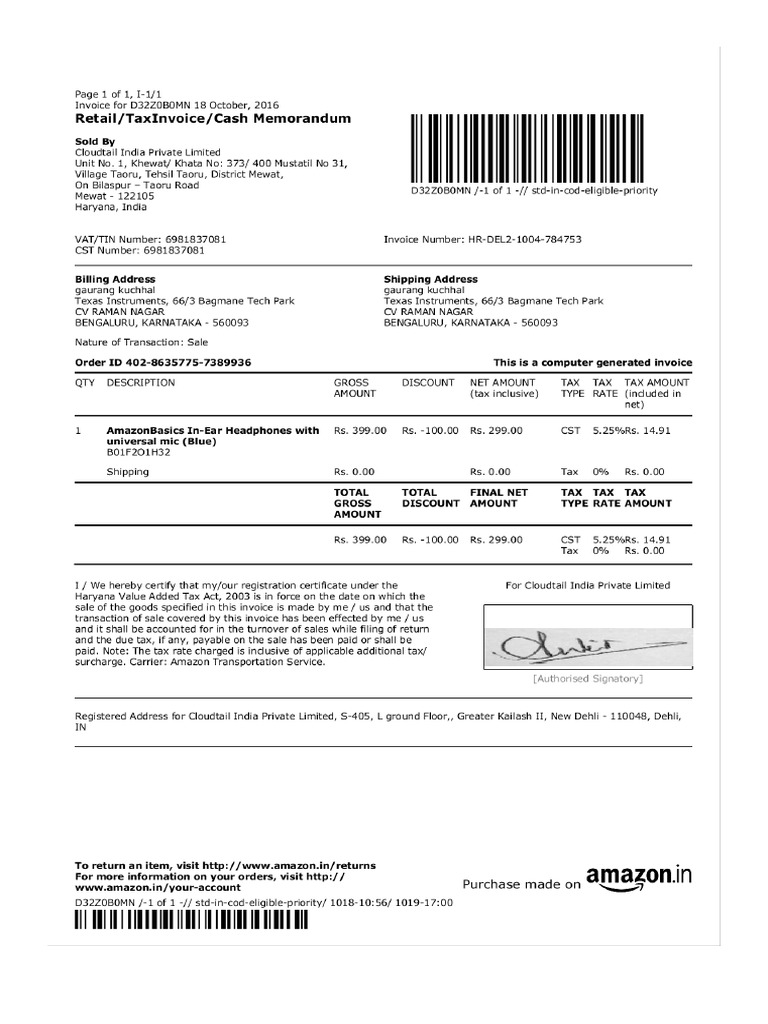

1. Invoice Format

Amazon invoices should follow a standardized format that includes the following essential elements:

- Business contact information (name, address, phone number, email)

- Invoice number and date

- Customer information (name, address)

- Product or service description and quantity

- Unit price

- Total amount

- Payment terms

2. Essential Elements

In addition to the invoice format, there are several essential elements that must be included on Amazon invoices:

- Seller Name and Address: Clearly state your business name and registered address.

- Invoice Number: Assign a unique invoice number for each invoice generated.

- Tax Information: Include your business tax ID and any applicable sales tax rates.

- Payment Information: Provide clear instructions for payment, including accepted methods and deadlines.

3. Product/Service Details

Accurately describe the products or services sold, including the quantity, unit price, and total amount:

- Product/Service Description: Provide a detailed description of the product or service sold.

- Quantity: State the number of units sold or services rendered.

- Unit Price: Clearly indicate the price per unit.

- Total Amount: Calculate and display the total amount due for each line item.

4. Shipping and Handling Fees

If applicable, include separate charges for shipping and handling:

- Shipping Method: Specify the shipping method used.

- Shipping Cost: Clearly state the cost of shipping.

- Handling Fee: Charge a handling fee if applicable.

5. Payment Terms

Clearly state the due date, payment methods accepted, and any applicable discounts or penalties:

- Due Date: Indicate the date by which payment is expected.

- Payment Methods: Specify the accepted payment methods, such as credit card, wire transfer, or check.

- Discounts: Offer discounts for early payment or bulk purchases.

- Penalties: Outline any late payment penalties or interest charges.

Conclusion

Creating accurate and professional Amazon invoices is essential for businesses to maintain efficient operations, foster trust with customers, and ensure timely payments. By adhering to the guidelines outlined in this comprehensive guide, businesses can confidently navigate the invoicing process, streamline their financial management, and position themselves for success. Remember to continuously review and update your invoices to reflect any changes in business practices or Amazon’s requirements.

Keyword Tags

- Amazon Invoice

- Amazon Invoicing

- Invoice Format

- Invoice Elements

- Payment Terms