Postpaid Bill Generator

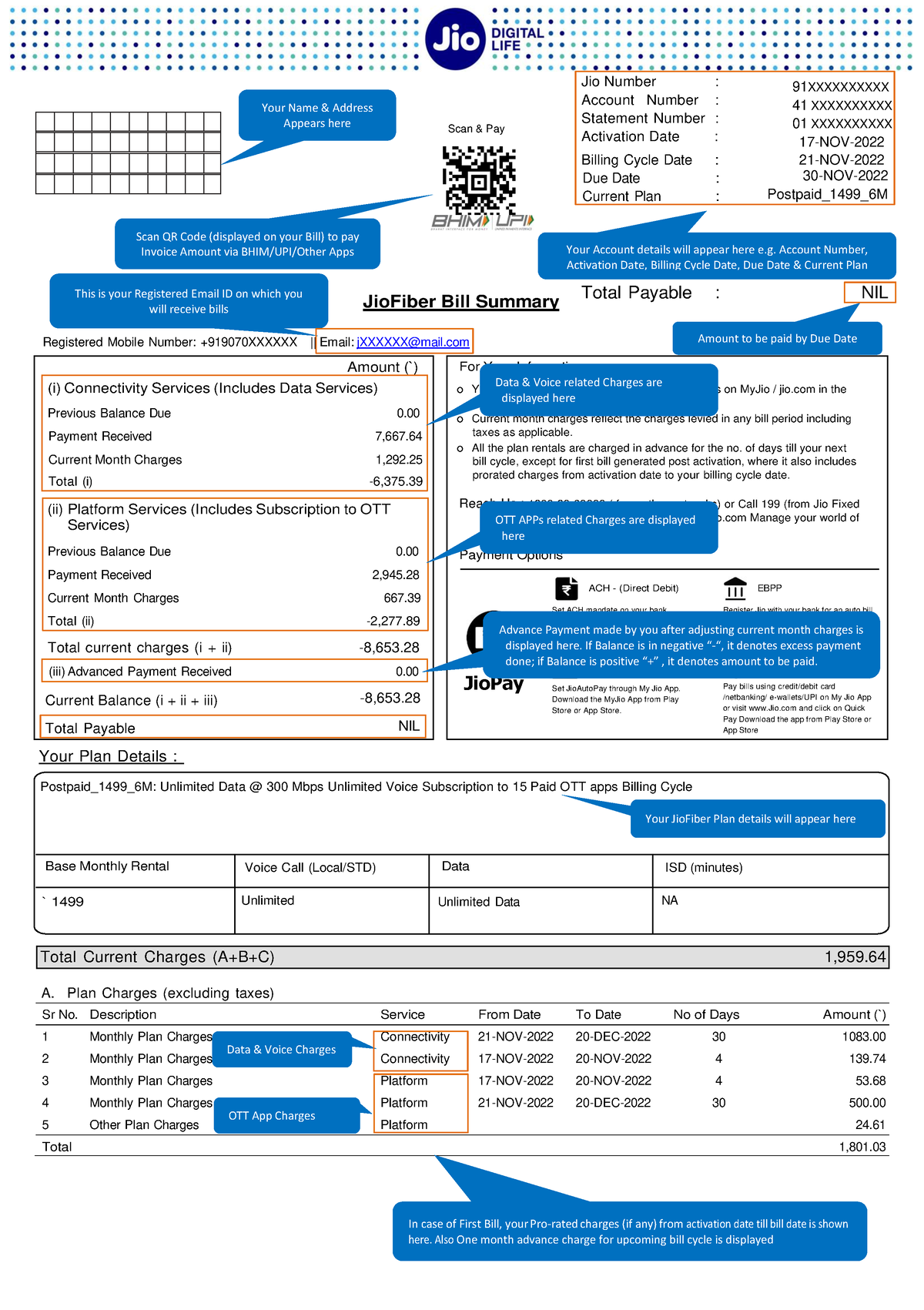

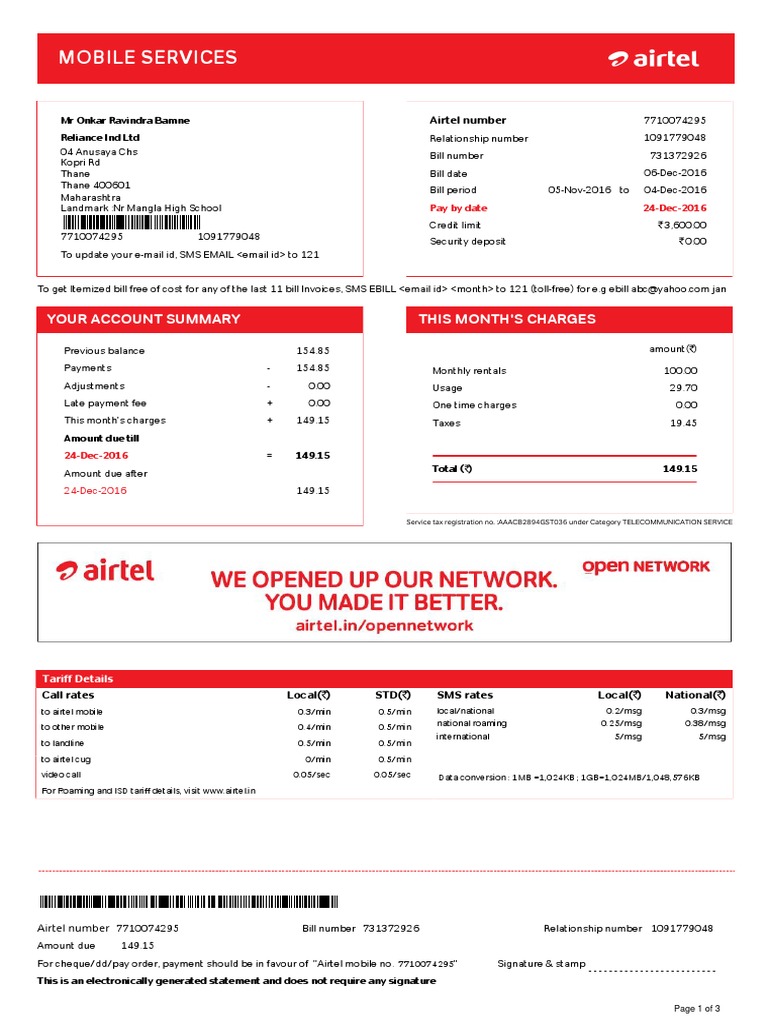

Customer Information

- Name: [Customer Name]

- Address: [Customer Address]

- Phone Number: [Customer Phone Number]

- Email Address: [Customer Email Address]

Billing Period

- Start Date: [Start Date]

- End Date: [End Date]

Usage Information

- Voice Minutes Used: [Voice Minutes Used]

- SMS Messages Sent: [SMS Messages Sent]

- Data Usage: [Data Usage]

Plan Charges

- Monthly Plan Fee: [Monthly Plan Fee]

- Voice Charge: [Voice Charge]

- SMS Charge: [SMS Charge]

- Data Charge: [Data Charge]

Additional Charges

- Roaming Charges: [Roaming Charges]

- International Calls: [International Calls]

- Value-Added Services: [Value-Added Services]

Taxes and Fees

- Sales Tax: [Sales Tax]

- Regulatory Fee: [Regulatory Fee]

- Other Fees: [Other Fees]

Total Due

- Total Amount: [Total Amount]

Payment Information

- Due Date: [Due Date]

- Payment Methods Accepted: [Payment Methods Accepted]

Important Notes

- This bill is subject to the terms and conditions of your service agreement.

- Please review your bill carefully and report any errors promptly.

- Payments received after the due date may be subject to late payment charges.

- If you have any questions or concerns, please contact our customer service at [Customer Service Phone Number] or [Customer Service Email Address].## [Postpaid Bill Generator]

Executive Summary

A postpaid bill generator is an essential tool for businesses that need to manage their finances efficiently. It provides a comprehensive and accurate overview of all postpaid expenses, making it easy to track and control spending. This article explores the key benefits, features, and considerations associated with postpaid bill generators, empowering businesses to make informed decisions about this valuable financial management solution.

Introduction

In today’s fast-paced business environment, efficient financial management is crucial for success. Postpaid bill generators have emerged as a valuable tool in this regard, offering businesses a range of advantages that can streamline operations and improve financial performance. Understanding the functionality and benefits of postpaid bill generators is essential for businesses looking to enhance their financial management capabilities.

FAQs

1. What is a Postpaid Bill Generator?

A postpaid bill generator is a software solution that enables businesses to automate the calculation and generation of postpaid invoices or bills. It typically integrates with accounting systems to pull relevant data, such as usage or consumption details, and generates comprehensive and detailed invoices for customers to facilitate timely payments.

2. Why Use a Postpaid Bill Generator?

There are numerous benefits to using a postpaid bill generator, including:

