Small Business Invoice Generator

Generate Professional Invoices in Minutes

Invoice Details:

- Invoice Number:

- Invoice Date:

- Due Date:

- Customer Name:

- Customer Address:

- Customer Contact:

Billing Details:

- Business Name:

- Business Address:

- Business Contact:

- Payment Terms: <Replace with payment terms (e.g., net 30 days)>

Itemized Services or Products:

| Item | Description | Quantity | Unit Price | Total |

|---|---|---|---|---|

| <Replace with item 1> | <Replace with item 1 description> | <Replace with total for item 1> | ||

| <Replace with item 2> | <Replace with item 2 description> | <Replace with total for item 2> | ||

Subtotal:

Taxes (if applicable):

| Tax | Amount |

|---|---|

Total Due:

Notes:

Payment Instructions:

- Please remit payment to the following account:

- Bank Name:

- Account Number:

- Other payment methods:

- ## [Small Business Invoice Generator]

Executive Summary

Small business owners often struggle with the time-consuming and error-prone task of creating invoices. To address this challenge, a small business invoice generator provides an invaluable solution, streamlining the invoicing process and offering numerous benefits.

Introduction

Invoicing is a crucial aspect of business operations, serving as a formal record of transactions between a business and its customers. However, it can be a tedious and error-ridden task for small business owners who may lack the time or expertise to create professional invoices. A small business invoice generator addresses this issue by providing an automated and user-friendly solution.

FAQs

1. What is a small business invoice generator?

A small business invoice generator is an online software or application that automates the creation of invoices. It simplifies the process by providing pre-designed templates, ensuring accuracy and professionalism.

2. What are the benefits of using an invoice generator?

Invoice generators offer numerous benefits, including:

- Time-saving: Automated features minimize manual data entry, freeing up valuable time for other tasks.

- Accuracy: Pre-defined calculations and templates reduce errors and ensure consistency.

- Professionalism: Invoice generators produce visually appealing and standardized invoices that enhance the business’s image.

- Flexibility: Customizable templates allow businesses to tailor their invoices to specific needs and preferences.

3. How do I choose the right invoice generator for my business?

Consider the following factors when selecting an invoice generator:

- Features: Ensure the generator provides the essential features your business requires, such as customizable templates, payment processing, and integration with accounting software.

- Ease of use: Opt for generators that offer a user-friendly interface and require minimal technical knowledge.

- Price: Choose a generator that fits within your budget and provides value for the features it offers.

Key Subtopics

1. Features and Functionality

- Customization: Allows businesses to tailor templates to match their branding and preferences.

- Payment processing: Integrates with payment gateways for secure and convenient payments.

- Reporting: Provides detailed reports on invoice performance and customer activity.

- Integration: Connects with accounting software for seamless data transfer and synchronization.

- Mobile access: Enables invoice creation and management on smartphones or tablets.