- Enhanced Accuracy and Efficiency: Automating the billing process reduces errors and improves overall efficiency, freeing up valuable time and resources.

- Improved Cash Flow Management: Accurate and timely billing ensures timely payments from customers, resulting in improved cash flow and financial planning capabilities.

- Enhanced Customer Satisfaction: Professional and accurate invoices enhance customer satisfaction, fostering trust and strengthening relationships.

3. What Features to Look for in a Postpaid Bill Generator?

When choosing a postpaid bill generator, consider the following features:

- Integration with Accounting Systems

- Customizable Billing Templates

- Automated Calculations and Adjustments

- Payment Processing Capabilities

- Reporting and Analytics

Top 5 Subtopics

Integration with Accounting Systems

Seamless integration with accounting systems is essential for efficient postpaid billing. It enables the automated transfer of data, such as usage details and customer information, ensuring accuracy and reducing manual data entry errors.

Customizable Billing Templates

The ability to customize billing templates is crucial for businesses to create invoices that align with their brand and specific requirements. Templates can be tailored to include business logos, specific data fields, and legal disclaimers.

Automated Calculations and Adjustments

Accurate calculations are vital for postpaid billing. Generators should provide automated calculations based on usage or consumption data, handling prorated charges, taxes, and discounts to ensure precise billing amounts.

Payment Processing Capabilities

Integrating payment processing capabilities enables businesses to offer convenient and secure payment options to their customers. This eliminates the need for manual payment handling and reduces the risk of payment errors.

Reporting and Analytics

In-depth reporting and analytics capabilities provide businesses with valuable insights into their billing data. Reports on revenue, expenses, and payment trends empower businesses to optimize financial performance and make data-driven decisions.

Conclusion

Postpaid bill generators offer a range of benefits that can improve financial management and drive business success. By automating the billing process, enhancing accuracy, improving cash flow, and fostering customer satisfaction, these solutions empower businesses to streamline operations and optimize their financial performance. When selecting a postpaid bill generator, it is essential to consider integration capabilities, customization options, automated calculations, payment processing capabilities, and reporting and analytics. By leveraging the right postpaid bill generator, businesses can gain a competitive edge and achieve financial excellence.

Keyword Tags

- Postpaid Bill Generator

- Invoice Automation

- Business Billing

- Financial Management

- Expense Tracking