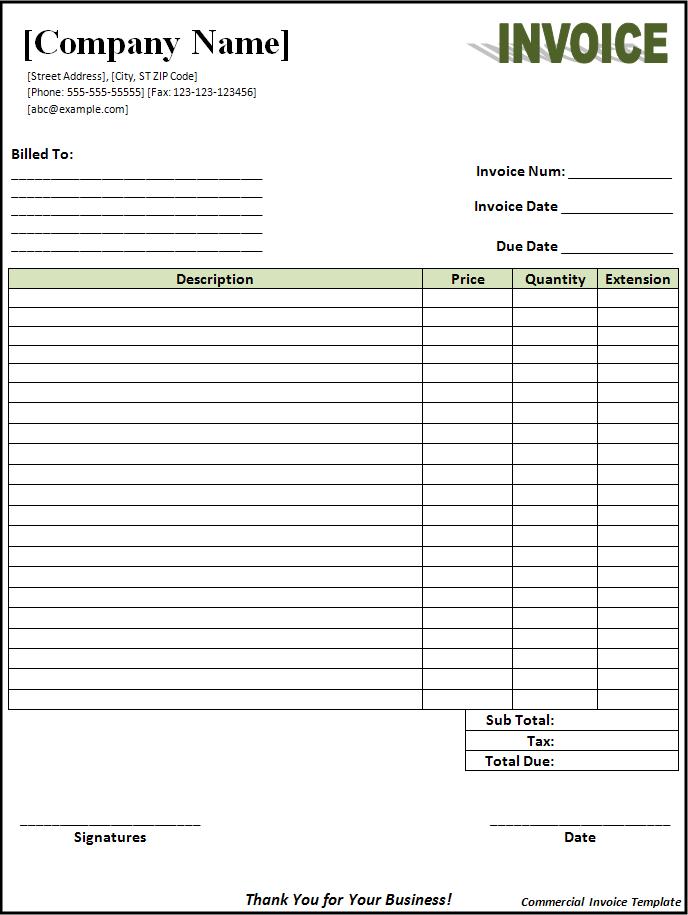

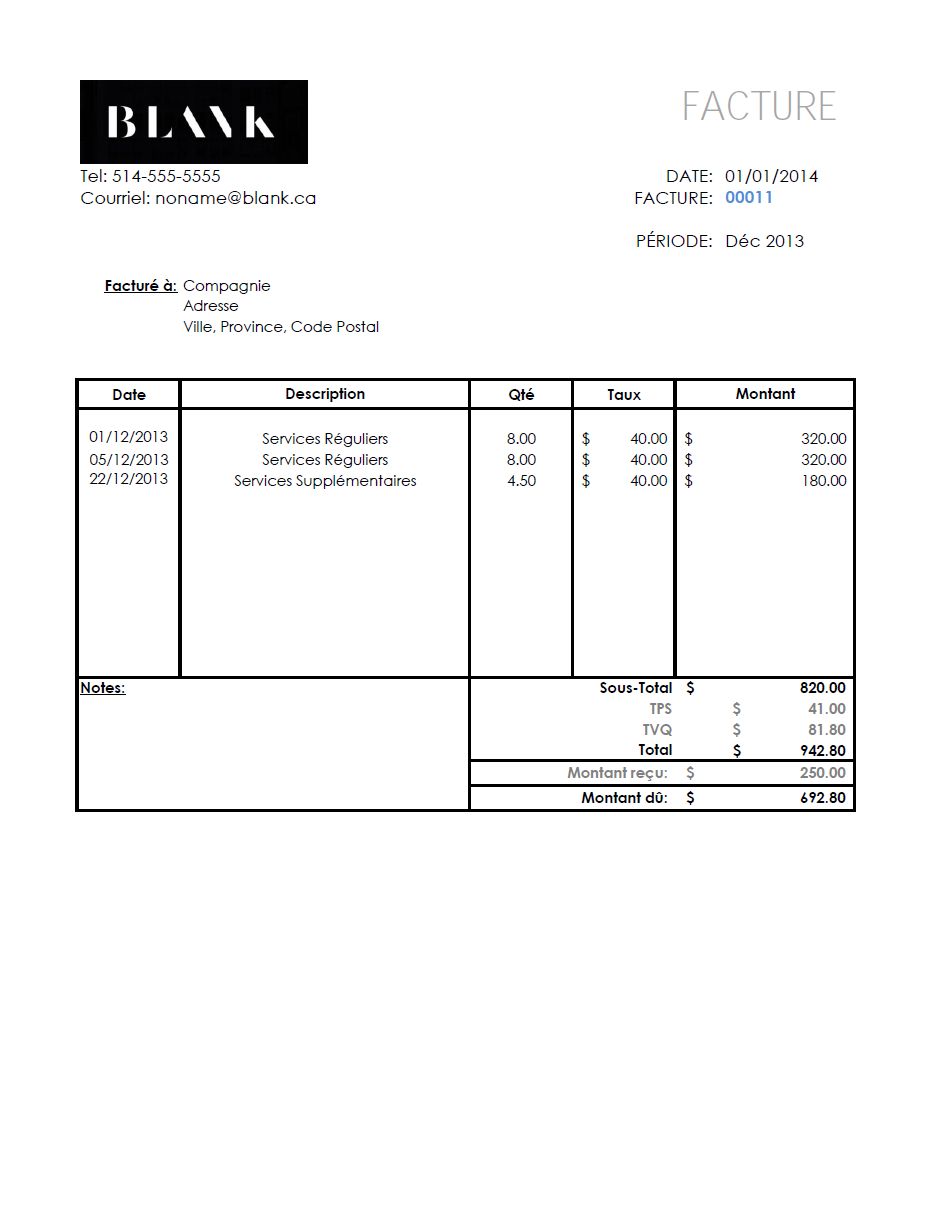

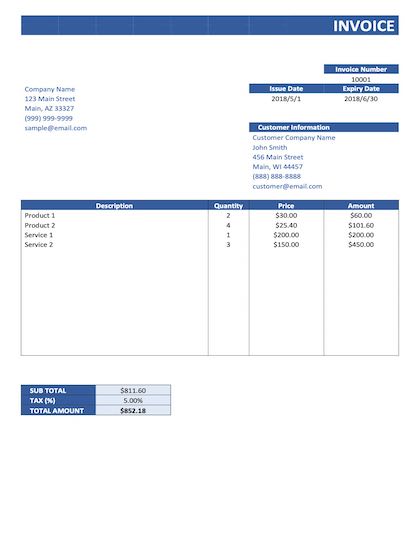

2. Template Design

- Professional: Offers visually appealing and branded templates that enhance the invoice’s credibility.

- Variety: Provides a range of templates to suit different business needs and industries.

- Customizable: Allows businesses to modify templates with their own branding elements, such as logos and colors.

- Easy to edit: Enables quick and effortless customization to suit specific invoice requirements.

- Automated numbering: Generates unique invoice numbers to ensure organization and tracking.

3. Automation

- Data import: Automates the import of customer and product data from CRM or accounting systems.

- Recurring invoices: Creates and schedules recurring invoices for regular billing cycles.

- Payment reminders: Sends automated payment reminders to customers to minimize late payments.

- Tax calculations: Automatically calculates and applies applicable sales tax rates.

- Discount and promotion tracking: Allows businesses to apply discounts and promotions to invoices.

4. Security and Compliance

- Data encryption: Protects sensitive invoice data with secure encryption protocols.

- PCI compliance: Ensures compliance with industry standards for payment card processing.

- GDPR adherence: Aligns with the General Data Protection Regulation (GDPR) to protect customer privacy.

- Audit trails: Provides detailed audit trails for invoices, ensuring transparency and accountability.

- Secure payment gateways: Utilizes reputable and secure payment gateways to safeguard financial transactions.

5. Customer Support

- Live chat: Offers real-time assistance and troubleshooting through live chat support.

- Email support: Provides email-based customer support for queries and problem resolution.

- Phone support: Enables direct communication with support representatives for immediate assistance.

- Knowledge base: Provides a comprehensive database of articles and tutorials for self-help and reference.

- Regular updates: Ensures the invoice generator remains up-to-date with the latest features and security enhancements.

Conclusion

A small business invoice generator is an indispensable tool for small business owners seeking to streamline their invoicing process, improve accuracy and efficiency, and enhance their professional形象. By utilizing the advanced features and capabilities of an invoice generator, businesses can free up valuable time, reduce errors, and elevate the quality of their invoices, ultimately driving business growth and customer satisfaction.

Keywords

- Small Business Invoice Generator

- Invoice Automation

- Invoice Template

- Invoice Software

- Invoice Management